eBay 1998 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

69

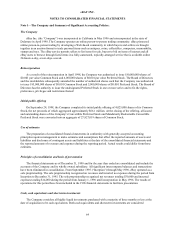

The acquisition has been structured as a tax free exchange of stock, therefore, the differences between the

recognized fair values of the acquired assets, including tangible assets, and their historical tax bases are not

deductible for tax purposes.

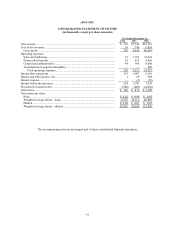

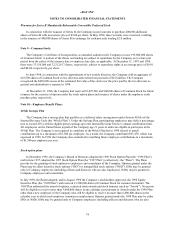

The following unaudited pro forma consolidated financial information reflects the results of operations for the

years ended December 31, 1997 and 1998, as if the acquisition had occurred on January 1, 1997 and 1998,

respectively, and after giving effect to purchase accounting adjustments. These pro forma results have been prepared

for comparative purposes only and do not purport to be indicative of what operating results would have been had the

acquisitions actually taken place on January 1, 1997 or 1998, and may not be indicative of future operating results,

(in thousands, except per share amounts).

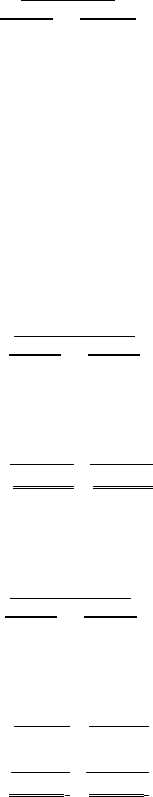

Year Ended

December 31,

1997 1998

Net revenues...................................................................................................................... $5,755 $47,364

Income (loss) from operations........................................................................................... (655) 5,361

Net income (loss) .............................................................................................................. (1,199) 1,597

Net income (loss) per share:

Basic.......................................................................................................................... $ (0.05) $ 0.02

Diluted....................................................................................................................... $ (0.05) $ 0.01

Weighted average shares:

Basic.......................................................................................................................... 22,743 88,787

Diluted....................................................................................................................... 22,743 129,491

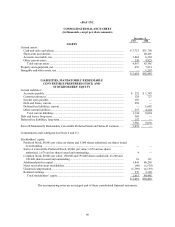

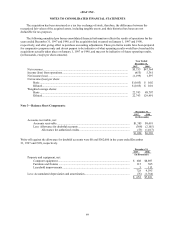

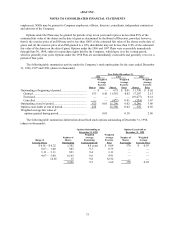

Note 3—Balance Sheet Components:

December 31,

1997 1998

(in thousands)

Accounts receivable, net:

Accounts receivable .................................................................................................... $1,385 $9,491

Less: Allowance for doubtful accounts ....................................................................... (308) (2,105)

Allowance for authorized credits ..................................................................... (53) (1,017)

$1,024 $6,369

Write-offs against the allowance for doubtful accounts were $0 and $562,000 in the years ended December

31, 1997 and 1998, respectively.

December 31,

1997 1998

(in thousands)

Property and equipment, net:

Computer equipment ................................................................................................... $ 608 $8,897

Furniture and fixtures .................................................................................................. 115 585

Leasehold improvements............................................................................................. 5 113

728 9,595

Less: Accumulated depreciation and amortization.............................................................. (76) (1,764)

$ 652 $7,831