3M 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 28

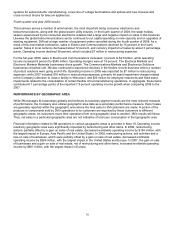

The Display and Graphics segment serves markets that include electronic display, traffic safety and commercial

graphics. This segment includes optical film solutions for electronic displays; computer screen filters; reflective

sheeting for transportation safety; commercial graphics systems; and projection systems, including mobile display

technology and visual systems products. The optical film business provides films that serve numerous market

segments of the electronic display industry. 3M provides distinct products for five market segments, including

products for: 1) LCD computer monitors 2) LCD televisions 3) handheld devices such as cellular phones 4) notebook

PCs and 5) automotive displays. The optical business includes a number of different products that are protected by

various patents and groups of patents. These patents provide varying levels of exclusivity to 3M for a number of such

products. As some of 3M’s optical film patents begin to expire in the next few years, 3M will likely see more

competition in these products. 3M continues to innovate in the area of optical films and files patents on its new

technology and products. 3M’s proprietary manufacturing technology and know-how also provide a competitive

advantage to 3M independent of its patents.

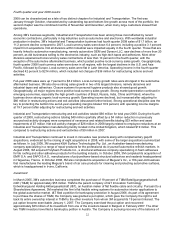

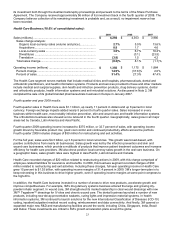

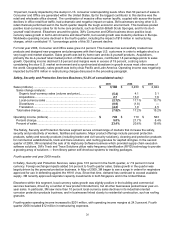

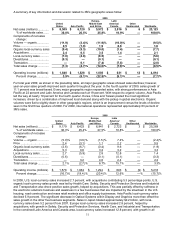

Fourth quarter and year 2009 results:

Display and Graphics fourth quarter sales increased nearly 19 percent to $817 million. Sales grew 15.7 percent in

local currencies, and foreign exchange impacts added just over 3 percentage points to the fourth quarter growth rate.

Operating income increased to $141 million. Operating income in the fourth quarter of 2008 included net charges of

$22 million for restructuring actions and exit activities.

Optical systems continued to grow in the fourth quarter, with sales up over 50 percent year-on-year. Innovation was

the key driver, as 3M film technology effectively improves the energy efficiency of an LCD panel by over 30 percent

and can greatly simplify its design. Sales of optical films began to accelerate in the second and third quarter of 2009,

and even though fourth-quarter sales declined sequentially due to normal seasonal reductions, year-on-year growth

rates were strong. Optical will remain intensely competitive going forward. 3M’s OEM customers continue to drive

price reductions, and 3M will need to continue to respond with aggressive cost reduction and productivity in order to

fund new products.

Fourth-quarter local-currency sales were up slightly in traffic safety systems, driven by the December 2008

acquisition of a finished license plate provider in France. Sales in the commercial graphics business were flat

sequentially versus third-quarter and declined year-on-year as advertising spending remains soft.

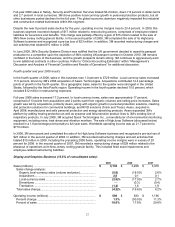

For the full year, sales in Display and Graphics declined 4 percent to $3.1 billion, and operating income increased 1.3

percent to $590 million. Sales grew in traffic safety systems and optical systems, but declined in commercial graphics

as the global recession significantly slowed spending on corporate advertising. In 2009, operating income margins

were 18.8 percent, negatively impacted by 0.8 percentage points due to net restructuring charges of $22 million. This

net aggregate charge included fixed asset impairments of $13 million and employee-related severance/benefits/other

of $9 million, which is recorded net of adjustments to previously recorded restructuring charges. In 2008,

restructuring charges and exit activities reduced operating income by $42 million.

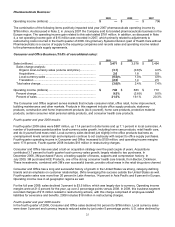

Display and Graphics is working aggressively to accelerate longer-term growth possibilities for the business. For

example, this segment formed a new architectural markets business to further 3M’s footprint in film solutions for

interior surfaces and for energy efficient lighting solutions. Display and Graphics also formed a new mobile interactive

solutions business to develop products that improve projection, personalization and privacy for mobile device users.

In addition, this segment announced a unique optical film that enables 3D viewing on handheld devices without the

need for 3D glasses. Finally, Display and Graphics is preparing to launch the third in a family of pocket projectors,

the 3M™ MPro 150, which projects high-quality images up to 50 inches.

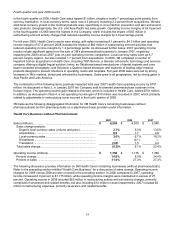

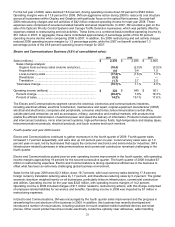

Fourth quarter and year 2008 results:

Results in this business were affected by end-market challenges in 3M’s optical films business. Demand for optical

films slowed considerably in November and December of 2008 as TV, desktop monitor and notebook PC makers

cancelled orders for large-size LCD panels due to weak holiday season sales, reflecting the global downturn in both

consumer and corporate demand. For the fourth quarter, 3M posted sales of $687 million in Display and Graphics.

Sales declined 28 percent, or about 8 percent excluding optical. Traffic safety systems posted local-currency sales

growth of nearly 3 percent, as highway infrastructure projects around the world grew at a modest rate. Local-currency

sales declined by 6.2 percent in 3M’s commercial graphics business and by 48 percent in optical systems. Operating

income in the fourth quarter declined 80 percent, which included net charges of $22 million for restructuring and exit

activities.