Toyota 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 96

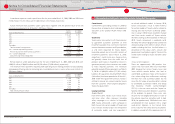

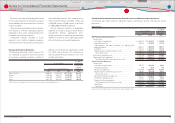

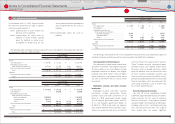

Statement of cash fl ows

Yen in millions U.S. dollars in millions

For the year ended March 31, 2010 For the year ended March 31, 2010

Non-Financial

Services

Businesses

Financial

Services

Businesses Consolidated

Non-Financial

Services

Businesses

Financial

Services

Businesses Consolidated

Cash fl ows from operating activities

Net income ···················································································································· ¥ 116,218 ¥ 128,106 ¥ 244,212 $ 1,249 $ 1,377 $ 2,625

Adjustments to reconcile net income to net cash provided by

operating activities

Depreciation ········································································································· 1,065,749 348,820 1,414,569 11,455 3,749 15,204

Provision for doubtful accounts and credit losses ··························· 1,905 98,870 100,775 20 1,063 1,083

Pension and severance costs, less payments ······································ 55 1,199 1,254 0 13 13

Losses on disposal of fi xed assets······························································ 46,661 276 46,937 502 3 505

Unrealized losses on available-for-sale securities, net ···················· 2,486 ̶ 2,486 27 ̶ 27

Deferred income taxes ···················································································· (14,183) 39,759 25,537 (152) 427 274

Equity in (earnings) losses of affi liated companies ·························· (109,944) 64,536 (45,408) (1,182) 694 (488)

Changes in operating assets and liabilities, and other ··················· 733,338 133,275 768,168 7,882 1,432 8,256

Net cash provided by operating activities ········································ 1,842,285 814,841 2,558,530 19,801 8,758 27,499

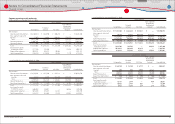

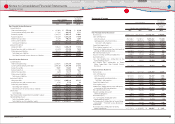

Cash fl ows from investing activities

Additions to fi nance receivables ······································································· ̶ (13,492,119) (7,806,201) ̶ (145,014) (83,902)

Collection of and proceeds from sales of fi nance receivables··········· ̶ 13,107,531 7,517,968 ̶ 140,880 80,804

Additions to fi xed assets excluding equipment leased to others ···· (599,154) (5,382) (604,536) (6,440) (58) (6,498)

Additions to equipment leased to others ····················································· (64,345) (768,720) (833,065) (692) (8,262) (8,954)

Proceeds from sales of fi xed assets excluding equipment leased to

others ···························································································································· 46,070 6,403 52,473 495 69 564

Proceeds from sales of equipment leased to others ······························ 36,668 428,424 465,092 394 4,605 4,999

Purchases of marketable securities and security investments ·········· (2,310,912) (101,270) (2,412,182) (24,838) (1,088) (25,926)

Proceeds from sales of and maturity of marketable securities and

security investments ···························································································· 1,012,781 95,960 1,108,741 10,886 1,031 11,917

Payment for additional investments in affi liated companies, net of

cash acquired ··········································································································· (1,020) ̶(1,020) (11) ̶(11)

Changes in investments and other assets, and other ···························· (259,089) 102,497 (337,454) (2,784) 1,101 (3,627)

Net cash used in investing activities ························································ (2,139,001) (626,676) (2,850,184) (22,990) (6,736) (30,634)

Cash fl ows from fi nancing activities

Proceeds from issuance of long-term debt ················································· 492,300 2,733,465 3,178,310 5,292 29,379 34,161

Payments of long-term debt ··············································································· (77,033) (2,926,308) (2,938,202) (828) (31,452) (31,580)

Decrease in short-term borrowings ································································· (249,238) (251,544) (335,363) (2,679) (2,704) (3,605)

Dividends paid ············································································································· (172,476) ̶ (172,476) (1,854) ̶ (1,854)

Purchase of common stock, and other ·························································· (10,251) ̶ (10,251) (110) ̶ (110)

Net cash used in fi nancing activities ······················································· (16,698) (444,387) (277,982) (179) (4,777) (2,988)

Eff ect of exchange rate changes on cash and cash equivalents ·········· 4,092 (12,990) (8,898) 44 (139) (95)

Net decrease in cash and cash equivalents ····················································· (309,322) (269,212) (578,534) (3,324) (2,894) (6,218)

Cash and cash equivalents at beginning of year ·········································· 1,648,143 796,137 2,444,280 17,714 8,557 26,271

Cash and cash equivalents at end of year ························································ ¥ 1,338,821 ¥ 526,925 ¥ 1,865,746 $ 14,390 $ 5,663 $ 20,053

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

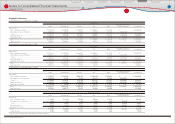

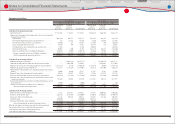

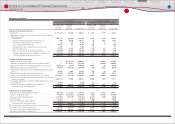

Notes to Consolidated Financial Statements