eBay 1998 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

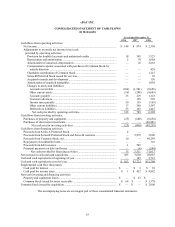

eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

73

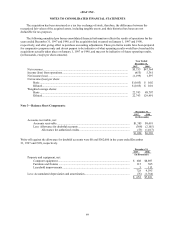

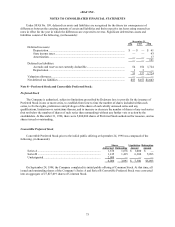

Under SFAS No. 109, deferred tax assets and liabilities are recognized for the future tax consequences of

differences between the carrying amounts of assets and liabilities and their respective tax bases using enacted tax

rates in effect for the year in which the differences are expected to reverse. Significant deferred tax assets and

liabilities consist of the following, (in thousands):

December 31,

1996 1997 1998

Deferred tax assets:

Depreciation .......................................................................................................... $ — $ — $ 61

State income taxes................................................................................................. — — 43

Amortization.......................................................................................................... — — 17

— — 121

Deferred tax liabilities:

Accruals and reserves not currently deductible ..................................................... 54 154 1,724

Depreciation .......................................................................................................... 1 3 —

55 157 1,724

Valuation allowance...................................................................................................... — — —

Net deferred tax liabilities ............................................................................................. $55 $157 $1,603

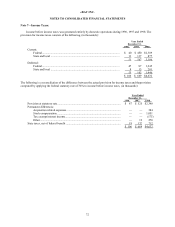

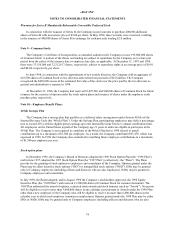

Note 8—Preferred Stock and Convertible Preferred Stock:

Preferred Stock

The Company is authorized, subject to limitations prescribed by Delaware law, to provide for the issuance of

Preferred Stock in one or more series, to establish from time to time the number of shares included within each

series, to fix the rights, preferences and privileges of the shares of each wholly unissued series and any

qualifications, limitations or restrictions thereon, and to increase or decrease the number of shares of any such series

(but not below the number of shares of such series then outstanding) without any further vote or action by the

stockholders. At December 31, 1998, there were 5,000,000 shares of Preferred Stock authorized for issuance, and no

shares issued or outstanding.

Convertible Preferred Stock

Convertible Preferred Stock prior to the initial public offering at September 24, 1998 was composed of the

following, (in thousands):

Shares Liquidation Redemption

Authorized Outstanding Amount Amount

Series A ...................................................................................... . 1,676 1,676 $ 1,000 $ —

Series B ....................................................................................... 1,415 1,415 6,300 5,093

Undesignated............................................................................... 2,909 — — —

6,000 3,091 $ 7,300 $5,093

On September 24, 1998, the Company completed its initial public offering of Common Stock. At that time, all

issued and outstanding shares of the Company’ s Series A and Series B Convertible Preferred Stock were converted

into an aggregate of 27,827,019 shares of Common Stock.