eBay 1998 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

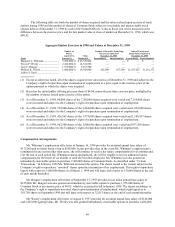

shares (2,376,000 shares on employment and an additional 108,000 shares during his first year of employment) of

Common Stock at a weighted average exercise price of $0.07 per share which he exercised in full in January, May

and June 1998 subject to the Company’ s right to repurchase unvested shares upon termination of employment,

which lapses at a rate of 25% of the shares originally subject to the option on the first anniversary of his employment

or the date of grant, depending on the option, and one forty-eighth of the shares at the end of each month thereafter.

During his first year of employment, Mr. Westly received an additional $30,000 bonus.

Mr. Wilson’ s employment offer letter of December 9, 1996 provides for an initial annual base salary of

$78,000. Mr. Wilson was also granted an immediately exercisable option to purchase 1,800,000 shares of Common

Stock at an exercise price of $0.01 per share which he exercised in full in January 1998 subject to the Company’ s

right to repurchase unvested shares upon termination of employment, which lapsed as to 450,000 shares in

December 1997 and will lapse with respect to 37,500 shares at the end of each month thereafter. During his first

year of employment, Mr. Wilson received an additional option to purchase 900,000 shares of Common Stock at an

exercise price of $0.03 per share.

Mr. Skoll’ s employment offer letter of October 16, 1996 provides for an initial annual salary of $30,000 and a

30-day right to purchase the 30,600,000 shares of Common Stock that he currently owns subject to the Company’ s

right of repurchase through June 30, 2000. The right of repurchase lapsed with respect to seven forty-eighths of the

total shares purchased on February 1, 1997 and will lapse with respect to an additional one forty-eighth of the shares

on the first day of each month thereafter. In the event of an acquisition of the Company or other similar transaction,

the right of repurchase will expire with respect to all of the shares subject to the Company’ s right of repurchase.

Mr. Swette’ s employment offer letter of August 14, 1998 provides for an initial annual base salary of $150,000

and a $25,000 signing bonus. Mr. Swette was also granted an option to purchase 1,800,000 shares of Common Stock

outside of the 1997 Plan at an exercise price of $5 per share. These options vest with respect to 450,000 shares in

August 1999 and with respect to 37,500 shares at the end of each month thereafter. In the event Mr. Swette’ s

employment is terminated without cause prior to August 14, 1999, such option will vest at a rate of 37,500 shares

per month from August 14, 1998 through the termination date.

Mr. Jacobson’ s employment offer letter of August 20, 1998 provides for an initial annual base salary of

$150,000 and a $50,000 signing bonus. Mr. Jacobson was also granted options to purchase an aggregate of 750,006

shares of Common Stock under the Company’ s 1997 Plan at an exercise price of $5 per share. The first option for

45,000 shares vested in full on January 24, 1999. The second option for 705,006 shares vests with respect to 176,252

shares on August 24, 1999 and with respect to 14,687 shares at the end of each month thereafter (14,565 shares for

September through December 1999), provided, however, that in the event Mr. Jacobson’ s employment is terminated

without cause prior to August 24, 1999, such option will vest at a rate of 14,687 shares per month from August 24,

1998 through the termination date.

Indemnification of Directors and Executive Officers and Limitation of Liability

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’ s board of

directors to grant indemnity to directors and officers in terms sufficiently broad to permit such indemnification

under certain circumstances for liabilities (including reimbursement for expenses incurred) arising under the

Securities Act.

As permitted by the Delaware General Corporation Law, the Company’ s Amended and Restated Certificate of

Incorporation includes a provision that eliminates the personal liability of its directors for monetary damages for

breach of fiduciary duty as a director, except for liability (1) for any breach of the director’ s duty of loyalty to the

Company or its stockholders, (2) for acts or omissions not in good faith or that involve intentional misconduct or a

knowing violation of law, (3) under section 174 of the Delaware General Corporation Law (regarding unlawful

dividends and stock purchases) or (4) for any transaction from which the director derived an improper personal

benefit.

As permitted by the Delaware General Corporation Law, the Company’ s Amended and Restated Bylaws

provide that (1) the Company is required to indemnify its directors and officers to the fullest extent permitted by the

Delaware General Corporation Law, subject to certain very limited exceptions, (2) the Company is required to

indemnify its other employees to the extent that it indemnifies its officers and directors, unless otherwise required by