eBay 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

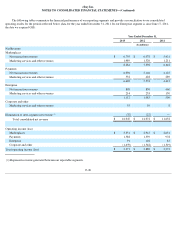

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Investments

Short-term investments, which may include marketable equity securities, time deposits, certificates of deposit, government bonds and

corporate debt securities with original maturities of greater than three months but less than one year when purchased, are classified as available-

for-sale and are reported at fair value using the specific identification method. Unrealized gains and losses are excluded from earnings and

reported as a component of other comprehensive income (loss), net of related estimated tax provisions or benefits.

Long-term investments may include marketable government bonds and corporate debt securities, time deposits, certificates of deposit and

cost and equity method investments. Debt securities are classified as available-for-sale and are reported at fair value using the specific

identification method. Unrealized gains and losses on our available-for-

sale investments are excluded from earnings and reported as a component

of other comprehensive income (loss), net of related estimated tax provisions or benefits.

Certain time deposits are classified as held to maturity and recorded at amortized cost. Our equity method investments are investments in

privately held companies. Our consolidated results of operations include, as a component of interest and other, net, our share of the net income or

loss of the equity method investments. Our share of investees' results of operations is not significant for any period presented. Our cost method

investments consist of investments in privately held companies and are recorded at cost. Amounts received from our cost method investees were

not material to any period presented.

We assess whether an other-than-temporary impairment loss on our investments has occurred due to declines in fair value or other market

conditions. With respect to our debt securities, this assessment takes into account the severity and duration of the decline in value, our intent to

sell the security, whether it is more likely than not that we will be required to sell the security before recovery of its amortized cost basis, and

whether we expect to recover the entire amortized cost basis of the security (that is, whether a credit loss exists). We did not recognize an other-

than-temporary impairment loss on our investments in 2013 , 2012 , or 2011 .

Property and equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation is computed using the straight-

line method

over the estimated useful lives of the assets, generally, one to three years for computer equipment and software, up to thirty years for buildings

and building improvements, ten years for aviation equipment, the shorter of five years or the term of the lease for leasehold improvements and

three years for furniture, fixtures and vehicles.

Goodwill and intangible assets

Goodwill is tested for impairment at a minimum on an annual basis. Goodwill is tested for impairment at the reporting unit level by first

performing a qualitative assessment to determine whether it is more likely than not that the fair value of the reporting unit is less than its carrying

value. If the reporting unit does not pass the qualitative assessment, then the reporting unit's carrying value is compared to its fair value. The

fair values of the reporting units are estimated using market and discounted cash flow approaches. Goodwill is considered impaired if the

carrying value of the reporting unit exceeds its fair value. The discounted cash flow approach uses expected future operating results. Failure to

achieve these expected results may cause a future impairment of goodwill at the reporting unit. We conducted our annual impairment test of

goodwill as of August 31, 2013 and 2012. As a result of this test , we determined that no adjustment to the carrying value of goodwill for any

reporting units was required.

Intangible assets consist of purchased customer lists and user base, trademarks and trade names, developed technologies and other

intangible assets, including patents and contractual agreements. Intangible assets are amortized over the period of estimated benefit using the

straight-line method and estimated useful lives ranging from one to eight years. No significant residual value is estimated for intangible assets.

Impairment of long-lived assets

We evaluate long-lived assets (including intangible assets) for impairment whenever events or changes in circumstances indicate that the

carrying amount of a long-lived asset may not be recoverable. An asset is considered impaired if its carrying amount exceeds the undiscounted

future net cash flow the asset is expected to generate. In 2013 , 2012 and 2011 , no impairment was noted.

F-12