eBay 1998 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

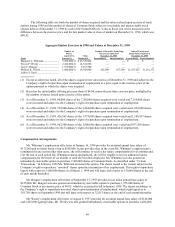

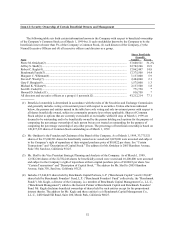

(5) Consists of 15,244,821 shares held by Benchmark Capital and 2,130,687 shares held by Benchmark Founders’

Fund. In addition to Mr. Kagle, David M. Beirne, Bruce W. Dunlevie, Kevin R. Harvey and Andrew S.

Rachleff are members of Benchmark management and would be deemed to beneficially own 17,620,548

(14.6%), 17,837,154 (14.8%), 17,862,447 (14.8%), and 17,837,154 (14.8%) shares respectively, of the

Company’ s common stock if such shares are included with the other shares they beneficially own. Each of

Mssrs. Beirne, Dunlevie, Harvey, and Rachleff disclaims beneficial ownership of shares held by such entities

except for his proportional interest therein. The address for theses stockholders is c/o Benchmark Capital

Management Co., L.L.C., 2480 Sand Hill Road, Suite 200, Menlo Park California, 94025.

(6) Ms. Whitman is the President and Chief Executive Officer of the Company. As of March 1, 1999, 1,710,000

shares of the 7,110,000 shares she beneficially owned were vested and 5,400,000 shares were unvested and

subject to the Company’ s right of repurchase at their original purchase price of $0.067 per share. Includes

27,000 shares held by Ms. Whitman’ s husband as custodian for her two children. The address for Ms.

Whitman is 2005 Hamilton Avenue, Suite 350, San Jose, California 95125.

(7) Mr. Westly is the Vice President Marketing and Business Development of the Company. As of March 1,

1999, 898,312 shares of the 2,484,000 shares he beneficially owned were vested and 1,585,688 shares were

unvested and subject to the Company’ s right of repurchase at their original purchase price. The original

purchase prices of Mr. Westly’ s unvested shares are: $0.033 (1,485,000 shares); $0.067 (19,688 shares); $0.22

(36,000 shares); $0.67 (27,000 shares); and $3.11 (18,000 shares). The address for Mr. Westly is 2005

Hamilton Avenue, Suite 350, San Jose, California 95125.

(8) Mr. Bengier is the Chief Financial Officer and Vice President Operations of the Company. As of March 1,

1999, 492,187 shares of the 1,575,000 shares he beneficially owned were vested and 1,082,813 shares were

unvested and subject to the Company’ s right of repurchase at their original purchase price of $0.033 per share.

The address for Mr. Bengier is 2005 Hamilton Avenue, Suite 350, San Jose, California 95125.

(9) Mr. Wilson is the Senior Vice President Product Development and Site Operations of the Company. As of

March 1, 1999, 937,500 shares of the 1,800,000 shares he beneficially owned were vested and 862,500 shares

were unvested and subject to the Company’ s right of repurchase at their original purchase price of $0.0057 per

share. Also includes 337,500 shares subject to options vesting within 60 days of March 1, 1999. The address

for Mr. Wilson is 2005 Hamilton Avenue, Suite 350, San Jose, California 95125.

(10) Includes 450,000 shares subject to an immediately exercisable option outstanding at March 1, 1999. See “Item

11—Executive Compensation.” The address for Mr. Cook is 2550 Garcia Avenue, M.S. 2475, Mountain

View, California 94043.

(11) Mr. Schultz’ s shares include 450,000 shares issued to him upon exercise of an option that were unvested as of

March 1, 1999 and subject to the Company’ s right of repurchase at their original purchase price of $3.11 per

share. Of these 450,000 unvested shares, Mr. Schultz has transferred 337,500 shares to Maveron. An

additional 321,750 shares held by Maveron or purchased by Maveron in June 1998 will be distributed to the

partners of Maveron in a pro rata partnership distribution. The address for Mr. Schultz is 2401 Utah Ave.

South, Seattle, Washington, 98134. The address for Maveron is 800 Fifth Avenue, Suite 4100, Seattle,

Washington 98104.

(12) Includes the shares described in footnotes (2)-(4) and (6)-(11).