eBay 2013 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

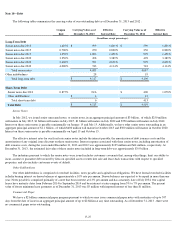

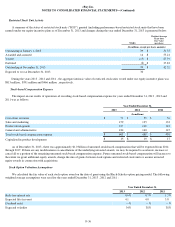

Restricted Stock Unit Activity

A summary of the status of restricted stock units ("RSU") granted (including performance-based restricted stock units that have been

earned) under our equity incentive plans as of December 31, 2013 and changes during the year ended December 31, 2013 is presented below:

During the years 2013 , 2012 and 2011 , the aggregate intrinsic value of restricted stock units vested under our equity incentive plans was

$813 million , $591 million and $466 million , respectively.

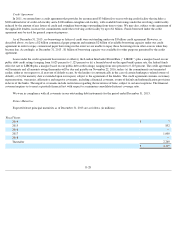

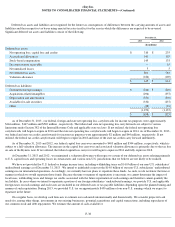

Stock-based Compensation Expense

The impact on our results of operations of recording stock-based compensation expense for years ended December 31, 2013 , 2012 and

2011 was as follows:

As of December 31, 2013 , there was approximately $1.0 billion of unearned stock-based compensation that will be expensed from 2014

through 2017. If there are any modifications or cancellations of the underlying unvested awards, we may be required to accelerate, increase or

cancel all or a portion of the remaining unearned stock-based compensation expense. Future unearned stock-based compensation will increase to

the extent we grant additional equity awards, change the mix of grants between stock options and restricted stock units or assume unvested

equity awards in connection with acquisitions.

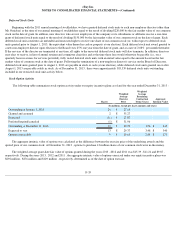

Stock Option Valuation Assumptions

We calculated the fair value of each stock option award on the date of grant using the Black-Scholes option pricing model. The following

weighted average assumptions were used for the years ended December 31, 2013 , 2012 and 2011 :

F-36

Units

Weighted Average

Grant-Date

Fair Value

(per share)

(In millions, except per share amounts)

Outstanding at January 1, 2013

39

$

31.35

Awarded and assumed

14

$

55.21

Vested

(15

)

$

27.79

Forfeited

(4

)

$

37.83

Outstanding at December 31, 2013

34

$

42.32

Expected to vest at December 31, 2013

30

Year Ended December 31,

2013

2012

2011

(In millions)

Cost of net revenues

$

79

$

55

$

56

Sales and marketing

159

135

132

Product development

187

138

123

General and administrative

184

160

147

Total stock-based compensation expense

$

609

$

488

$

458

Capitalized in product development

$

15

$

19

$

17

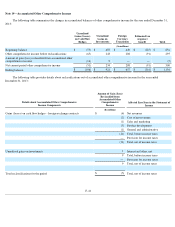

Year Ended December 31,

2013

2012

2011

Risk-free interest rate

0.6

%

0.7

%

1.2

%

Expected life (in years)

4.1

4.0

3.8

Dividend yield —

%

—

%

—

%

Expected volatility

34

%

38

%

38

%