eBay 1998 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

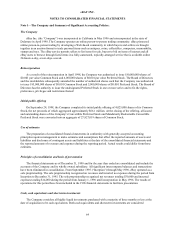

eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

65

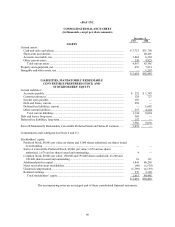

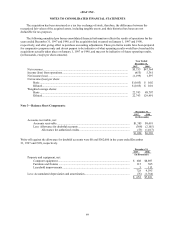

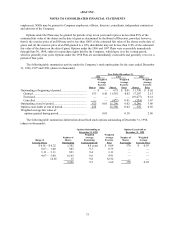

available-for-sale securities and are carried at amortized cost, which approximates fair value. The following

schedule summarizes the estimated fair value of the Company’ s cash, cash equivalents and short-term investments,

(in thousands):

December 31,

1997 1998

Cash and cash equivalents:

Cash........................................................................................................................... $ 676 $ 6,397

Money market funds.................................................................................................. 3,047 2,828

Municipal bonds and notes........................................................................................ — 19,555

Corporate securities................................................................................................... — 3,010

$ 3,723 $31,790

Short-term investments:

Municipal bonds and notes........................................................................................ $ — $40,401

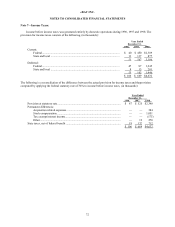

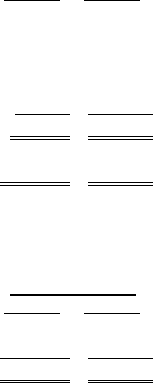

The estimated fair value of short-term investments classified by date of contractual maturity is as follows, (in

thousands):

December 31,

1997 1998

Due within one year or less ................................................................................................ $ — $12,287

Due after one year through two years................................................................................. — 28,114

$ — $40,401

Concentration of credit risk

Financial instruments that potentially subject the Company to a concentration of credit risk consist of cash, cash

equivalents, short-term investments and accounts receivable. Cash, cash equivalents and short-term investments are

deposited with high credit, quality financial institutions. The Company’ s accounts receivable are derived from

revenue earned from customers located in the U.S. and throughout the world and are denominated in U.S. dollars.

Accounts receivable balances are typically settled through customer credit cards and, as a result, the majority of

accounts receivable are collected upon processing of credit card transactions. The Company maintains an allowance

for doubtful accounts receivable based upon the expected collectibility of accounts receivable. During the years

ended December 31, 1997 and 1998, no customers accounted for more than 10% of net revenues or net accounts

receivable.

Fair value of financial instruments

The Company’ s financial instruments, including cash, cash equivalents, short-term investments, accounts

receivable, accounts payable and capital lease obligations are carried at cost, which approximates their fair value

because of the short-term maturity of these instruments.

Property and equipment

Property and equipment are stated at historical cost. Depreciation and amortization are computed using the

straight-line method over the estimated useful lives of the assets, generally five years or less, or the shorter of the

lease term or the estimated useful lives of the assets, if applicable.

Intangible assets

Goodwill and other intangible assets resulting from the acquisition of Jump Incorporated (“Jump”) were

estimated by management to be primarily associated with the acquired customer list, workforce and technological

know how. As a result of the rapid technological changes occurring in the Internet industry and the intense