eBay 1998 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

76

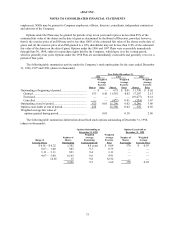

Fair value disclosures

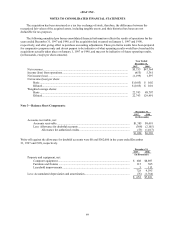

The Company calculated the minimum fair value of each option grant on the date of grant using the Black-

Scholes option pricing model as prescribed by SFAS No. 123 using the following assumptions:

Year Ended December 31,

1996 1997 1998

Risk-free interest rates............................................................................................. 6.0% 5.9% 4.9%

Expected lives (in years) ......................................................................................... 5.0 5.0 3.0

Dividend yield ......................................................................................................... 0% 0% 0%

Expected volatility................................................................................................... 0% 0% 80%

Prior to the Company’ s initial public offering, the fair value of each option grant was determined using the

minimum value method. Subsequent to the offering, the fair value was determined using the Black-Scholes model.

The compensation cost associated with the Company’ s stock-based compensation plans, determined using the

minimum value method prescribed by SFAS No. 123, did not result in a material difference from the reported net

income for the years ended December 31, 1996 and 1997. The effect of compensation cost on net income and

earnings per share for the year ended December 31, 1998 is as follows, (in thousands, except per share amounts):

1998

Net income:

As reported .................................................................................................................................. $2,398

Pro forma..................................................................................................................................... $1,622

Net income per share—basic:

As reported .................................................................................................................................. $ 0.05

Pro forma..................................................................................................................................... $ 0.03

Net income per share—diluted:

As reported .................................................................................................................................. $ 0.02

Pro forma..................................................................................................................................... $ 0.01

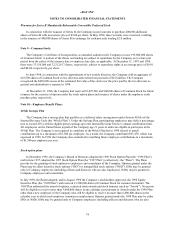

1998 Employee Stock Purchase Plan

In July 1998, the Board adopted, and in August 1998 the Company’ s stockholders approved, the 1998 Employee

Stock Purchase Plan (the “Purchase Plan”) and reserved 900,000 shares of Common Stock for issuance thereunder.

On each January 1, the aggregate number of shares reserved for issuance under the Purchase Plan will be increased

automatically by the number of shares purchased under the Purchase Plan in the preceding calendar year. The

aggregate number of shares reserved for issuance under the Purchase Plan shall not exceed 4,500,000 shares. The

Purchase Plan became effective on September 24, 1998, the first business day on which price quotations for the

Company’ s Common Stock were available on the Nasdaq National Market. Employees are generally eligible to

participate in the Purchase Plan if they are customarily employed by the Company for more than 20 hours per week

and more than five months in a calendar year and are not (and would not become as a result of being granted an

option under the Purchase Plan) 5% stockholders of the Company. Under the Purchase Plan, eligible employees may

select a rate of payroll deduction between 2% and 10% of their W-2 cash compensation subject to certain maximum

purchase limitations. Each Offering Period has a maximum duration of two years (the “Offering Period”) and

consists of four six-month Purchase Periods (each, a “Purchase Period”), with the exception of the first Offering

Period, which began on September 24, 1998 and will end on April 30, 1999. Offering Periods and Purchase Periods

thereafter will begin on April 1 and November 1. The price at which the Common Stock is purchased under the

Purchase Plan is 85% of the lesser of the fair market value of the Company’ s Common Stock on the first day of the

applicable offering period or on the last day of that purchase period. The Purchase Plan will terminate after a period

of ten years unless terminated earlier as permitted by the Purchase Plan.