eBay 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

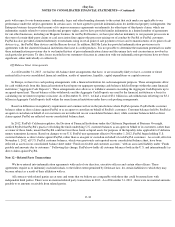

Our computation of expected volatility is based on a combination of historical and market-based implied volatility from traded options on

our common stock. Our computation of expected life is based on historical experience of similar awards, giving consideration to the contractual

terms of the stock-based awards, vesting schedules and expectations of future employee behavior. The interest rate for periods within the

contractual life of the award is based on the U.S. Treasury yield curve in effect at the time of grant.

Note 16 – Income Taxes

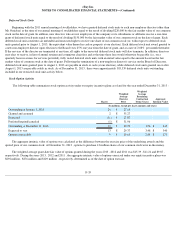

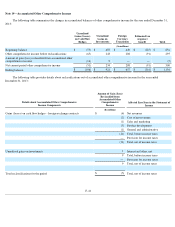

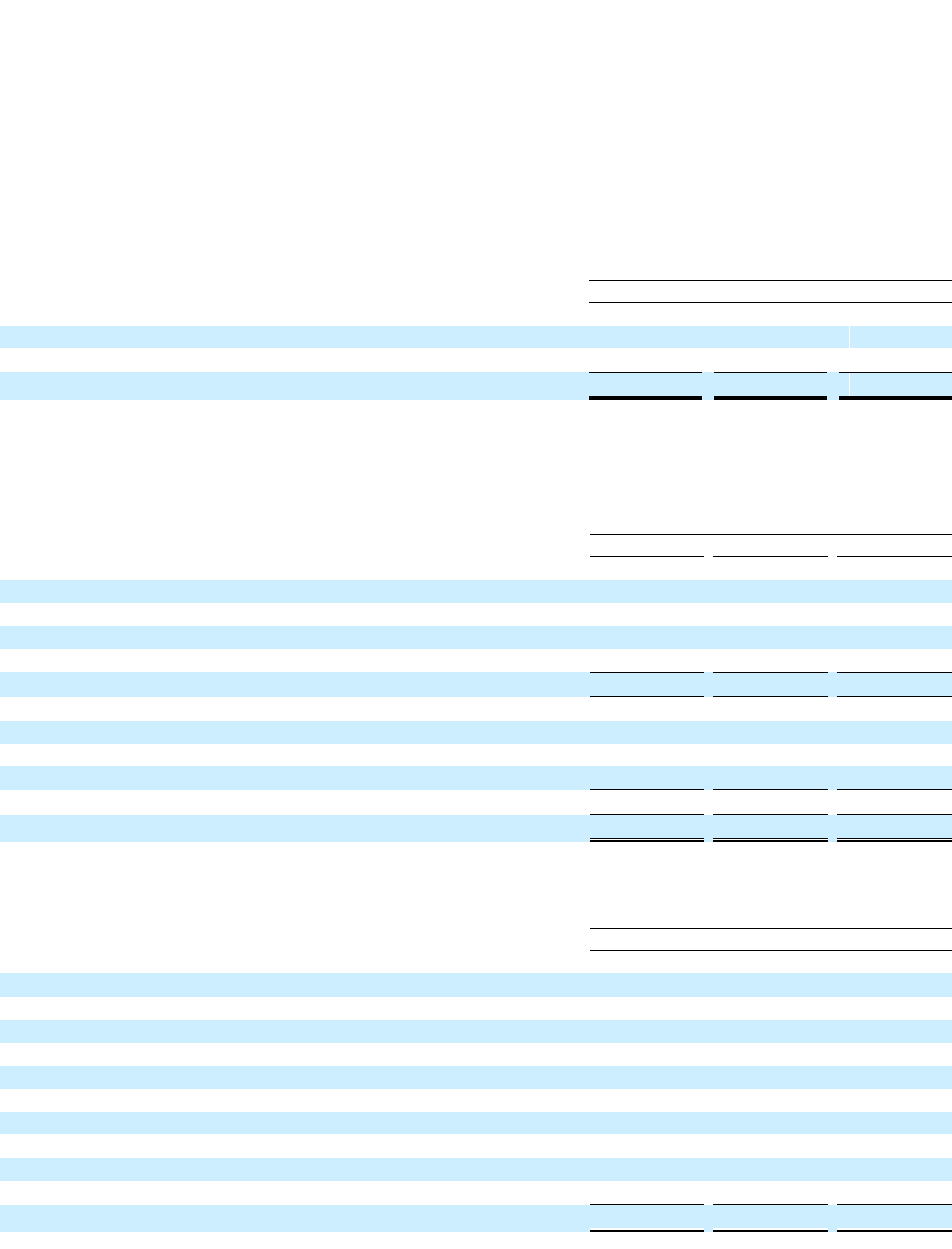

The components of pretax income for the years ended December 31, 2013 , 2012 and 2011 are as follows:

U.S. pre-tax income for the year ended December 31, 2011 includes approximately $449 million relating to non-U.S. income

recharacterized as U.S. income due to the settlement of multiple uncertain tax positions.

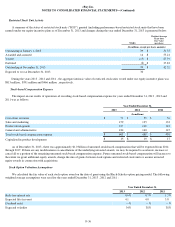

The provision for income taxes is comprised of the following:

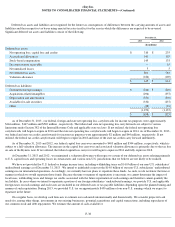

The following is a reconciliation of the difference between the actual provision for income taxes and the provision computed by applying

the federal statutory rate of 35% for 2013 , 2012 and 2011 to income before income taxes:

Year Ended December 31,

2013

2012

2011

(In millions)

United States

$

594

$

605

$

1,746

International

2,872

2,479

2,164

$

3,466

$

3,084

$

3,910

Year Ended December 31,

2013

2012

2011

(In millions)

Current:

Federal

$

455

$

327

$

518

State and local

(4

)

63

24

Foreign

190

120

122

$

641

$

510

$

664

Deferred:

Federal

$

18

$

34

$

64

State and local

(22

)

(24

)

(3

)

Foreign

(27

)

(45

)

(44

)

(31

)

(35

)

17

$

610

$

475

$

681

Year Ended December 31,

2013

2012

2011

(In millions)

Provision at statutory rate

$

1,213

$

1,080

$

1,369

Permanent differences:

Foreign income taxed at different rates

(607

)

(617

)

(1,093

)

Gain on sale of Skype

—

—

321

Change in valuation allowance

—

3

(1

)

Stock-based compensation

33

(14

)

32

State taxes, net of federal benefit

(26

)

39

21

Research and other tax credits

(43

)

1

(8

)

Divested business

21

(41

)

34

Other

19

24

6

$

610

$

475

$

681