eBay 2013 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2013 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

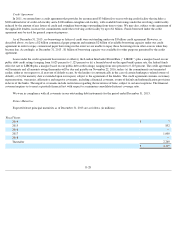

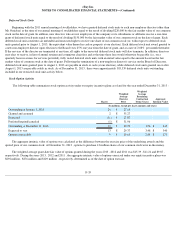

Deferred Stock Units

Beginning with the 2011 annual meeting of stockholders, we have granted deferred stock units to each non-employee director (other than

Mr. Omidyar) at the time of our annual meeting of stockholders equal to the result of dividing $220,000 by the fair market value of our common

stock on the date of grant. In addition, new directors who are not employees of the company or its subsidiaries or affiliates receive a one-time

grant of deferrred stock units equal to the result of dividing $150,000 by the fair market value of our common stock on the date of grant. Each

deferred stock unit constitutes an unfunded and unsecured right to receive one share of our common stock (or, with respect to deferred stock

units granted prior to August 1, 2013, the equivalent value thereof in cash or property at our election). Each deferred stock unit award granted to

a new non-employee director upon election to the Board vests 25% one year from the date of grant, and at a rate of 2.08% per month thereafter.

If the services of the director are terminated at any time, all rights to the unvested deferred stock units will also terminate. In addition, directors

may elect to receive, in lieu of annual retainer and committee chair fees and at the time these fees would otherwise be payable (i.e., on a

quarterly basis in arrears for services provided), fully vested deferred stock units with an initial value equal to the amount based on the fair

market value of common stock at the date of grant. Following the termination of a non-employee director's service on the Board of Directors,

deferred stock units granted prior to August 1, 2013 are payable in stock or cash (at our election), while deferred stock units granted on or after

August 1, 2013 are payable solely in stock. As of December 31, 2013 , there were approximately 303,339 deferred stock units outstanding

included in our restricted stock unit activity below.

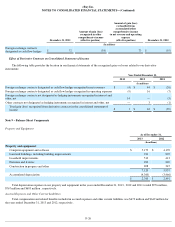

Stock Option Activity

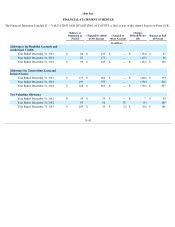

The following table summarizes stock option activity under our equity incentive plans as of and for the year ended December 31, 2013 :

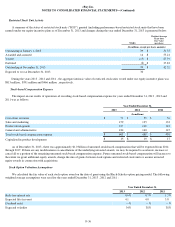

The aggregate intrinsic value of options was calculated as the difference between the exercise price of the underlying awards and the

quoted price of our common stock. At December 31, 2013 , options to purchase 12 million shares of our common stock were in-the-money.

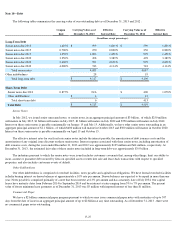

The weighted average grant-date fair value of options granted during the years 2013 , 2012 and 2011 was $15.39 , $11.21 and $9.87 ,

respectively. During the years 2013 , 2012 and 2011 , the aggregate intrinsic value of options exercised under our equity incentive plans was

$292 million , $276 million and $129 million , respectively, determined as of the date of option exercise.

F-35

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Term (Years)

Aggregate

Intrinsic Value

(In millions, except per share amounts and years)

Outstanding at January 1, 2013

24

$

27.14

Granted and assumed

2

$

55.27

Exercised

(11

)

$

27.07

Forfeited/expired/canceled

(1

)

$

31.96

Outstanding at December 31, 2013

14

$

29.79

3.54

$

345

Expected to vest

13

$

29.37

3.48

$

340

Options exercisable

9

$

25.65

2.84

$

271