Toyota 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

TOYOTA ANNUAL REPORT 2010

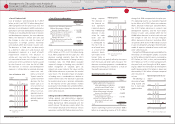

prior calendar year, respectively. Aff ected by this

downturn, Toyotas vehicle unit sales decreased

to 7,567 thousand vehicles, or by 15.1%,

compared to the prior fi scal year. The decrease in

net revenues was also due to the eff ect of foreign

currency exchange rate fl uctuations and changes

in the market demand resulting from a shift in

consumer preference towards small vehicles and

low-price vehicles.

Toyotas net revenues include net revenues from

sales of products, consisting of net revenues

from automotive operations and all other

operations, which decreased by 22.8% during

fi scal 2009 compared with the prior fi scal year

to ¥19,173.7 billion, and net revenues from

fi nancial services operations, which decreased

by 7.7% during fi scal 2009 compared with the

prior fi scal year to ¥1,355.8 billion. Eliminating

the diff erence in the Japanese yen value used

for translation purposes, net revenues from sales

of products would have been approximately

¥21,011.3 billion, a 15.3% decrease during fi scal

2009 compared with the prior fi scal year. The

decrease in net revenues from sales of products is

primarily attributable to a substantial contraction

of the automotive market caused by a rapid

deterioration of the world economy following

the fi nancial crisis since the fall of 2008, as well as

changes in market demand resulting from a shift

in consumer preference towards small vehicles

and low-price vehicles. Eliminating the diff erence

in the Japanese yen value used for translation

purposes, net revenues from fi nancial services

operations would have been approximately

¥1,549.4 billion, a 5.5% increase during fi scal 2009

compared with the prior year. The increase in net

revenues from fi nancial services operations is

primarily attributable to the increase in volume

of fi nancings as a result of an increase in market

share primarily of the fi nance subsidiary in North

America.

