3M 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

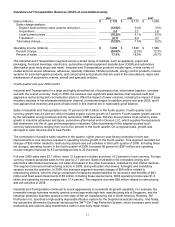

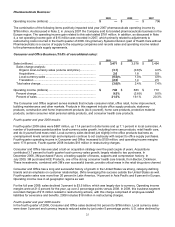

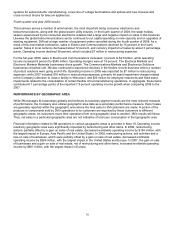

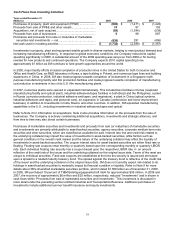

A summary of key information and discussion related to 3M’s geographic areas follow:

2009

United

States Asia Pacific

Europe,

Middle East

and Africa

Latin

America/

Canada

Other

Unallocated Worldwide

Net sales (millions) .............. $ 8,509 $ 6,120 $ 5,972 $ 2,516 $ 6 $ 23,123

% of worldwide sales ....... 36.8% 26.5% 25.8% 10.9% — 100.0%

Components of net sales

change:

Volume — organic............... (11.9) (3.4)% (11.9)% (10.0)% — (9.5)%

Price .................................... 2.5 (1.9) 1.9 8.6 — 1.8

Organic local-currency sales (9.4) (5.3) (10.0) (1.4) — (7.7)

Acquisitions ......................... 2.4 0.5 3.5 1.4 — 2.1

Local-currency sales ........... (7.0) (4.8) (6.5) — — (5.6)

Divestitures.......................... (0.3) — (0.1) — — (0.1)

Translation........................... — 0.1 (7.4) (7.6) — (2.8)

Total sales change .............. (7.3) (4.7)% (14.0)% (7.6)% — (8.5)%

Operating income (millions) $ 1,640 $ 1,528 $ 1,003 $ 631 $ 12 $ 4,814

Percent change................ 3.9% (8.1)% (22.5)% (9.1)% — (7.7)%

For total year 2009, as shown in the preceding table, all major geographic areas showed sales declines; however,

year-on-year sales growth improved each quarter throughout the year. In the fourth quarter of 2009, sales growth of

11.1 percent was broad-based. Every major geographic region expanded sales, with strong performances in Asia

Pacific at 22 percent and Latin America and Canada each at 19 percent. With respect to organic volume, Asia Pacific

led the way at nearly 19 percent for the fourth quarter. Korea, China and Taiwan posted the most significant

increases, driven by a combination of improved local demand along with the pickup in global electronics. Organic

volumes were flat to slightly down in other geographic regions, which is an improvement versus the levels of decline

seen in the first three quarters of 2009. For 2009, international operations represented approximately 63 percent of

3M’s sales.

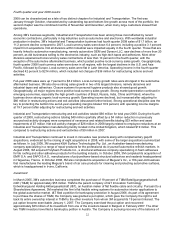

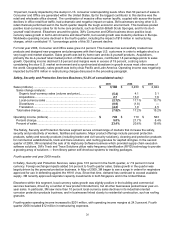

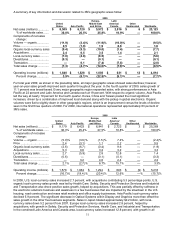

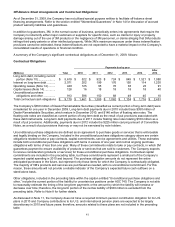

2008

United

States Asia Pacific

Europe,

Middle East

and Africa

Latin

America/

Canada

Other

Unallocated Worldwide

Net sales (millions).............. $ 9,179 $ 6,423 $ 6,941

$

2,723 $ 3 $ 25,269

% of worldwide sales ....... 36.3% 25.4% 27.5% 10.8% — 100.0%

Components of net sales

change:

Volume — organic............... (5.0)% (3.6)% (1.5 )% 7.4% — (2.4)%

Price .................................... 2.4 (3.1) 1.1 2.2 — 0.5

Organic local-currency sales (2.6) (6.7) (0.4) 9.6 — (1.9)

Acquisitions ......................... 5.3 0.8 3.2 3.2 — 3.3

Local-currency sales ........... 2.7 (5.9) 2.8 12.8 — 1.4

Divestitures.......................... (0.6) — (0.1) (0.1) — (0.3)

Translation........................... — 3.2 4.0 2.4 — 2.2

Total sales change .............. 2.1% (2.7)% 6.7% 15.1% — 3.3%

Operating income (millions) $ 1,578 $ 1,662 $ 1,294

$

693 $ (9) $ 5,218

Percent change................ (16.7)% (19.4 )% (20.4 )% 12.6% —% (15.7)%

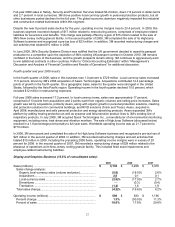

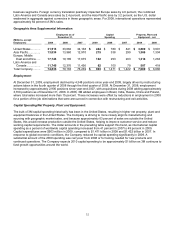

In 2008, U.S. local-currency sales increased 2.7 percent, with acquisitions contributing 5.3 percentage points. U.S.

organic local-currency sales growth was led by Health Care. Safety, Security and Protection Services and Industrial

and Transportation also drove positive sales growth, helped by acquisitions. This was partially offset by softness in

the electronic solutions business and weakness in a few businesses that are impacted by the slowdown in the U.S.

housing, road construction and mass retail markets and office supply businesses. Asia Pacific local-currency sales

declined 5.9 percent. The significant decrease in Optical Systems within Display and Graphics more than offset the

sales growth in the other five business segments. Sales in Japan totaled approximately $2.2 billion, with local-

currency sales down 5.2 percent from 2007. Europe local-currency sales increased 2.8 percent, helped by

acquisitions, with growth in Safety, Security and Protection Services, Health Care, and Industrial and Transportation.

In the combined Latin America and Canada area, local-currency sales increased 12.8 percent, with growth in all