eBay 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

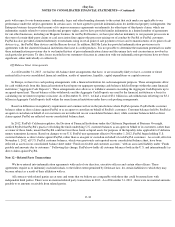

Note 8 – Derivative Instruments

The notional amounts associated with our foreign currency contracts at December 31, 2013 and 2012 were $5.6 billion and $6.6 billion ,

respectively, of which $2.3 billion was designated as cash flow hedges for both periods. Derivative transactions are measured in terms of the

notional amount, but this amount is not recorded on the balance sheet and is not, when viewed in isolation, a meaningful measure of the risk

profile of the instruments. The notional amount is generally not exchanged, but is used only as the basis on which the value of foreign exchange

payments under these contracts are determined .

During each of the fiscal years presented, the amounts recognized in earnings on derivative instruments designated as cash flow hedges

related to the ineffective portion were not material, and we did not exclude any component of the changes in fair value of the derivative

instruments from the assessment of hedge effectiveness. As of December 31, 2013 , we estimate that $90 million of net derivative losses related

to our cash flow hedges included in accumulated other comprehensive income will be reclassified into earnings within the next 12 months.

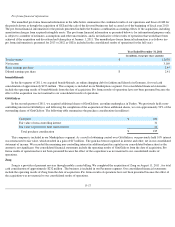

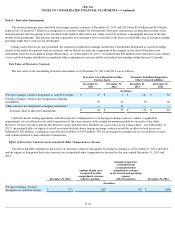

Fair Value of Derivative Contracts

The fair value of our outstanding derivative instruments as of December 31, 2013 and 2012 was as follows:

Under the master netting agreements with the respective counterparties to our foreign exchange contracts, subject to applicable

requirements, we are allowed to net settle transactions of the same currency with a single net amount payable by one party to the other.

However, we have elected to present the derivative assets and derivative liabilities on a gross basis in our balance sheet. As of December 31,

2013 , the potential effect of rights of set-off associated with the above foreign exchange contracts would be an offset to both assets and

liabilities by $42 million , resulting in a net derivative liability of $105 million . We are not required to pledge, nor are we entitled to receive,

cash collateral related to these derivative transactions.

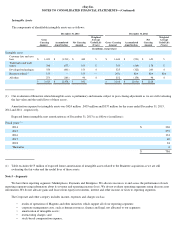

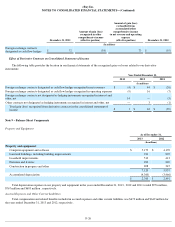

Effect of Derivative Contracts on Accumulated Other Comprehensive Income

The following table summarizes the activity of derivative contracts that qualify for hedge accounting as of December 31, 2013 and 2012 ,

and the impact of designated derivative contracts on accumulated other comprehensive income for the years ended December 31, 2013 and

2012 :

F-25

Derivative Assets Reported in Other

Current Assets

Derivative Liabilities Reported in

Other Current Liabilities

December 31,

2013

December 31,

2012

December 31,

2013

December 31,

2012

(In millions)

Foreign exchange contracts designated as cash flow hedges

$

15

$

1

$

121

$

56

Foreign exchange contracts not designated as hedging

instruments

29

43

30

30

Other contracts not designated as hedging instruments

—

11

—

—

Total fair value of derivative instruments

$

44

$

55

$

151

$

86

December 31, 2012

Amount of gain (loss)

recognized in other

comprehensive income

(effective portion)

Amount of gain (loss)

reclassified from

accumulated other

comprehensive income

to net revenue and operating

expense

(effective portion)

December 31, 2013

(In millions)

Foreign exchange contracts

designated as cash flow hedges

$

(55

)

(65

)

(14

)

$

(106

)