eBay 1998 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

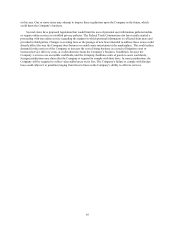

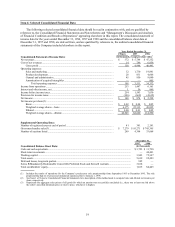

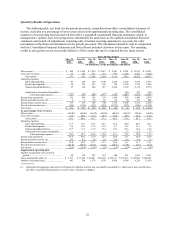

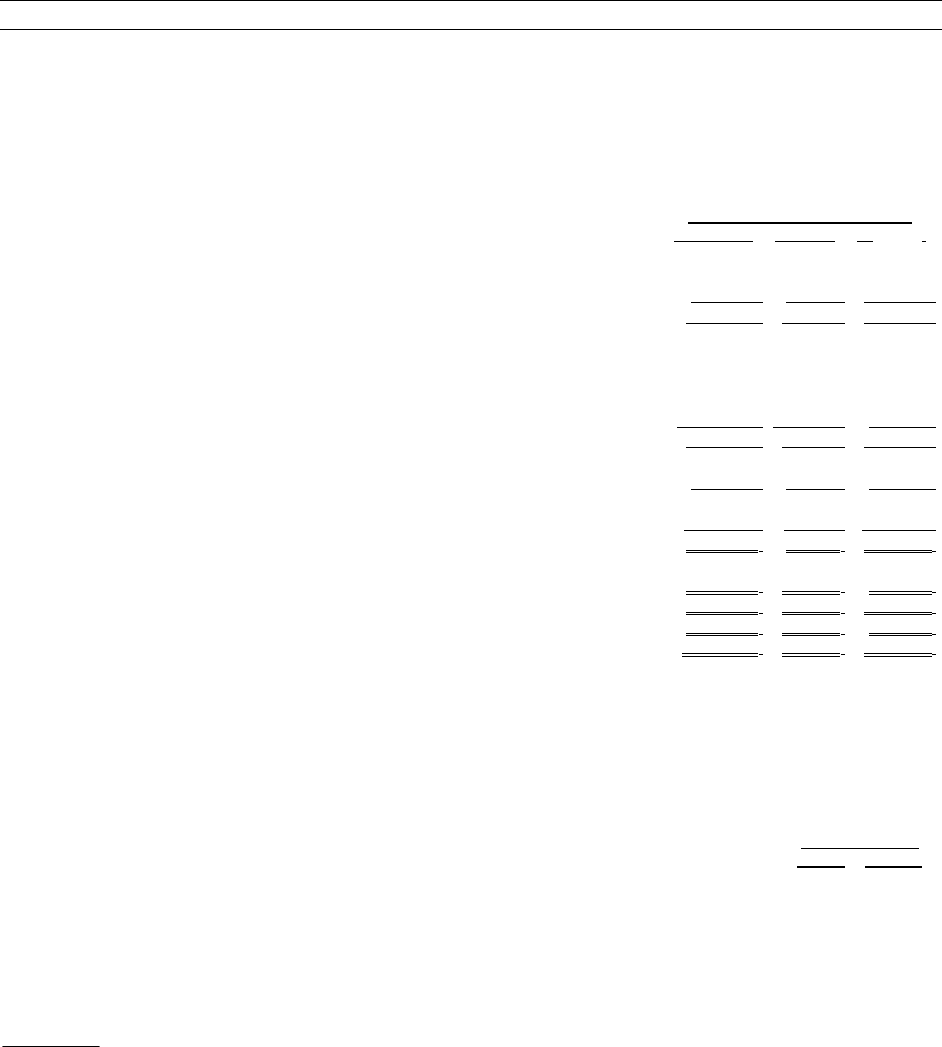

Item 6: Selected Consolidated Financial Data

The following selected consolidated financial data should be read in conjunction with, and are qualified by

reference to, the Consolidated Financial Statements and Notes thereto and “Management’ s Discussion and Analysis

of Financial Condition and Results of Operations” appearing elsewhere in this report. The consolidated statement of

income data for the years ended December 31, 1996, 1997 and 1998 and the consolidated balance sheet data at

December 31, 1997 and 1998, are derived from, and are qualified by reference to, the audited consolidated financial

statements of the Company included elsewhere in this report.

Year Ended December 31,

1996(1) 1997 1998

Consolidated Statement of Income Data: (in thousands, except per share data)

Net revenues......................................................................................................................... $ 372 $ 5,744 $ 47,352

Cost of net revenues............................................................................................................ . 14 746 6,859

Gross profit ................................................................................................................. . 358 4,998 40,493

Operating expenses:

Sales and marketing .................................................................................................... . 32 1,730 19,841

Product development................................................................................................... . 28 831 4,606

General and administrative.......................................................................................... . 45 950 9,080

Amortization of acquired intangibles.......................................................................... . — — 805

Total operating expenses..................................................................................... . 105 3,511 34,332

Income from operations ...................................................................................................... . 253 1,487 6,161

Interest and other income, net ............................................................................................. . 1 56 869

Income before income taxes................................................................................................ . 254 1,543 7,030

Provision for income taxes.................................................................................................. . (106) (669) (4,632)

Net income........................................................................................................................... $ 148 $ 874 $ 2,398

Net income per share(2): .....................................................................................................

Basic............................................................................................................................. $ 0.02 $ 0.04 $ 0.05

Weighted average shares—basic................................................................................. . 6,375 22,313 49,895

Diluted ......................................................................................................................... $ 0.00 $ 0.01 $ 0.02

Weighted average shares—diluted.............................................................................. . 42,945 82,660 114,590

Supplemental Operating Data:

Number of registered users at end of period ....................................................................... . 41 341 2,181

Gross merchandise sales(3)................................................................................................. . $ 7,279 $ 95,271 $ 745,395

Number of auctions listed ................................................................................................... . 289 4,394 33,668

December 31,

1997 1998

Consolidated Balance Sheet Data: (in thousands)

Cash and cash equivalents............................................................................................................................... $ 3,723 $ 31,790

Short-term investments ................................................................................................................................... — 40,401

Working capital............................................................................................................................................... 3,843 75,347

Total assets...................................................................................................................................................... 5,619 92,483

Debt and leases, long-term portion ................................................................................................................. 305 —

Series B Mandatorily Redeemable Convertible Preferred Stock and Series B warrants ................................. 3,018 —

Total stockholders’ equity............................................................................................................................... 1,015 84,445

(1) Includes the results of operations for the Company’ s predecessor sole proprietorship from September 1995 to December 1995. The sole

proprietorship had no revenues and immaterial expenses prior to January 1, 1996.

(2) See Note 1 of Notes to Consolidated Financial Statements for a description of the method used to compute basic and diluted net income per

share, respectively.

(3) Represents the aggregate sales prices of all goods for which an auction was successfully concluded (i.e., there was at least one bid above

the seller’s specified minimum price or reserve price, whichever is higher).