Toyota 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 81

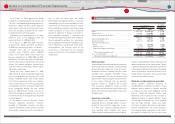

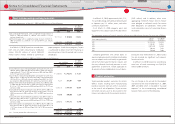

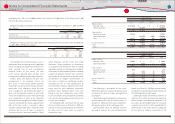

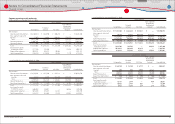

The following table summarizes Toyotas stock option activity:

Yen Yen in

millions

Number of

shares

Weighted-

average

exercise

price

Weighted-

average

remaining

contractual

life in years

Aggregate

intrinsic

value

Options outstanding at March 31, 2007 ····················· 6,292,700 ¥ 5,175 5.53 ¥ 14,947

Granted ······················································································· 3,264,000 7,278

Exercised ···················································································· (792,100) 4,208

Canceled ···················································································· (423,000) 6,196

Options outstanding at March 31, 2008 ····················· 8,341,600 6,038 5.71 1,753

Granted ······················································································· 3,494,000 4,726

Exercised ···················································································· (119,900) 3,626

Canceled ···················································································· (375,000) 6,889

Options outstanding at March 31, 2009 ····················· 11,340,700 5,631 5.51 1

Granted ······················································································· 3,492,000 4,193

Exercised ···················································································· (157,800) 3,116

Canceled ···················································································· (958,200) 4,646

Options outstanding at March 31, 2010 ····················· 13,716,700 ¥ 5,363 5.23 ¥ ̶

Options exercisable at March 31, 2008 ························· 2,354,600 ¥ 4,225 2.76 ¥ 1,753

Options exercisable at March 31, 2009 ························· 4,971,700 ¥ 5,302 3.76 ¥ 1

Options exercisable at March 31, 2010 ························· 7,515,700 ¥ 6,132 3.86 ¥ ̶

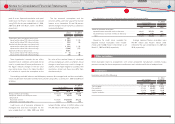

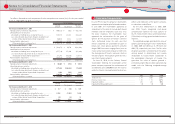

The total intrinsic value of options exercised for

the years ended March 31, 2008, 2009 and 2010

was ¥1,651 million, ¥97 million and ¥113 million

($1 million), respectively.

As of March 31, 2010, there were unrecognized

compensation expenses of ¥1,822 million

($20 million) for stock options granted. Those

expenses are expected to be recognized over a

weighted-average period of 1.1 years.

Cash received from the exercise of stock

options for the years ended March 31, 2008, 2009

and 2010 was ¥3,333 million, ¥435 million and

¥492 million ($5 million), respectively.

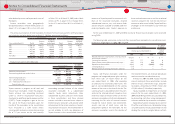

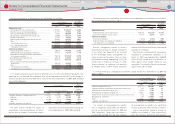

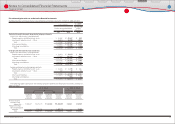

The following table summarizes information for options outstanding and options exercisable at March

31, 2010:

Outstanding Exercisable

Exercise price

range

Weighted-

average

exercise

price

Weighted-

average

exercise

price

Weighted-

average

remaining

life

Weighted-

average

exercise

price

Weighted-

average

exercise

price

Yen

Number of

shares Yen Dollars Years

Number of

shares Yen Dollars

¥4,193 − 6,000 8,133,700 ¥4,429 $48 5.50 1,932,700 ¥4,427 $48

6,001 − 7,278 5,583,000 6,723 72 4.85 5,583,000 6,723 72

4,193 − 7,278 13,716,700 5,363 58 5.23 7,515,700 6,132 66

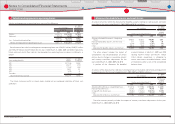

Pension and severance plans

Upon terminations of employment, employees

of the parent company and subsidiaries in Japan

are entitled, under the retirement plans of each

company, to lump-sum indemnities or pension

payments, based on current rates of pay and

lengths of service or the number of points

mainly determined by those. Under normal

circumstances, the minimum payment prior to

retirement age is an amount based on voluntary

retirement. Employees receive additional

benefi ts on involuntary retirement, including

retirement at the age limit.

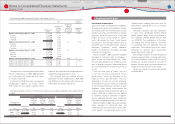

Eff ective October 1, 2004, the parent company

amended its retirement plan to introduce a

point based retirement benefi t plan. Under

the new plan, employees are entitled to lump-

sum or pension payments determined based

on accumulated points vested in each year of

service.

There are three types of points that vest

in each year of service consisting of service

period points which are attributed to the

length of service, job title points which are

attributed to the job title of each employee,

and performance points which are attributed

to the annual performance evaluation of each

employee. Under normal circumstances, the

minimum payment prior to retirement age is an

amount refl ecting an adjustment rate applied

to represent voluntary retirement. Employees

receive additional benefi ts upon involuntary

retirement, including retirement at the age limit.

Eff ective October 1, 2005, the parent company

partly amended its retirement plan and

introduced the quasi cash-balance plan under

which benefi ts are determined based on the

variable-interest crediting rate rather than the

fi xed-interest crediting rate as was in the pre-

amended plan.

The parent company and most subsidiaries

in Japan have contributory funded defi ned

benefi t pension plans, which are pursuant to

the Corporate Defi ned Benefi t Pension Plan

Law (CDBPPL). The contributions to the plans

are funded with several fi nancial institutions

in accordance with the applicable laws and

regulations. These pension plan assets consist

principally of common stocks, government

bonds and insurance contracts.

Most foreign subsidiaries have pension plans or

severance indemnity plans covering substantially

all of their employees under which the cost of

benefi ts are currently invested or accrued. The

benefi ts for these plans are based primarily on

lengths of service and current rates of pay.

Toyota uses a March 31 measurement date for

its benefi t plans.

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Notes to Consolidated Financial Statements

Employee benefi t plans:

19