eBay 1998 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

72

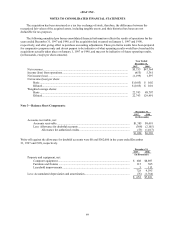

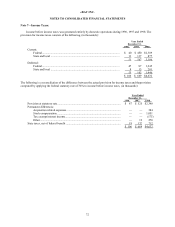

Note 7—Income Taxes:

Income before income taxes was generated entirely by domestic operations during 1996, 1997 and 1998. The

provision for income taxes consists of the following, (in thousands):

Year Ended

December 31,

1996 1997 1998

Current:

Federal........................................................................................................... $ 40 $ 450 $2,309

State and local ............................................................................................... 11 117 877

51 567 3,186

Deferred:

Federal........................................................................................................... 47 87 1,245

State and local ............................................................................................... 8 15 201

55 102 1,446

$ 106 $ 669 $4,632

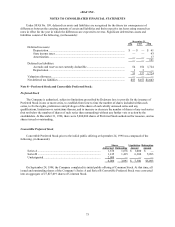

The following is a reconciliation of the difference between the actual provision for income taxes and theprovision

computed by applying the federal statutory rate of 34% to income before income taxes, (in thousands):

Year Ended

December 31,

1996 1997 1998

Provision at statutory rate........................................................................................ $ 87 $ 525 $2,390

Permanent differences:

Acquisition related expenses ........................................................................... — — 384

Stock compensation......................................................................................... — — 1,051

Tax exempt interest income............................................................................. — — (175)

Other................................................................................................................ — 12 270

State taxes, net of federal benefit ............................................................................ 19 132 712

$ 106 $ 669 $4,632