eBay 1998 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBAY INC.

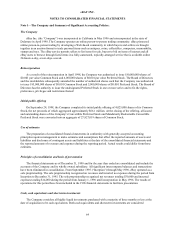

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

66

competition for qualified Internet professionals, goodwill and other intangible assets are amortized on a straight-line

basis over the estimated periods of benefit, which range from eight to 24 months. See Note 2—Acquisition.

Impairment of long-lived assets

The Company evaluates the recoverability of long-lived assets in accordance with Statement of Financial

Accounting Standards No. 121, “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to

be Disposed of” (“SFAS”). SFAS No. 121 requires recognition of impairment of long-lived assets in the event the

net book value of such assets exceeds the future undiscounted cash flows attributable to such assets.

Revenue recognition

Revenues are derived primarily from placement fees charged for the listing of items for auction and success

fees calculated as a percentage of the final sales transaction value. Revenues related to placement fees are

recognized at the time the item is listed, while those related to success fees are recognized at the time that the

auction is successfully concluded. An auction is considered successfully concluded when there is at least one bid

above the seller’ s specified minimum price or reserve price, whichever is higher, at the end of the auction term,

which is generally three to seven days. Provisions for doubtful accounts and authorized credits to sellers are

provided at the time of revenue recognition based upon the Company’ s historical experience.

Product development costs

Product development costs include expenses incurred by the Company to develop, enhance, manage, monitor

and operate the Company’ s website. Product development costs are expensed as incurred.

Advertising expense

The Company recognizes advertising expenses in accordance with Statement of Position (“SOP”) 93-7

“Reporting on Advertising Costs.” As such, the Company expenses the costs of producing advertisements at the

time production occurs, and expenses the cost of communicating advertising in the period in which the advertising

space or airtime is used. Internet advertising expenses are recognized based on the terms of the individual

agreements, but generally over the greater of the ratio of the number of impressions delivered over the total number

of contracted impressions, or a straight-line basis over the term of the contract. Advertising expenses totaled $0,

$478,000, and $12.3 million during the years ended Decemer 31, 1996, 1997 and 1998, respectively.

Stock-based compensation

The Company accounts for stock-based employee compensation arrangements in accordance with provisions of

Accounting Principles Board (“APB”) Opinion No. 25, “Accounting for Stock Issued to Employees,” and complies

with the disclosure provisions of SFAS No. 123, “Accounting for Stock-Based Compensation.” Under APB No. 25,

compensation expense is based on the difference, if any, on the date of the grant, between the fair value of the

Company’ s stock and the exercise price. The Company accounts for stock issued to non-employees in accordance

with the provisions of SFAS No. 123 and the Emerging Issues Task Force Consensus in Issue No. 96-18.

Income taxes

Income taxes are accounted for using an asset and liability approach, which requires the recognition of taxes

payable or refundable for the current year and deferred tax liabilities and assets for the future tax consequences of

events that have been recognized in the Company’ s financial statements or tax returns. The measurement of current