eBay 1998 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

67

and deferred tax liabilities and assets are based on the provisions of enacted tax law; the effects of future changes in

tax laws or rates are not anticipated. The measurement of deferred tax assets is reduced, if necessary, by the amount

of any tax benefits that, based on available evidence, are not expected to be realized.

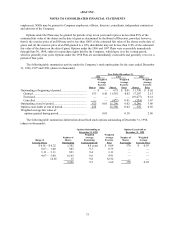

Net income per share

The Company computes net income per share in accordance with SFAS No. 128, “Earnings per Share” and

SEC Staff Accounting Bulletin No. 98 (“SAB 98”). Under the provisions of SFAS No. 128 and SAB 98, basic net

income per share is computed by dividing the net income available to common stockholders for the period by the

weighted average number of common shares outstanding during the period. Diluted net income per share is

computed by dividing the net income for the period by the weighted average number of common and common

equivalent shares outstanding during the period. Common equivalent shares, composed of unvested restricted

Common Stock and incremental common shares issuable upon the exercise of stock options and warrants and upon

conversion of Series A and Series B Convertible Preferred Stock, are included in diluted net income per share to the

extent such shares are dilutive.

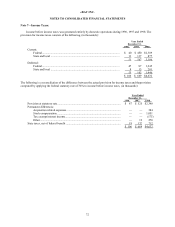

The following table sets forth the computation of basic and diluted net income per share for the periods

indicated, (in thousands, except per share amounts):

Year Ended December 31,

1996 1997 1998

Numerator:

Net income............................................................................................................ $ 148 $ 874 $ 2,398

Accretion of Series B Mandatorily Redeemable Convertible Preferred

Stock to redemption value ................................................................................. — (46) (46)

Net income available to common stockholders..................................................... $ 148 $ 828 $ 2,352

Denominator:

Weighted average shares....................................................................................... 30,600 61,200 89,473

Weighted average unvested common shares subject to repurchase

agreements ......................................................................................................... (24,225) (38,887) (39,578)

Denominator for basic calculation ........................................................................ 6,375 22,313 49,895

Weighted average effect of dilutive securities:

Series A Preferred Stock………………………………………………….. 12,345 15,088 11,037

Series B Preferred Stock............................................................................. — 6,372 8,054

Series B Preferred Stock warrants………………………………………... — — 1,098

Unvested common shares subject to

repurchase agreements ............................................................................ 24,225 38,887 39,578

Employee stock options.............................................................................. — — 4,928

Denominator for diluted calculation ..................................................................... 42,945 82,660 114,590

Net income per share:

Basic ..................................................................................................................... $ 0.02 $ 0.04 $ 0.05

Diluted .................................................................................................................. $ 0.00 $ 0.01 $ 0.02