eBay 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

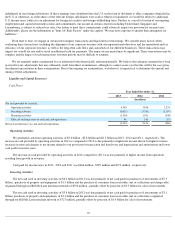

General and Administrative

General and administrative expenses consist primarily of employee compensation, contractor costs, facilities costs, depreciation of

equipment, employer payroll taxes on employee stock-based compensation, legal expenses, restructuring, insurance premiums and professional

fees. Our legal expenses, including those related to various ongoing legal proceedings, may fluctuate substantially from period to period.

General and administrative expenses increased $136 million , or 9% , in 2013 compared to 2012

. The increase was due primarily to higher

employee-related costs (including consultant costs, facility costs and equipment-related costs) and an increase in professional service fees

partially offset by a decrease in restructuring costs. General and administrative expenses as a percentage of net revenues were 11% in both 2013

and 2012 .

General and administrative expenses increased $203 million, or 15%, in 2012 compared to 2011. The increase was due primarily to higher

employee-related costs (including consultant costs, facility costs and equipment-related costs), the impact from acquisitions, primarily GSI,

restructuring costs and the increase in professional service fees. General and administrative expenses as a percentage of net revenues were 11%

and 12% in 2012 and 2011, respectively.

Provision for Transaction and Loan Losses

Provision for transaction and loan losses consists primarily of transaction loss expense associated with our customer protection programs,

fraud, chargebacks and merchant credit losses, bad debt expense associated with our accounts receivable balances and loan losses associated

with our loan receivables balances. We expect our provision for transaction and loan loss expense to fluctuate depending on many factors,

including macroeconomic conditions, our customer protection programs and the impact of regulatory changes.

Provision for transaction and loan losses increased by $211 million , or 36% , in 2013 compared to 2012 . This increase was attributable to

both our Marketplaces and Payments segments. Provision for transaction and loan loss expense as a percentage of net revenues was 5% and 4%

in 2013 and 2012 , respectively.

Marketplaces provision for transaction losses increased by $62 million, or 36%, in 2013 compared to 2012. This increase was due

primarily to higher transaction volume. The volume increase in the transaction losses was due primarily to an increase in the number of cases

being opened under our eBay Buyer Protection Program as a result of our recently simplified process for users to file claims which resulted in

higher transaction losses.

Payments provision for transaction and loan losses increased by $149 million, or 38%, in 2013 compared to 2012. This increase was due

primarily to higher PayPal transaction losses driven by higher transaction volume, due to the introduction of new products, initiatives to enhance

customers' experience, and growth in active registered accounts. The increase is also due to growth in our Bill Me Later portfolio of receivables

from consumer loans. Modifications to our Bill Me Later acceptable risk parameters did not have a material impact on our provision for loan

losses.

Provision for transaction and loan losses increased by $63 million, or 12%, in 2012 compared to 2011. This increase was due primarily to

higher transaction volume and growth in our Bill Me Later portfolio of receivables from consumer loans. The increase was partially offset by a

reduction in our Marketplaces consumer protection program expense as a result of certain loss prevention programs and lower Marketplaces bad

debt expense. Provision for transaction and loan loss expense as a percentage of net revenues was 4% in both 2012 and 2011.

Amortization of Acquired Intangible Assets

From time to time we have purchased, and we expect to continue to purchase, assets and businesses. These purchase transactions generally

result in the creation of acquired intangible assets with finite lives and lead to a corresponding increase in our amortization expense in periods

subsequent to acquisition. We amortize intangible assets over the period of estimated benefit, using the straight-

line method and estimated useful

lives ranging from one to eight years. Amortization of acquired intangible assets is also impacted by our sales of assets and businesses and

timing of acquired intangible assets becoming fully amortized. See “Note 4 - Goodwill and Intangible Assets” to the consolidated financial

statements included in this report.

Amortization of acquired intangible assets decreased by $17 million , or 5% , in 2013 compared to 2012 .

Amortization of acquired intangible assets increased by $68 million, or 25%, in 2012 compared to 2011. The increase in amortization of

acquired intangible assets was due to the impact of acquisitions, primarily GSI.

70