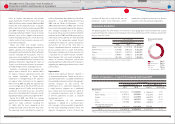

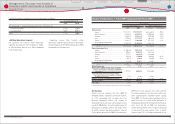

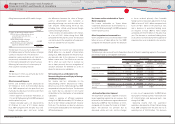

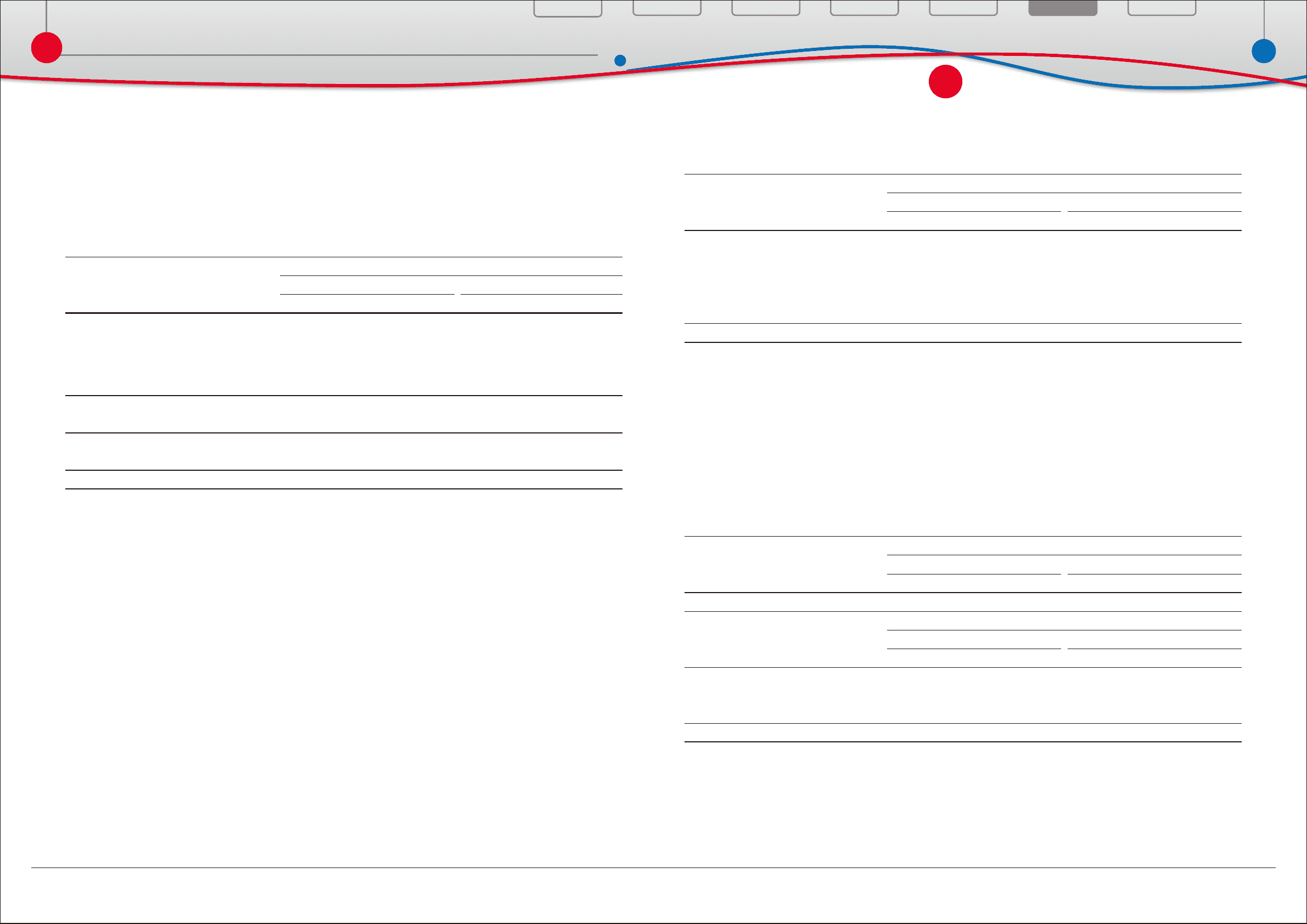

Toyotas net revenues by product category in each business to external customer is as follows:

Yen in millions

Year ended March 31, 2009 vs. 2008 change

2008 2009 Amount Percentage

Vehicles ······································································· ¥20,723,588 ¥15,635,490 ¥(5,088,098) ‒24.6%

Parts and components for

overseas production ······································· 342,244 298,176 (44,068) ‒12.9%

Parts and components for after service ···· 1,785,684 1,575,316 (210,368) ‒11.8%

Other ············································································ 1,308,738 1,041,519 (267,219) ‒20.4%

Total Automotive ·········································· 24,160,254 18,550,501 (5,609,753) ‒23.2%

All Other ····································································· 660,256 623,219 (37,037) ‒5.6%

Total sales of products ········································ 24,820,510 19,173,720 (5,646,790) ‒22.8%

Financial services ··················································· 1,468,730 1,355,850 (112,880) ‒7.7%

Total ····································································· ¥26,289,240 ¥20,529,570 ¥(5,759,670) ‒21.9%

Number of fi nancing contracts in thousands

Year ended March 31, 2009 vs. 2008 change

2008 2009 Amount Percentage

Japan ······································································· 1,614 1,660 46 +2.9%

North America ··················································· 4,241 4,403 162 +3.8%

Europe ···································································· 709 748 39 +5.5%

Asia ··········································································· 357 387 30 +8.4%

Other* ····································································· 413 440 27 +6.5%

Total ·································································· 7,334 7,638 304 +4.1%

* Other consists of Central and South America, Oceania and Africa.

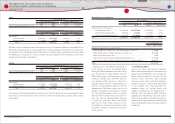

Geographically, net revenues (before the

elimination of intersegment revenues) for fi scal

2009 decreased by 20.4% in Japan, 34.0% in

North America, 24.5% in Europe, 12.9% in Asia

and 17.9% in Other compared with the prior fi scal

year. Eliminating the diff erence in the Japanese

yen value used for translation purposes, net

revenues in fi scal 2009 would have decreased by

20.4% in Japan, 25.0% in North America, 14.1% in

Europe, 1.1% in Other and 0.5% in Asia compared

with the prior fi scal year.

The following is a discussion of net revenues in

each geographic market (before the elimination

of intersegment revenues).

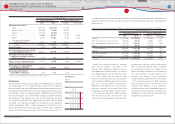

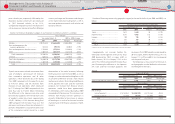

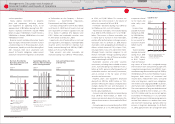

Number of fi nancing contracts by geographic region (at the end of the fi scal year 2008 and 2009) is as

follows:

Japan

Thousands of units

Year ended March 31, 2009 vs. 2008 change

2008 2009 Amount Percentage

Toyotas consolidated vehicle unit sales ·

2,188 1,945 (243) ‒11.1%

Yen in millions

Year ended March 31, 2009 vs. 2008 change

2008 2009 Amount Percentage

Net revenues:

Sales of products ······································ ¥15,183,262 ¥12,067,494 ¥(3,115,768) ‒20.5%

Financial services ····································· 132,550 119,243 (13,307) ‒10.0%

Total ························································· ¥15,315,812 ¥12,186,737 ¥(3,129,075) ‒20.4%

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Management's Discussion and Analysis of

Financial Condition and Results of Operations