eBay 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

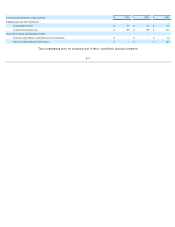

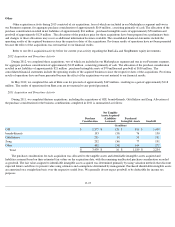

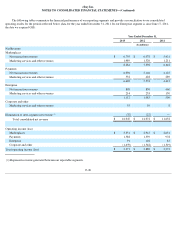

Pro forma financial information

The unaudited pro forma financial information in the table below summarizes the combined results of our operations and those of GSI for

the periods shown as though the acquisition of GSI and the sale of the divested businesses had occurred as of the beginning of fiscal year 2010.

The pro forma financial information for the periods presented includes the business combination accounting effects of the acquisition, including

amortization charges from acquired intangible assets. The pro forma financial information as presented below is for informational purposes only,

is subject to a number of estimates, assumptions and other uncertainties, and is not indicative of the results of operations that would have been

achieved if the acquisition and divestiture had taken place at January 1, 2011. The unaudited pro forma financial information is as follows (no

pro forma information is presented for 2013 or 2012 as GSI is included in the consolidated results of operations for the full year):

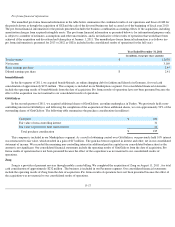

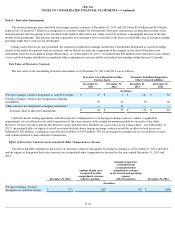

brands4friends

In the first quarter of 2011, we acquired brands4friends, an online shopping club for fashion and lifestyle in Germany, for total cash

consideration of approximately $193 million . This company is included in our Marketplaces segment. Our consolidated financial statements

include the operating results of brands4friends from the date of acquisition. Pro forma results of operations have not been presented because the

effect of the acquisition was not material to our consolidated results of operations.

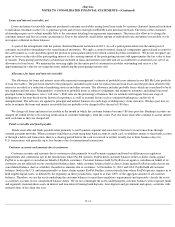

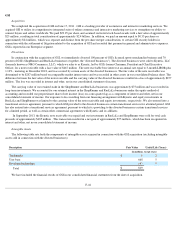

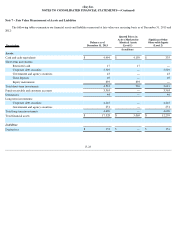

GittiGidiyor

In the second quarter of 2011, we acquired additional shares of GittiGidiyor, an online marketplace in Turkey. We previously held a non-

controlling interest in GittiGidiyor, and following the completion of the acquisition of these additional shares, we own approximately 93%

of the

outstanding shares of GittiGidiyor. The following table summarizes the purchase consideration (in millions):

This company is included in our Marketplaces segment. As a result of obtaining control over GittiGidiyor, our previously held 10%

interest

was remeasured to fair value, which resulted in a gain of $17 million

. The gain has been recognized in interest and other, net in our consolidated

statement of income. We recorded the remaining non-controlling interest in additional paid-in capital in our consolidated balance sheet as the

amount is not significant. Our consolidated financial statements include the operating results of GittiGidiyor from the date of acquisition. Pro

forma results of operations have not been presented because the effect of the acquisition was not material to our consolidated results of

operations.

Zong

Zong is a provider of payment services through mobile carrier billing. We completed the acquisition of Zong on August 11, 2011 , for total

cash consideration of approximately $232 million . The business is included in our Payments segment. Our consolidated financial statements

include the operating results of Zong from the date of acquisition. Pro forma results of operations have not been presented because the effect of

the acquisition was not material to our consolidated results of operations.

F-17

Year Ended December 31, 2011

(In millions, except per share amounts)

Total revenues

$

12,038

Net income

3,169

Basic earnings per share

2.45

Diluted earnings per share

$

2.41

Cash paid

$

182

Fair value of non-controlling interest

31

Fair value of previously held equity interest

22

Total purchase consideration

$

235