eBay 1998 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

was expensed during 1998. In March 1999, eBay and AOL expanded the scope of their strategic relationship. Under

this new agreement, eBay will pay AOL $75 million over the four-year term of the contract. Under this agreement,

the Company’ s remaining payment obligations to AOL were cancelled. See Notes 6 and 11 of Notes to Consolidated

Financial Statements.

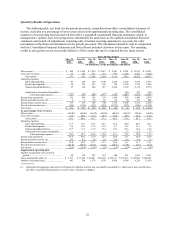

Product Development

eBay’ s product development expenses consist primarily of compensation for product development staff and

payments to outside contractors and, to a lesser extent, of depreciation on equipment used for development and

overhead costs. The Company expenses product development costs as they are incurred. Product development

expenses increased substantially in absolute dollars in each quarter throughout the past eight quarters. Compensation

and other personnel-related expenses grew most rapidly on a percentage basis between the first quarter of 1997 and

the second quarter of 1997. Product development expenses increased to 11.5% of net revenues in the second quarter

of 1998 from 8.7% in the first quarter of 1998 as the Company significantly increased its engineering staff and the

use of outside contractors, while the rate of growth of net revenues declined. Increases in engineering staff were

level with net revenues growth in the third quarter of 1998 and, accordingly, product development expenses as a

percentage of net revenues remained relatively constant. In the fourth quarter of 1998, product development

expenses remained relatively unchanged from the prior quarter, while net revenues grew. This resulted in a decline

in product development expenses to 7.9% of net revenues in the fourth quarter of 1998 from 11.7% in the third

quarter of 1998. The Company expects that product development expenses will continue to increase in absolute

dollars and will vary as a percentage of net revenues in future quarters primarily due to the addition of headcount

relative to the rate of net revenues growth.

General and Administrative

eBay’ s general and administrative expenses consist primarily of compensation for personnel and, to a lesser

extent, fees for outside professional advisors and overhead costs. General and administrative expenses increased as a

percentage of net revenues in the third quarter of 1997 as personnel-related costs increased. General and

administrative expenses increased as a percentage of net revenues to 35.3% in the second quarter of 1998 because,

in that quarter, the Company donated 321,750 shares of its common stock, with an estimated fair value of $1.2

million, to a charitable foundation, recorded compensation expense of $429,000 associated with purchases of

restricted common stock by its outside directors and recorded compensation expense of $403,000 associated with

the grant of stock options to employees. General and administrative expenses decreased as a percentage of net

revenues to 16.4% in the third quarter of 1998 and 14.2% in the fourth quarter of 1998 as increases in personnel

related costs and professional fees were more than offset by increases in net revenues. The Company expects that

general and administrative expenses will continue to increase in absolute dollars in future quarters as the Company

continues to build its administrative staff and infrastructure, but may eventually decline as a percentage of net

revenues, and fluctuate from quarter to quarter depending on the rate of net revenue growth.

Amortization of Acquired Intangibles

During the second quarter of 1998, eBay recognized expenses totaling $150,000 for in-process technology

assumed in the acquisition of Jump and charged it to operations because the technology had not reached the stage of

technological feasibility at the acquisition date and had no alternative future use. The Company recognized

amortization expense of approximately $328,000 in each of the third and fourth quarters of 1998 associated with the

covenants not to compete, customer list and goodwill assumed in the Jump acquisition. Amortization associated with

these intangible assets is anticipated to be approximately $328,000 in each of the first three quarters of 1999, and

approximately $26,000 in each of the fourth quarter of 1999 and the first and second quarters of 2000, assuming no

additional acquisitions and no impairment of value resulting in an acceleration of amortization. See Note 2 of Notes

to Consolidated Financial Statements.