eBay 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

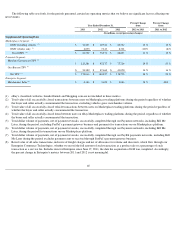

Interest and Other, Net

Interest and other, net, primarily consists of interest earned on cash, cash equivalents and investments, as well as foreign exchange

transaction gains and losses, our portion of operating results from investments accounted for under the equity method of accounting, investment

gain/loss on acquisitions, and interest expense, consisting of interest charges on any amounts borrowed and commitment fees on unborrowed

amounts under our credit agreement and interest expense on our outstanding debt securities and commercial paper, if any. Interest and other, net

excludes interest expense on borrowings incurred to finance Bill Me Later's portfolio of loan receivables, which is included in cost of net

revenues (see "Note 18 - Interest and Other, Net" to the consolidated financial statements included in this report for more information).

Interest and other, net, decreased $101 million in 2013 compared to 2012 . The decrease in interest and other, net was due primarily to a

gain on a divested business of $118 million in 2012 and an increase in interest expense as a result of our issuance of $3 billion of senior notes in

July 2012. The decrease was partially offset by a gain on the sale of our investments in RueLaLa and ShopRunner in September 2013.

Interest and other, net, decreased $1.3 billion in 2012 compared to 2011. The decrease in interest and other, net was due primarily to an

investment gain of approximately $1.7 billion associated with the sale of our remaining 30% equity interest in Skype in 2011. The decrease in

interest and other, net was partially offset by a gain on the divestiture of a business, a favorable impact from the foreign currency activity,

favorable resolution of an indirect tax dispute and higher interest income from investments.

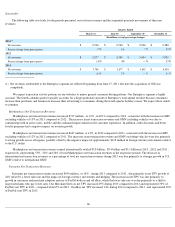

Provision for Income Taxes

Our effective tax rate was 18% in 2013 compared to 15% in 2012 . The increase in our effective tax rate during 2013 compared to 2012

was due primarily to increases in foreign earnings subject to U.S. tax and the repayment of the Kynetic note receivable and the sale of our

investments in RueLaLa and ShopRunner in 2013.

Our effective tax rate was 15% in 2012 compared to 17% in 2011. The decrease in our effective tax rate during 2012 compared to 2011

was due primarily to U.S. taxes on the sale of our remaining equity interest in Skype in 2011 and the favorable impact from the sale of Rent.com

in 2012.

Our relative pretax earnings and revenues attributable to the U.S. as compared to the rest of the world may differ over time. For the year

ended December 31, 2013, our U.S. share of pretax income and net revenues was 17.1% and 48.1%, respectively. For the year ended December

31, 2012, our U.S. share of pretax income and net revenues was 19.6% and 48.2%, respectively. The difference in relative pretax income and net

revenues attributable to the U.S., as compared to the rest of the world for both 2013 and 2012, was primarily related to our Enterprise segment,

which has lower U.S. based operating margins and higher amortization of U.S. based intangible assets, larger stock-

based compensation expense

recorded in the U.S. for U.S. based employees, overhead related to our corporate operations which are primarily U.S. based and higher average

margins earned by non-U.S. businesses.

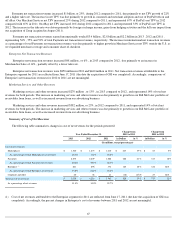

Our provision for income taxes differs from the provision computed by applying the U.S. federal statutory rate of 35% due primarily to

lower tax rates associated with certain earnings from our operations in certain lower-tax jurisdictions outside the U.S. The impact on our

provision for income taxes of foreign income being taxed at different rates than the U.S. federal statutory rate was a benefit of approximately

$607 million in 2013, and $617 million in 2012 and $772 million in 2011, net of a $321 million charge for U.S. taxes on the sale of Skype. We

benefit from tax rulings concluded in several different jurisdictions, most significantly Switzerland, Singapore and Luxembourg. These rulings

provide for significantly lower rates of taxation on certain classes of income and require various thresholds of investment and employment in

those jurisdictions. We evaluate compliance with our tax ruling agreements annually. The cash benefit of these reduced rates totaled

approximately $540 million in 2013, $439 million in 2012 and $697 million in 2011. The foreign jurisdictions with lower tax rates that had the

most significant impact on our provision for income taxes in the periods presented include Switzerland, Singapore and Luxembourg. See "Note

16 - Income Taxes" to the consolidated financial statements included in this report for more information on our tax rate reconciliation.

Our provision for income taxes is volatile and, in general, is adversely impacted by earnings being lower than anticipated in countries that

have lower tax rates and higher than anticipated in countries that have higher tax rates. Our provision for income taxes does not include

provisions for U.S. income taxes and foreign withholding taxes associated with the repatriation of a substantial portion of undistributed earnings

of certain foreign subsidiaries because we intend to reinvest those earnings

71