eBay 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

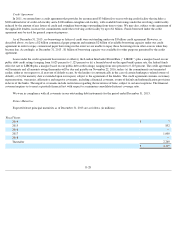

Credit Agreement

In 2011, we entered into a credit agreement that provides for an unsecured $3 billion five-year revolving credit facility that includes a

$300 million letter of credit sub-facility and a $100 million swingline sub-facility, with available borrowings under the revolving credit facility

reduced by the amount of any letters of credit and swingline borrowings outstanding from time to time. We may also, subject to the agreement of

the applicable lenders, increase the commitments under the revolving credit facility by up to $1 billion . Funds borrowed under the credit

agreement may be used for general corporate purposes.

As of December 31, 2013 , no borrowings or letters of credit were outstanding under our $3 billion credit agreement. However, as

described above, we have a $2 billion commercial paper program and maintain $2 billion of available borrowing capacity under our credit

agreement in order to repay commercial paper borrowings in the event we are unable to repay those borrowings from other sources when they

become due. Accordingly, at December 31, 2013 , $1 billion of borrowing capacity was available for other purposes permitted by the credit

agreement.

Loans under the credit agreement bear interest at either (i) the London Interbank Offered Rate (“ LIBOR ”) plus a margin (based on our

public debt credit ratings) ranging from 0.625 percent to 1.125 percent or (ii) a formula based on the agent bank's prime rate, the federal funds

effective rate or LIBOR plus a margin (based on our public debt credit ratings) ranging from zero percent to 0.125 percent. The credit agreement

will terminate and all amounts owing thereunder will be due and payable on November 22, 2016, unless (a) the commitments are terminated

earlier, either at our request or, if an event of default occurs, by the lenders (or automatically in the case of certain bankruptcy-related events of

default), or (b) the maturity date is extended upon our request, subject to the agreement of the lenders. The credit agreement contains customary

representations, warranties, affirmative and negative covenants, including a financial covenant, events of default and indemnification provisions

in favor of the banks. The negative covenants include restrictions regarding the incurrence of liens, subject to certain exceptions. The financial

covenant requires us to meet a quarterly financial test with respect to a minimum consolidated interest coverage ratio.

We were in compliance with all covenants in our outstanding debt instruments for the period ended December 31, 2013 .

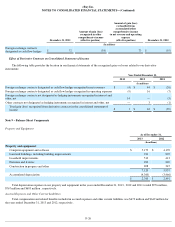

Future Maturities

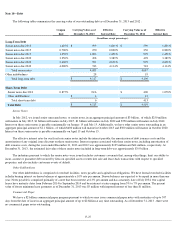

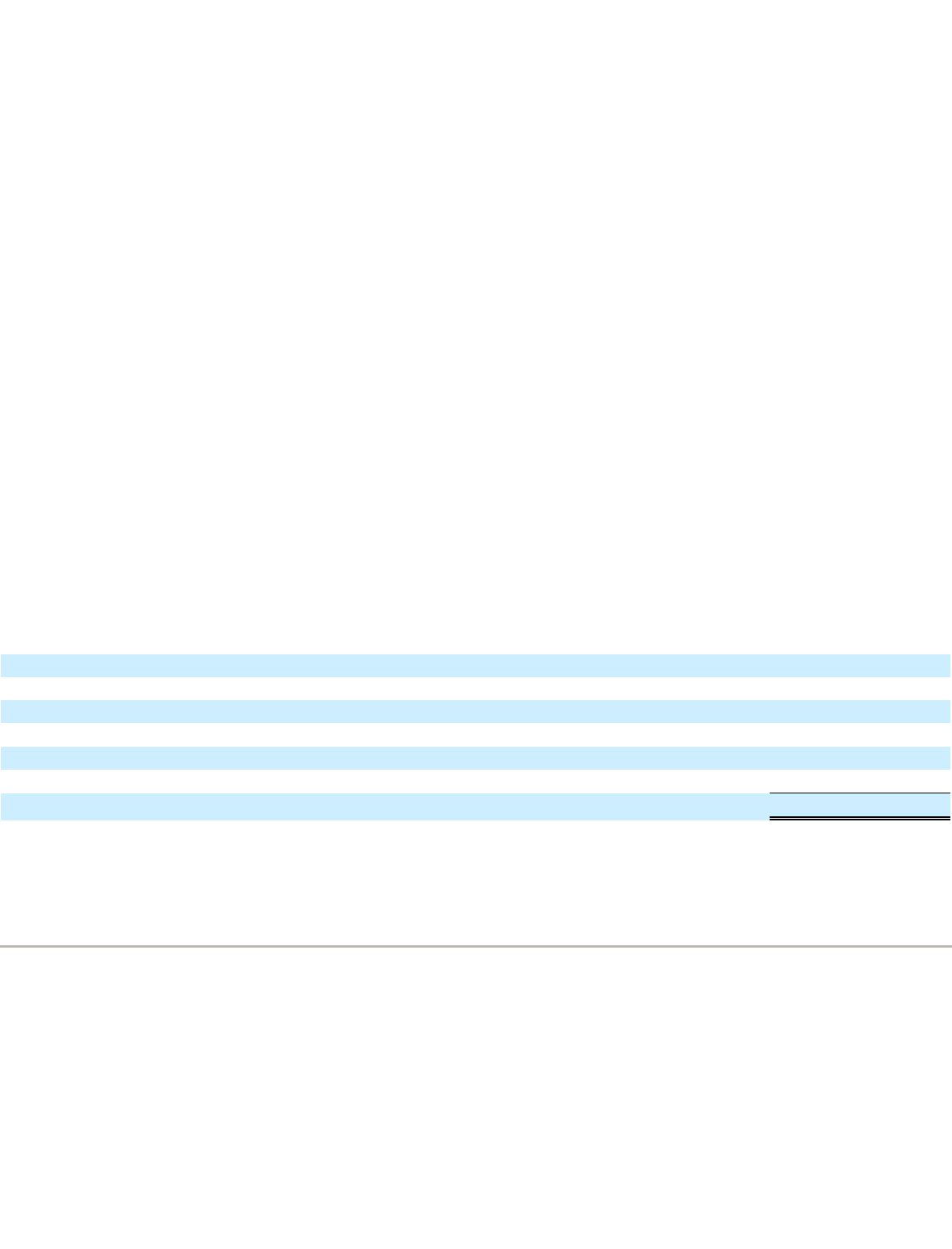

Expected future principal maturities as of December 31, 2013 are as follows (in millions):

F-28

Fiscal Years:

2014

$

7

2015

852

2016

—

2017

1,000

2018

—

Thereafter

2,260

$

4,119