eBay 1998 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

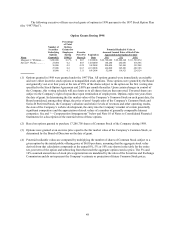

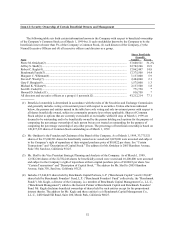

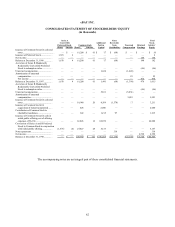

Item 12: Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information known to the Company with respect to beneficial ownership

of the Company’ s Common Stock as of March 1, 1999 by (1) each stockholder known by the Company to be the

beneficial owner of more than 5% of the Company’ s Common Stock, (2) each director of the Company, (3) the

Named Executive Officers and (4) all executive officers and directors as a group.

Shares Beneficially

Owned(1)

Name Number Percent

Pierre M. Omidyar(2) ............................................................................................................... 37,600,521 31.2%

Jeffrey S. Skoll(3)..................................................................................................................... 22,782,246 18.9

Robert C. Kagle(4).................................................................................................................... 17,862,447 14.8

Benchmark Funds(5)................................................................................................................. 17,375,508 14.4

Margaret C. Whitman(6)........................................................................................................... 7,137,000 5.9

Steven P. Westly(7) .................................................................................................................. 2,484,000 2.1

Gary F. Bengier(8).................................................................................................................... 1,575,000 1.3

Michael K. Wilson(9) ............................................................................................................... 2,137,500 1.8

Scott D. Cook(10)..................................................................................................................... 771,750 *

Howard D. Schultz(11)............................................................................................................. 816,750 *

All directors and executive officers as a group (11 persons)(12).............................................. 93,212,214 77.1

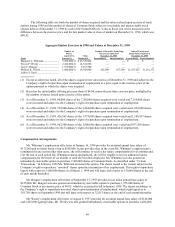

(1) Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission

and generally includes voting or investment power with respect to securities. Unless otherwise indicated

below, the persons and entities named in the table have sole voting and sole investment power with respect to

all shares beneficially owned, subject to community property laws where applicable. Shares of Common

Stock subject to options that are currently exercisable or exercisable within 60 days of March 1, 1999 are

deemed to be outstanding and to be beneficially owned by the person holding such options for the purpose of

computing the percentage ownership of such person but are not treated as outstanding for the purpose of

computing the percentage ownership of any other person. The percentage of beneficial ownership is based on

120,817,222 shares of Common Stock outstanding as of March 1, 1999.

(2) Mr. Omidyar is the Founder and Chairman of the Board of the Company. As of March 1, 1999, 33,775,521

shares of the 37,600,521 shares he beneficially owned were vested and 3,825,000 were unvested and subject

to the Company’ s right of repurchase at their original purchase price of $0.0022 per share. See “Certain

Transactions” and “Description of Capital Stock.” The address for Mr. Omidyar is 2005 Hamilton Avenue,

Suite 350, San Jose, California 95125.

(3) Mr. Skoll is the Vice President Strategic Planning and Analysis of the Company. As of March 1, 1999,

12,582,246 shares of the 22,782,246 shares he beneficially owned were vested and 10,200,000 were unvested

and subject to the Company’ s right of repurchase at their original purchase price of $0.0022 per share. See

“Certain Transactions” and “Description of Capital Stock.” The address for Mr. Skoll is 2005 Hamilton

Avenue, Suite 350, San Jose, California 95125.

(4) Includes 15,244,821 shares held by Benchmark Capital Partners, L.P. (“Benchmark Capital”) and 2,130,687

shares held by Benchmark Founders’ Fund, L.P. (“Benchmark Founders’ Fund” collectively, the “Benchmark

Funds”). Mr. Kagle, a director of the Company, is a member of Benchmark Capital Management Co., L.L.C.,

(“Benchmark Management”) which is the General Partner of Benchmark Capital and Benchmark Founders’

Fund. Mr. Kagle disclaims beneficial ownership of shares held by such entities except for his proportional

interest therein. The address for Mr. Kagle and these entities is c/o Benchmark Capital Management Co.,

L.L.C., 2480 Sand Hill Road, Suite 200, Menlo Park, California 94025.