eBay 1998 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

70

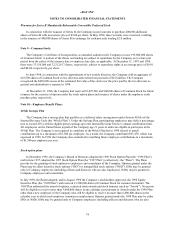

Property and equipment includes $23,000 and $0 of equipment under capital leases at December 31, 1997 and

1998, respectively. Accumulated depreciation of assets under capital leases totaled $7,000 and $0 at December 31,

1997 and 1998, respectively.

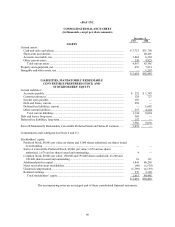

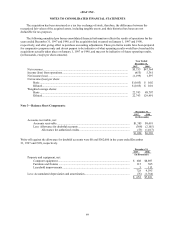

December 31,

1997 1998

(in thousands)

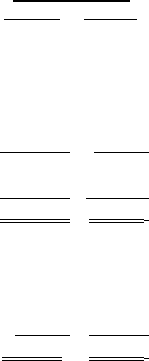

Intangible assets, net:

Purchased technology.................................................................................................. $ — $ 500

Covenants not to compete ........................................................................................... — 208

Customer list ............................................................................................................... — 1,484

Goodwill...................................................................................................................... — 24

— 2,216

Less: Accumulated amortization ................................................................................. — (1,030)

$ — $1,186

Other current liabilities:

Accrued compensation and related benefits ................................................................ $ 68 $ 978

Advertising accruals.................................................................................................... — 1,274

Professional fees.......................................................................................................... — 451

Other accruals.............................................................................................................. 249 1,541

$ 317 $4,244

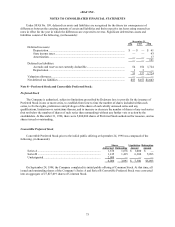

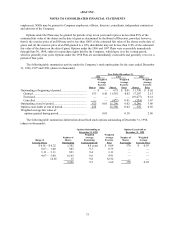

Note 4—Related Party Transactions:

Notes receivable from stockholders

At December 31, 1997 the Company held a note receivable from an officer of the Company totaling $68,000.

The note was full recourse, was secured by Common Stock and bore simple interest at 6% per annum. The principal

and interest on the note was repaid in November 1998. At December 31, 1998, the Company held notes receivable

from employees, officers and a director totaling $1.1 million, representing amounts owed to the Company from the

exercise of stock options. These full recourse notes are secured by Common Stock and bear interest at a rate of 8%

per annum. Interest is due and payable on December 1st of each year, and the principal is due on or before

December 1, 2002.

Professional services

In connection with the recruitment of its Chief Executive Officer, the Company engaged the services of an

executive search firm affiliated with a holder of the Company’ s Series B Mandatorily Redeemable Convertible

Preferred Stock. During 1998, the Company paid fees for services performed of $93,000 and issued 46,248 shares of

Series B Mandatorily Redeemable Convertible Preferred Stock with a fair value on the date earned of $93,000. The

amount paid for the services and the fair value of the shares are included in general and administrative expenses in

the consolidated statement of income for the year ended December 31, 1998.

Note 5—Debt:

Line of credit

At December 31, 1997 and 1998, the Company had $545,000 and $0, respectively, outstanding under a line of credit

with a financial institution. The line of credit provides for a revolving line, including an equipment sub-

limit facility, of up to $750,000 and expired on January 5, 1999. Under the line of credit, the Company was required

to comply with certain financial covenants. The Company was in compliance with all such covenants at December

31, 1997 and 1998.