3M 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 64

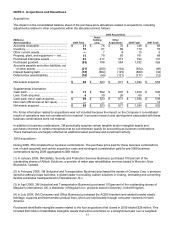

150 thousand shares of 3M common stock, which had a market value of $13 million at the acquisition measurement

date and was previously held as 3M treasury stock.

8) In July 2007, 3M (Safety, Security and Protection Services Business) purchased 100 percent of the outstanding

shares of Rochford Thompson Equipment Ltd., a manufacturer of optical character recognition passport readers

used by airlines and immigration authorities, headquartered in Newbury, U.K.

9) In August 2007, 3M (Health Care Business) purchased certain assets of Neoplast Co. Ltd., a

manufacturer/distributor of surgical tapes and dressings and first aid bandages for both the professional and

consumer markets across the Asia Pacific region.

10) In October 2007, 3M (Health Care Business) purchased 100 percent of the outstanding shares of Abzil Industria

e Comercio Ltda., a manufacturer of orthodontic products based in Sao Jose do Rio Preto, Sao Paulo, Brazil.

11) In October 2007, 3M (Industrial and Transportation Business) purchased 100 percent of the outstanding shares

of Venture Tape Corp. and certain related entities, a global provider of pressure sensitive adhesive tapes based in

Rockland, Mass.

12) In October 2007, 3M (Display and Graphics Business) purchased certain assets of Macroworx Media Pvt Ltd., a

software company that specializes in the design and development of digital signage solutions based in Bangalore,

India.

13) In October 2007, 3M (Health Care Business) purchased 100 percent of the outstanding shares of Lingualcare

Inc., a Dallas-based orthodontic technology and services company offering the iBraces system, a customized, lingual

orthodontic solution.

14) In November 2007, 3M (Industrial and Transportation Business) purchased certain assets of Standard Abrasives,

a manufacturer of coated abrasive specialties and non-woven abrasive products for the metalworking industry

headquartered in Simi Valley, Calif.

15) In November 2007, 3M (Industrial and Transportation Business) purchased 100 percent of the outstanding

shares of Unifam Sp. z.o.o., a manufacturer of cut-off wheels, depressed center grinding wheels and flap discs based

in Poland.

16) In November 2007, 3M (Industrial and Transportation Business) purchased certain assets of Bondo Corp., a

manufacturer of auto body repair products for the automotive aftermarket and various other professional and

consumer applications based in Atlanta, Ga.

Purchased identifiable intangible assets for the 16 business combinations closed during the twelve months ended

December 31, 2007 totaled $124 million and will be amortized on a straight-line basis over lives ranging from two to

10 years (weighted-average life of six years).

Divestitures:

In June 2008, 3M completed the sale of HighJump Software, a 3M Company, to Battery Ventures, a technology

venture capital and private equity firm. 3M received proceeds of $85 million for this transaction and recognized, net of

assets sold, transaction and other costs, a pre-tax loss of $23 million (recorded in the Safety, Security and Protection

Services segment) in 2008.

In June 2007, 3M completed the sale of its Opticom Priority Control Systems and Canoga Traffic Detection

businesses to TorQuest Partners Inc., a Toronto-based investment firm. 3M received proceeds of $80 million for this

transaction and recognized, net of assets sold, transaction and other costs, a pre-tax gain of $68 million (recorded in

the Display and Graphics segment) in 2007. In January 2007, 3M completed the sale of its global branded

pharmaceuticals business in Europe to Meda AB. 3M received proceeds of $817 million for this transaction and

recognized, net of assets sold, a pre-tax gain of $781 million (recorded in the Health Care segment) in 2007.

In connection with the pharmaceuticals transaction, 3M entered into agreements whereby its Drug Delivery Systems

Division became a source of supply to the acquiring company. Because of the extent of 3M cash flows from these

agreements in relation to those of the disposed-of businesses, the operations of the branded pharmaceuticals

business are not classified as discontinued operations. See Note 4 for further discussion of restructuring actions that

resulted from the divestiture of the Company’s global branded pharmaceuticals business.