eBay 1998 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

64

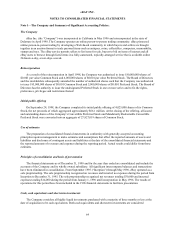

Note 1—The Company and Summary of Significant Accounting Policies:

The Company

eBay Inc. (the “Company”) was incorporated in California in May 1996 and reincorporated in the state of

Delaware in April 1998. The Company operates an online person-to-person trading community. eBay pioneered

online person-to-person trading by developing a Web-based community in which buyers and sellers are brought

together in an auction format to trade personal items such as antiques, coins, collectibles, computers, memorabilia,

stamps and toys. The eBay service permits sellers to list items for sale, buyers to bid on items of interest and all

eBay users to browse through listed items in a fully-automated, topically-arranged service that is available online

24-hours-a-day, seven-days-a-week.

Reincorporation

As a result of the reincorporation in April 1998, the Company was authorized to issue 180,000,000 shares of

$0.001 par value Common Stock and 6,000,000 shares of $0.001 par value Preferred Stock. The Board of Directors

and the stockholders subsequently amended the number of authorized shares such that the Company was authorized

to issue 195,000,000 shares of $0.001 Common Stock and 5,000,000 shares of $0.001 Preferred Stock. The Board of

Directors has the authority to issue the undesignated Preferred Stock in one or more series and to fix the rights,

preferences, privileges and restrictions thereof.

Initial public offering

On September 24, 1998, the Company completed its initial public offering of 4,025,000 shares of its Common

Stock, the net proceeds of which aggregated approximately $66.1 million. At the closing of the offering, all issued

and outstanding shares of the Company’ s Convertible Preferred Stock and Mandatorily Redeemable Convertible

Preferred Stock were converted into an aggregate of 27,827,019 shares of Common Stock.

Use of estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting

principles requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and

the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates.

Principles of consolidation and basis of presentation

The financial statements as of December 31, 1998 and for the year then ended are consolidated and include the

accounts of the Company and its wholly owned subsidiary. All significant intercompany balances and transactions

have been eliminated in consolidation. From September 1995 (“Inception”) through May 1996, eBay operated as a

sole proprietorship. The sole proprietorship recognized no revenues and incurred no expenses during the period from

Inception to December 31, 1995. The sole proprietorship recognized net revenues totaling $30,000 and incurred

expenses totaling $14,000 during the period from January 1, 1996 until incorporation in May 1996. The results of

operations for this period have been included in the 1996 financial statements to facilitate presentation.

Cash, cash equivalents and short-term investments

The Company considers all highly liquid investments purchased with a maturity of three months or less at the

date of acquisition to be cash equivalents. Both cash equivalents and short-term investments are considered