eBay 1998 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

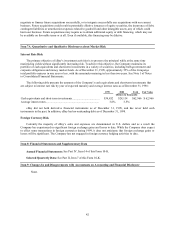

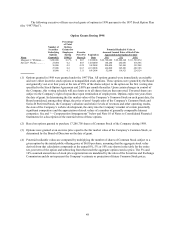

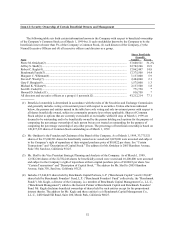

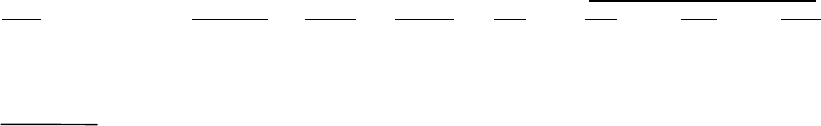

The following executive officers received grants of options in 1998 pursuant to the 1997 Stock Option Plan

(the “1997 Plan”).

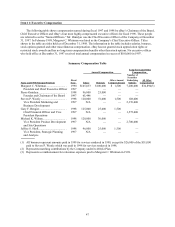

Option Grants During 1998

Number of

Securities

Underlying

Options

Percentage

of Total

Options

Granted to

Employees

during

Exercise

Price Per Expiration

Potential Realizable Value at

Assumed Annual Rates of Stock Price

Appreciation for Option Term(4)

Name Granted(1) 1998(2) Share(3) Date 0% 5% 10%

Margaret C. Whitman.... . 7,200,000 41.7% $ 0.07 1/20/2008 $ 42,720,000 $ 69,888,248 $ 111,569,674

Steven P. Westly............ . 27,000 0.2 0.07 1/20/2008 160,200 262,081 418,386

36,000 0.2 0.22 3/4/2008 208,000 343,841 552,248

27,000 0.2 0.67 4/13/2008 144,000 245,881 402,186

18,000 0.1 3.11 6/8/2008 52,000 119,921 224,124

(1) Options granted in 1998 were granted under the 1997 Plan. All options granted were immediately exercisable

and were either incentive stock options or nonqualified stock options. These options were granted by the Board

and generally vest over four years at the rate of 25% of the shares subject to the option on the first vesting date

specified in the Stock Option Agreement and 2.08% per month thereafter. Upon certain changes in control of

the Company, this vesting schedule will accelerate as to all shares that are then unvested. Unvested shares are

subject to the Company’ s right of repurchase upon termination of employment. Options expire ten years from

the date of grant. In determining the fair market value of the Company’ s Common Stock on each grant date, the

Board considered, among other things, the price of arms’ -length sales of the Company’ s Common Stock and

Series B Preferred Stock, the Company’ s absolute and relative levels of revenues and other operating results,

the state of the Company’ s website development, the entry into the Company’ s market of certain potentially

significant competitors and the appreciation of stock values of a number of generally comparable Internet

companies. See and “—Compensation Arrangements” below and Note 10 of Notes to Consolidated Financial

Statements for a description of the material terms of these options.

(2) Based on options granted to purchase 17,286,756 shares of Common Stock of the Company during 1998.

(3) Options were granted at an exercise price equal to the fair market value of the Company’ s Common Stock, as

determined by the Board of Directors on the date of grant.

(4) Potential realizable values are computed by multiplying the number of shares of Common Stock subject to a

given option by the initial public offering price of $6.00 per share, assuming that the aggregate stock value

derived from that calculation compounds at the annual 0%, 5% or 10% rate shown in the table for the entire

ten-year term of the option and subtracting from that result the aggregate option exercise price. The 5% and

10% assumed annual rates of stock price appreciation are mandated by the rules of the Securities and Exchange

Commission and do not represent the Company’ s estimate or projection of future Common Stock prices.