eBay 1998 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

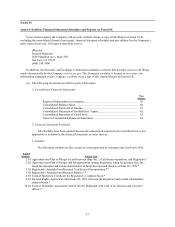

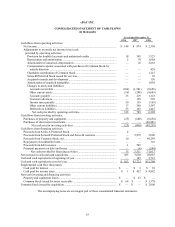

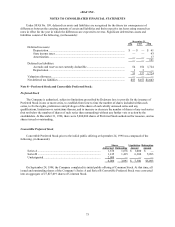

eBAY INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

(in thousands)

Year Ended December 31,

1996 1997 1998

Cash flows from operating activities:

Net income.............................................................................................................. $ 148 $ 874 $ 2,398

Adjustments to reconcile net income to net cash

provided by operating activities:

Provision for doubtful accounts and authorized credits ..................................... 18 343 3,323

Depreciation and amortization ........................................................................... 2 74 1,688

Amortization of unearned compensation ........................................................... — 25 2,662

Compensation expense associated with purchases of Common Stock by

outside directors ............................................................................................. — — 429

Charitable contribution of Common Stock ........................................................ — — 1,215

Series B Preferred Stock issued for services...................................................... — — 93

Acquired research and development .................................................................. — — 150

Amortization of acquired intangibles................................................................. — — 1,030

Changes in assets and liabilities:

Accounts receivable ....................................................................................... (184) (1,201) (8,656)

Other current assets ........................................................................................ (16) (204) (4,605)

Accounts payable ........................................................................................... 23 229 1,118

Customer advances......................................................................................... — 128 599

Income taxes payable ..................................................................................... 50 119 (169)

Other current liabilities................................................................................... 17 300 3,587

Deferred tax liabilities.................................................................................... 55 102 1,447

Net cash provided by operating activities.................................................... 113 789 6,309

Cash flows from investing activities:

Purchases of property and equipment ..................................................................... (25) (680) (8,858)

Purchases of short-term investments....................................................................... — — (40,401)

Net cash used in investing activities ............................................................ (25) (680) (49,259)

Cash flows from financing activities:

Proceeds from Series A Preferred Stock................................................................. 4 — —

Proceeds from Series B Preferred Stock and Series B warrants ............................. — 2,972 2,000

Proceeds from Common Stock, net......................................................................... 10 — 69,299

Repayment of stockholder loans ............................................................................. — — 316

Proceeds from debt issuance................................................................................... 1 545 —

Principal payments on debt and leases.................................................................... — (6) (598)

Net cash provided by financing activities ..................................................... 15 3,511 71,017

Net increase in cash and cash equivalents................................................................... 103 3,620 28,067

Cash and cash equivalents at beginning of year.......................................................... — 103 3,723

Cash and cash equivalents at end of year.................................................................... $ 103 $3,723 $31,790

Supplemental cash flow disclosures:

Cash paid for interest .............................................................................................. $ — $ 3 $ 39

Cash paid for income taxes ..................................................................................... $ 1 $ 452 $ 4,882

Non-cash investing and financing activities:

Property and equipment leases................................................................................ $ — $ 23 $ —

Common Stock issued for notes receivable ............................................................ $ 68 $ — $ 1,378

Common Stock issued for acquisition ........................................................................ $ — $ — $ 2,000

The accompanying notes are an integral part of these consolidated financial statements.