eBay 1998 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 1998 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBAY INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

68

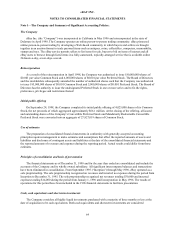

Comprehensive income

Effective January 1, 1998 the Company adopted the provisions of SFAS No. 130, “Reporting Comprehensive

Income.” SFAS No. 130 establishes standards for reporting comprehensive income and its components in financial

statements. Comprehensive income, as defined, includes all changes in equity (net assets) during a period from non-

owner sources. To date, the Company has not had any transactions that are required to be reported in comprehensive

income.

Segment information

Effective January 1, 1998, the Company adopted the provisions of SFAS No. 131, “Disclosures about

Segments of an Enterprise and Related Information.” The Company identifies its operating segments based on

business activities, management responsibility and geographical location. During the years ended December 31,

1996, 1997 and 1998, the Company operated in a single business segment operating an online person-to-person

trading community in an auction format, primarily in the United States. Through December 31, 1998, foreign

operations have not been significant in either revenue or investment in long-lived assets.

Reclassifications

Certain reclassifications have been made to the prior year financial statements to conform to the current period

presentation.

Recent accounting pronouncements

In March 1998, the American Institute of Certified Public Accountants issued SOP No. 98-1, “Software for

Internal Use,” which provides guidance on accounting for the cost of computer software developed or obtained for

internal use. SOP No. 98-1 is effective for financial statements for fiscal years beginning after December 15, 1998.

The Company does not expect that the adoption of SOP No. 98-1 will have a material impact on its consolidated

financial statements.

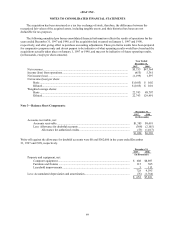

Note 2—Acquisition:

Effective June 30, 1998, the Company acquired all the outstanding shares of Jump, which provides a forum

where Internet users can buy and sell items in an online auction format. The acquisition has been accounted for

using the purchase method of accounting and accordingly, the purchase price has been allocated to the tangible and

intangible assets acquired and liabilities assumed on the basis of their respective fair values on the acquisition date.

The fair value of intangible assets was determined using a combination of methods, including replacement cost

estimates for acquired research and development and completed technology, a risk-adjusted income approach for the

acquired customer list and the amounts paid for covenants not to compete.

The total purchase price of approximately $2.3 million consisted of 428,544 shares of the Company’ s Common

Stock with an estimated fair value of approximately $2.0 million and other acquisition related expenses of

approximately $335,000, consisting primarily of payments for non-compete agreements totaling approximately

$208,000 and legal and other professional fees. Of the total purchase price, approximately $150,000 was allocated to

in-process technology and was immediately charged to operations because such in-process technology had not

reached the stage of technological feasibility at the acquisition date and had no alternative future use. The remainder

of the purchase price was allocated to net tangible liabilities assumed ($31,000) and intangible assets, including

completed technology ($500,000), customer list ($1.5 million), covenants not to compete ($208,000) and goodwill

($24,000). The intangible assets are being amortized over their estimated useful lives of eight to 24 months.