eBay 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

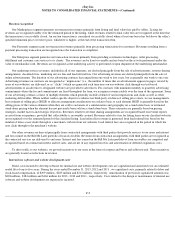

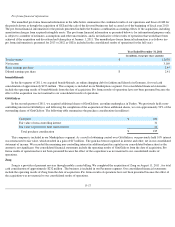

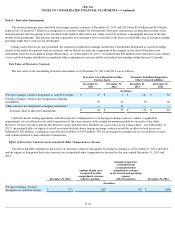

Intangible Assets

The components of identifiable intangible assets are as follows:

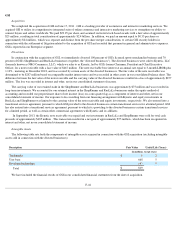

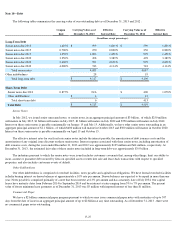

Amortization expense for intangible assets was $424 million , $433 million and $337 million for the years ended December 31, 2013 ,

2012 and 2011 , respectively.

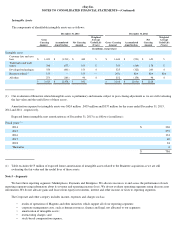

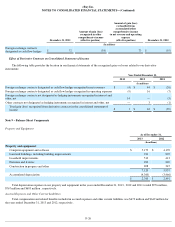

Expected future intangible asset amortization as of December 31, 2013 is as follows (in millions):

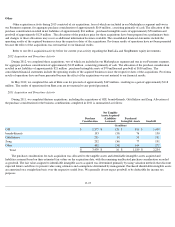

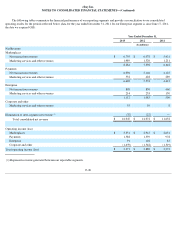

Note 5 – Segments

We have three reporting segments: Marketplaces, Payments and Enterprise. We allocate resources to and assess the performance of each

reporting segment using information about its revenue and operating income (loss). We do not evaluate operating segments using discrete asset

information. We do not allocate gains and losses from equity investments, interest and other income, or taxes to reporting segments.

The Corporate and other category includes income, expenses and charges such as:

December 31, 2013

December 31, 2012

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Weighted

Average

Useful Life

(Years)

Gross Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Weighted

Average

Useful Life

(Years)

(In millions, except years)

Intangible assets:

Customer lists and user

base

$

1,653

$

(1,213

)

$

440

5

$

1,644

$

(991

)

$

653

5

Trademarks and trade

names

780

(677

)

103

5

743

(569

)

174

5

Developed technologies

554

(401

)

153

4

525

(322

)

203

4

Braintree related

(1)

155

—

155

—

N/A

N/A

N/A

N/A

All other

273

(183

)

90

4

252

(154

)

98

4

$

3,415

$

(2,474

)

$

941

$

3,164

$

(2,036

)

$

1,128

(1) Our evaluation of Braintree related intangible assets is preliminary and remains subject to post-

closing adjustment as we are still evaluating

the fair value and the useful lives of these assets.

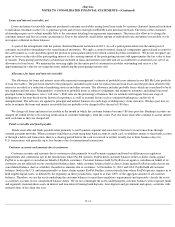

Fiscal years

(1)

:

2014

$

326

2015

257

2016

133

2017

40

2018

24

Thereafter

6

$

786

(1) Table excludes $155 million of expected future amortization of intangible assets related to the Braintree acquisition as we are still

evaluating the fair value and the useful lives of these assets.

•

results of operations of Magento and other initiatives which support all of our reporting segments;

•

corporate management costs, such as human resources, finance and legal, not allocated to our segments;

•

amortization of intangible assets;

•

restructuring charges; and

• stock-

based compensation expense.