eBay 1998 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

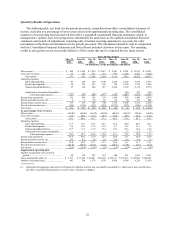

Revenues from placement fees are recognized at the time that the item is listed; revenues related to success fees

are recognized at the time that the auction is successfully concluded. At no point during the auction process does

eBay take possession of either the item being sold or the buyer’ s payment for the item. Fees to sellers are aggregated

and billed on a monthly basis. A substantial majority of customer accounts are settled by directly charging credit

card numbers provided by sellers. Provisions for estimated uncollectible accounts and authorized credits are

recorded as percentages of revenues and are provided for at the time of revenue recognition. In certain instances,

customers will deposit funds with the Company in anticipation of future transactions; these prepayments appear on

the Company’ s balance sheet as customer advances.

eBay’ s business model is significantly different from many existing online auction and other electronic

commerce businesses. Because individual sellers, rather than eBay, sell the items listed, the Company has no cost of

goods sold, no procurement, carrying or shipping costs and no inventory risk. The Company’ s rate of expense

growth is primarily driven by increases in personnel and expenditures for advertising and promotion. The Company

intends to increase its expenses significantly, and in particular its advertising, promotion and personnel expenses, in

an effort to maintain a high level of revenue growth.

Effective June 30, 1998, eBay acquired all of the outstanding shares of Jump Incorporated, the developer and

operator of Up4Sale, an advertising-supported online trading service in an auction format. The acquisition was

accounted for using the purchase method of accounting, and accordingly the purchase price was allocated to the

tangible and intangible assets acquired and liabilities assumed on the basis of their fair values on the acquisition

date. The fair value of intangible assets was determined using a combination of methods, including replacement cost

estimates for acquired research and development and completed technology, a risk-adjusted income approach for the

acquired customer list and the amounts paid for covenants not to compete. The total purchase price of approximately

$2.3 million consisted of 428,544 shares of eBay’ s common stock with an estimated fair value of approximately

$2.0 million and other acquisition related expenses of approximately $335,000, consisting primarily of payments for

non-compete agreements totaling approximately $208,000 and legal and other professional fees. Of the total

purchase price, approximately $150,000 was allocated to in-process technology and was immediately charged to

operations as the technology had not reached technological feasibility as of the acquisition date and had no

alternative future use. The remainder of the purchase price was allocated to net tangible liabilities assumed

($31,000) and intangible assets, including completed technology ($500,000), the customer list ($1.5 million),

covenants not to compete ($208,000) and goodwill ($24,000). The intangible assets are being amortized over their

estimated useful lives, which range from eight to 24 months.

The Company has operated profitably since the first quarter of 1996, when it began charging fees for its auction

service. The Company has only a limited operating history on which to base an evaluation of its business and

prospects. eBay’ s prospects must be considered in light of the risks, uncertainties, expenses and difficulties

frequently encountered by companies in their early stages of development, particularly companies in new and

rapidly evolving markets such as online commerce.

It is difficult for the Company to forecast its revenues or earnings accurately. The Company believes that

period-to-period comparisons of its operating results may not be meaningful and should not be relied upon as an

indication of future performance. The Company does not have backlog, and almost all of its net revenues each

quarter are derived from auctions that are listed and completed during that quarter. In order to respond to

competitive developments, the Company may from time to time make pricing, service or marketing decisions that

could harm its business. The Company’ s operating results in one or more future quarters may fall below the

expectations of securities analysts and investors. In that event, the trading price of its common stock would almost

certainly decline.