eBay 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

indemnification provisions due to our limited history of prior indemnification claims and the unique facts and circumstances involved in each

particular provision. To date, losses recorded in our consolidated statement of income in connection with our indemnification provisions have

not been material, either individually or collectively.

Critical Accounting Policies, Judgments and Estimates

General

The preparation of our consolidated financial statements and related notes requires us to make judgments, estimates and assumptions that

affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. We have based

our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of

which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources.

Our senior management has discussed the development, selection and disclosure of these estimates with the Audit Committee of our Board of

Directors. Actual results may differ from these estimates under different assumptions or conditions.

An accounting policy is considered to be critical if it requires an accounting estimate to be made based on assumptions about matters that

are highly uncertain at the time the estimate is made, and if different estimates that reasonably could have been used, or changes in the

accounting estimates that are reasonably likely to occur periodically, could materially impact the consolidated financial statements. We believe

the following critical accounting policies reflect the more significant estimates and assumptions used in the preparation of our consolidated

financial statements. The following descriptions of critical accounting policies, judgments and estimates should be read in conjunction with our

consolidated financial statements and related notes and other disclosures included in this report.

Provision for Transaction and Loan Losses

Provision for transaction and loan losses consists primarily of transaction loss expense associated with our customer protection programs,

fraud, chargebacks and merchant credit losses, bad debt expense associated with our accounts receivable balances and loan losses associated

with our loan receivables balances. We expect our provision for transaction and loan loss expense to fluctuate depending on many factors,

including macroeconomic conditions, our customer protection programs and the impact of regulatory changes.

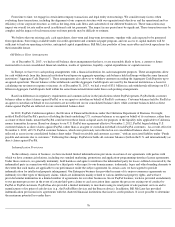

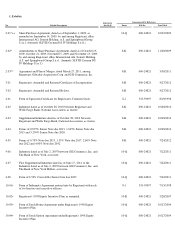

The following table illustrates the provision for transaction and loan losses as a percentage of net revenues for 2013 , 2012 and 2011 :

Determining appropriate allowances for these losses is an inherently uncertain process and is subject to numerous estimates and

judgments, and ultimate losses may vary from the current estimates. We regularly update our allowance estimates as new facts become known

and events occur that may impact the settlement or recovery of losses. The allowances are maintained at a level we deem appropriate to

adequately provide for losses incurred at the balance sheet date. An aggregate 50 basis point deviation from our provision for transaction and

loan losses as a percentage of net revenues would have resulted in an increase or decrease in operating income of approximately $80 million in

2013 , resulting in an approximate $0.04 change in diluted earnings per share.

Legal Contingencies

In connection with certain pending litigation and other claims, we have estimated the range of probable loss, net of expected recoveries,

and provided for such losses through charges to our consolidated statement of income. These estimates have been based on our assessment of the

facts and circumstances at each balance sheet date and are subject to change based upon new information and future events.

From time to time, we are involved in disputes and regulatory inquiries that arise in the ordinary course of business. We are currently

involved in legal proceedings, some of which are discussed in “Item 1A: Risk Factors,” “Item 3: Legal Proceedings” and “Note 11 -

Commitments and Contingencies”

to the consolidated financial statements included in this report. We believe that we have meritorious defenses

to the claims against us, and we intend to defend ourselves vigorously. However, even if successful, our defense against certain actions will be

costly and could require significant amounts of management's

77

Year Ended December 31,

2013

2012

2011

(In millions, except percentages)

Net revenues

$

16,047

$

14,072

$

11,652

Provision for transaction and loan losses

$

791

$

580

$

517

Provision for transaction and loan losses as a % of net revenues

4.9

%

4.1

%

4.4

%