eBay 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

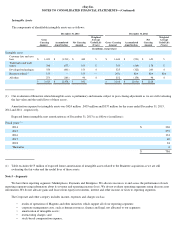

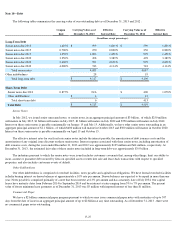

Note 10 – Debt

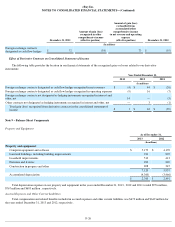

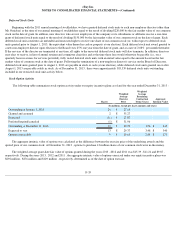

The following tables summarizes the carrying value of our outstanding debt as of December 31, 2013 and 2012 :

Senior Notes

In July 2012, we issued senior unsecured notes, or senior notes, in an aggregate principal amount of $3 billion , of which $250 million

will mature in July 2015, $1 billion will mature in July 2017, $1 billion will mature in July 2022 and $750 million will mature in July 2042.

Interest on these senior notes is payable semiannually on January 15 and July 15. Additionally, we have other senior notes outstanding in an

aggregate principal amount of $1.1 billion , of which $600 million will mature in October 2015 and $500 million will mature in October 2020.

Interest on these senior notes is payable semiannually on April 15 and October 15.

The effective interest rates for our fixed-rate senior notes include the interest payable, the amortization of debt issuance costs and the

amortization of any original issue discount on these senior notes. Interest expense associated with these senior notes, including amortization of

debt issuance costs, during the years ended December 31, 2013 and 2012 was approximately $105 million and $64 million , respectively. At

December 31, 2013 , the estimated fair value of these senior notes included in long-term debt was approximately $3.9 billion .

The indenture pursuant to which the senior notes were issued includes customary covenants that, among other things, limit our ability to

incur, assume or guarantee debt secured by liens on specified assets or enter into sale and lease-back transactions with respect to specified

properties, and also includes customary events of default.

Other Indebtedness

Our other indebtedness is comprised of overdraft facilities, notes payable and capital lease obligations. We have formal overdraft facilities

in India bearing interest on drawn balances at approximately a 10% rate per annum. Drawn balances are expected to be repaid in more than one

year. Notes payable is comprised primarily of a note that bears interest at

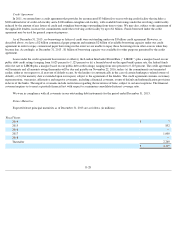

6.3% per annum and has a maturity date of July 2034. Our capital

leases have maturity dates from February 2014 to September 2014 and bear interest at rates ranging from 3% to 7% per annum. The present

value of future minimum lease payments as of December 31, 2013 was $5 million with imputed interest of less than $1 million .

Commercial Paper

We have a $2 billion commercial paper program pursuant to which we may issue commercial paper notes with maturities of up to 397

days from the date of issue in an aggregate principal amount of up to $2 billion at any time outstanding. As of December 31, 2013 , there were

no commercial paper notes outstanding.

F-27

Coupon

Carrying Value as of Effective

Carrying Value as of Effective

Rate

December 31, 2013 Interest Rate

December 31, 2012 Interest Rate

(In millions, except percentages)

Long-Term Debt

Senior notes due 2015

1.625

%

$

599

1.805

%

$

599

1.805

%

Senior notes due 2015

0.700

%

250

0.820

%

250

0.820

%

Senior notes due 2017

1.350

%

1,000

1.456

%

999

1.456

%

Senior notes due 2020

3.250

%

498

3.389

%

498

3.389

%

Senior notes due 2022

2.600

%

999

2.678

%

999

2.678

%

Senior notes due 2042

4.000

%

743

4.114

%

742

4.114

%

Total senior notes

4,089

4,087

Other indebtedness

28

19

Total long-term debt

$

4,117

$

4,106

Short-Term Debt

Senior notes due 2013

0.875

%

N/A

$

400

1.078

%

Other indebtedness

$

6

13

Total short-term debt

6

413

Total Debt

$

4,123

$

4,519