eBay 1998 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

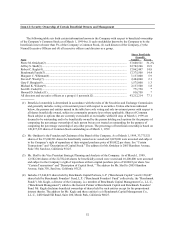

Engineering from the General Motors Institute (renamed Kettering University in January 1998) and an M.B.A.

degree from the Stanford Graduate School of Business.

Howard D. Schultz has served as a director of eBay since June 1998. Mr. Schultz is the founder of Starbucks

Corporation (“Starbucks”), a provider of gourmet coffee, and has been its Chairman of the Board and Chief

Executive Officer since its inception in 1985. From 1985 to June 1994, Mr. Schultz was also President of Starbucks.

Mr. Schultz was the director of Retail Operations and Marketing for Starbucks Coffee Company, a predecessor to

Starbucks from September 1982 to December 1985 and was the Chairman of the Board, Chief Executive Officer and

President of Il Giornale Coffee Company, a predecessor to Starbucks, from January 1986 to July 1987. Mr. Schultz

is also one of two founding members of Maveron LLC, a company providing advisory services to consumer-based

businesses, and is one of two members of a limited liability company that serves as a general partner of its affiliated

venture capital fund, Maveron Equity Partners, L.P. (together, “Maveron”).

Board Composition

eBay’ s Board of Directors (the “Board”) is divided into three classes, Class I, Class II and Class III, with each

class serving staggered three-year terms. The Class I directors, currently Messrs. Cook and Kagle, will stand for re-

election or election at the 1999 annual meeting of stockholders. The Class II directors, currently Messrs. Omidyar

and Schultz, will stand for re-election or election at the 2000 annual meeting of stockholders and the Class III

director, currently Ms. Whitman, will stand for re-election or election at the 2001 annual meeting of stockholders.

Board Committees

The Audit Committee of the Board consists of Robert C. Kagle and Scott D. Cook. The Audit Committee

reviews eBay’ s financial statements and accounting practices, makes recommendations to the Board regarding the

selection of independent auditors and reviews the results and scope of the audit and other services provided by

eBay’ s independent auditors. The Compensation Committee of the Board consists of Robert C. Kagle and Howard

D. Schultz. The Compensation Committee makes recommendations to the Board concerning salaries and incentive

compensation for eBay’ s officers and employees and administers eBay’ s employee benefit plans.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee of the Board was at any time since the formation of the

Company an officer or employee of the Company. No executive officer of the Company serves as a member of the

board of directors or compensation committee of any entity that has one or more executive officers serving on the

Company’ s Board or Compensation Committee.

Director Compensation

Directors of the Company do not receive cash compensation for their services as directors but are reimbursed

for their reasonable expenses for attending Board and Board committee meetings. In June 1998, Mr. Cook and Mr.

Schultz were each granted an option to purchase 450,000 shares of Common Stock of the Company at an exercise

price of $3.11 per share in connection with their service on the Board. Such options were immediately exercisable.

Prior to exercise, Mr. Schultz assigned the beneficial interest in his option to acquire 337,500 of these shares to his

affiliate, Maveron (see Mr. Schultz’ s biography above). Mr. Schultz thereafter exercised his option to acquire

112,500 shares in exchange for a full recourse fifty-five month promissory note for $350,000 at an interest rate of

8% per year. Interest on the note is payable annually and the principal is due on December 1, 2002. In addition, in

June 1998, Mr. Schultz exercised, on behalf of Maveron, the assigned portion of the option to acquire the remaining

337,500 shares in exchange for $1.05 million in cash. The shares of Common Stock received are subject to the

Company’ s right of repurchase at termination of service at a repurchase price equal to the exercise price of the

option that lapses as to 25% of the shares on the first anniversary of the date of grant and 2.08% each full succeeding

month thereafter. Also in June 1998, Mr. Cook and Maveron each purchased an additional 321,750 shares of

Common Stock at a price of $3.11 per share for cash. The Company subsequently concluded that the fair market

value of the Company’ s Common Stock on the date that the Company agreed to make the sale was $3.78 and