eBay 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GSI

Acquisition

We completed the acquisition of GSI on June 17, 2011 . GSI is a leading provider of ecommerce and interactive marketing services. We

acquired GSI to utilize its comprehensive integrated suite of online commerce and interactive marketing services to strengthen our ability to

connect buyers and sellers worldwide. We paid $29.25 per share, and assumed restricted stock-based awards with a fair value of approximately

$25 million , resulting in total consideration of approximately $2.4 billion . In addition, we paid an amount equal to $0.33 per share or

approximately $24 million , which was separate and distinct from the per share merger consideration, to certain GSI security holders in

connection with the settlement of litigation related to the acquisition of GSI and recorded that payment in general and administrative expenses.

GSI is reported in our Enterprise segment.

Divestiture

In conjunction with the acquisition of GSI, we immediately divested 100 percent of GSI's licensed sports merchandise business and 70

percent of GSI's ShopRunner and RueLaLa businesses (together, the "divested businesses"). The divested businesses were sold to Kynetic, LLC

(formerly known as NRG Commerce, LLC), which we refer to as Kynetic, led by GSI's former Chairman, President and Chief Executive

Officer, for a note receivable with a face value of $467 million . The note receivable bore interest at an annual rate equal to 3-month LIBOR

plus

1.10% , maturing in December 2018, and was secured by certain assets of the divested businesses. The fair value of the note receivable was

determined to be $287 million based on comparable market interest rates and was recorded in other assets in our consolidated balance sheet. The

difference between the fair value of the note receivable and the carrying value of the divested businesses resulted in a loss of approximately

$257

million . The loss was recorded in interest and other, net in our consolidated statement of income.

The carrying value of our retained stake in the ShopRunner and RueLaLa businesses was approximately $75 million and was recorded in

long-term investments. We accounted for our retained interest in the ShopRunner and RueLaLa businesses under the equity method of

accounting and recorded our proportionate share of net income (loss) on a one-quarter lag as a component of interest and other, net in our

consolidated statement of income. Our exposure to loss resulting from our financing arrangement with Kynetic and equity investments in

RueLaLa and ShopRunner was limited to the carrying value of the note receivable and equity investments, respectively. We also entered into a

transitional services agreement, pursuant to which GSI provided to the divested businesses certain transitional services for a limited period. GSI

has also entered into a transitional services agreement, pursuant to which it is providing to the divested businesses certain transitional services

for a limited period, as well as certain other commercial agreements with Kynetic and its affiliates.

In September 2013, the Kynetic note receivable was repaid and our investments in RueLaLa and ShopRunner were sold for total cash

proceeds of approximately $485 million . This transaction resulted in a net gain of approximately $75 million , which has been recognized in

interest and other, net in our consolidated statement of income.

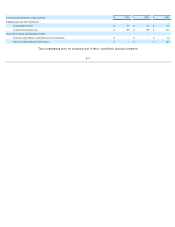

Intangible Assets

The following table sets forth the components of intangible assets acquired in connection with the GSI acquisition (excluding intangible

assets sold in connection with the divested businesses):

We have included the financial results of GSI in our consolidated financial statements from the date of acquisition.

F-16

Description Fair Value Useful Life (Years)

(In millions, except years)

Trademarks

$

8

2

User base

668

5

Developed technology

143

5

Total

$

819