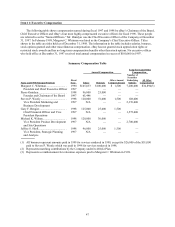

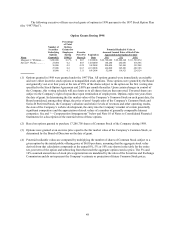

eBay 1998 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

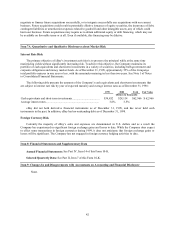

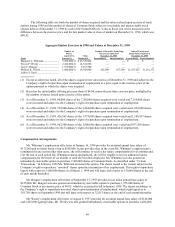

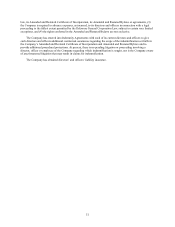

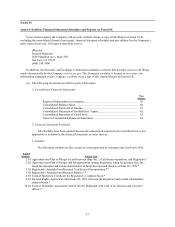

The following table sets forth the number of shares acquired and the value realized upon exercise of stock

options during 1998 and the number of shares of Common Stock subject to exercisable and unexercisable stock

options held as of December 31, 1998 by each of the Named Officers. Value at fiscal year end is measured as the

difference between the exercise price and the fair market value at close of market on December 31, 1998, which was

$80.42.

Aggregate Option Exercises in 1998 and Values at December 31, 1998

Number of

Shares

Acquired on Value

Number of Securities Underlying

Unexercised Options at

December 31, 1998

Value of Unexercised

In-the-Money Options at

December 31, 1998

Name Exercise(1) Realized(2) Exercisable(#) Unexercisable(#) Exercisable($) Unexercisable($)

Margaret C. Whitman ...................... . 7,200,000(3) $ 42,720,000 — — $ — $ —

Steven P. Westly .............................. . 2,484,000(4) 14,741,000 — — — —

Gary F. Bengier................................ . 1,575,000(5) 9,397,500 — — — —

Michael K. Wilson........................... . 1,800,000(6) 10,788,000 262,500 637,500 21,107,625 51,261,375

Jeffrey S. Skoll................................. . — — — — — —

(1) Except as otherwise noted, all of the shares acquired were unvested as of December 31, 1998 and subject to the

Company’ s right of repurchase upon termination of employment at a price equal to the exercise price of the

option pursuant to which the shares were acquired.

(2) Based on the initial public offering price per share of $6.00, minus the per share exercise price, multiplied by

the number of shares issued upon exercise of the option.

(3) As of December 31, 1998, 90,000 shares of the 7,200,000 shares acquired were vested and 7,110,000 shares

were unvested and subject to the Company’ s right of repurchase upon termination of employment.

(4) As of December 31, 1998, 792,000 shares of the 2,484,000 shares acquired were vested and 1,692,000 shares

were unvested and subject to the Company’ s right of repurchase upon termination of employment.

(5) As of December 31, 1998, 426,563 shares of the 1,575,000 shares acquired were vested and 1,148,437 shares

were unvested and subject to the Company’ s right of repurchase upon termination of employment.

(6) As of December 31, 1998, 862,500 shares of the 1,800,000 shares acquired were vested and 937,500 shares

were unvested and subject to the Company’ s right of repurchase upon termination of employment.

Compensation Arrangements

Ms. Whitman’ s employment offer letter of January 16, 1998 provides for an initial annual base salary of

$175,000 and an initial bonus of up to $100,000. It also provides that, in the event Ms. Whitman’ s employment is

terminated for any reason other than cause, she will continue to receive her salary compensation for six months and,

if at the end of such period Ms. Whitman remains unemployed, she will be eligible to receive additional salary

compensation for the lesser of six months or until she becomes employed. Ms. Whitman was also granted an

immediately exercisable option to purchase 7,200,000 shares of Common Stock. As described under “Certain

Transactions,” in February 1998 Ms. Whitman exercised this option. The shares issued to her remain subject to the

Company’ s right to repurchase “unvested” shares upon the termination of her employment. This right to repurchase

lapsed with respect to 1,800,000 shares as of March 1, 1999 and will lapse with respect to 150,000 shares at the end

of each month thereafter.

Mr. Bengier’ s employment offer letter of September 15, 1997 provides for an initial annual base salary of

$125,000. Mr. Bengier was also granted an immediately exercisable option to purchase 1,575,000 shares of

Common Stock at an exercise price of $0.03, which he exercised in full in January 1998. The shares are subject to

the Company’ s right to repurchase unvested shares upon termination of employment, which right lapsed as to

393,750 shares in September 1998 and will lapse with respect to 32,813 shares at the end of each month thereafter.

Mr. Westly’ s employment offer letter of August 8, 1997 provides for an initial annual base salary of $120,000

and a $25,000 signing bonus. Mr. Westly was also granted immediately exercisable options to purchase 2,484,000