Toyota 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 86

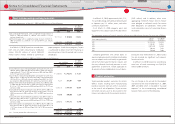

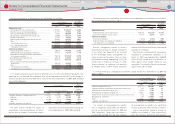

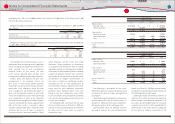

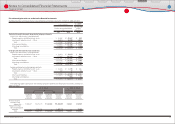

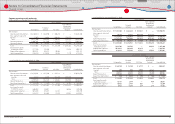

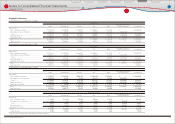

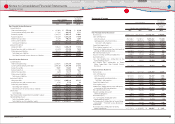

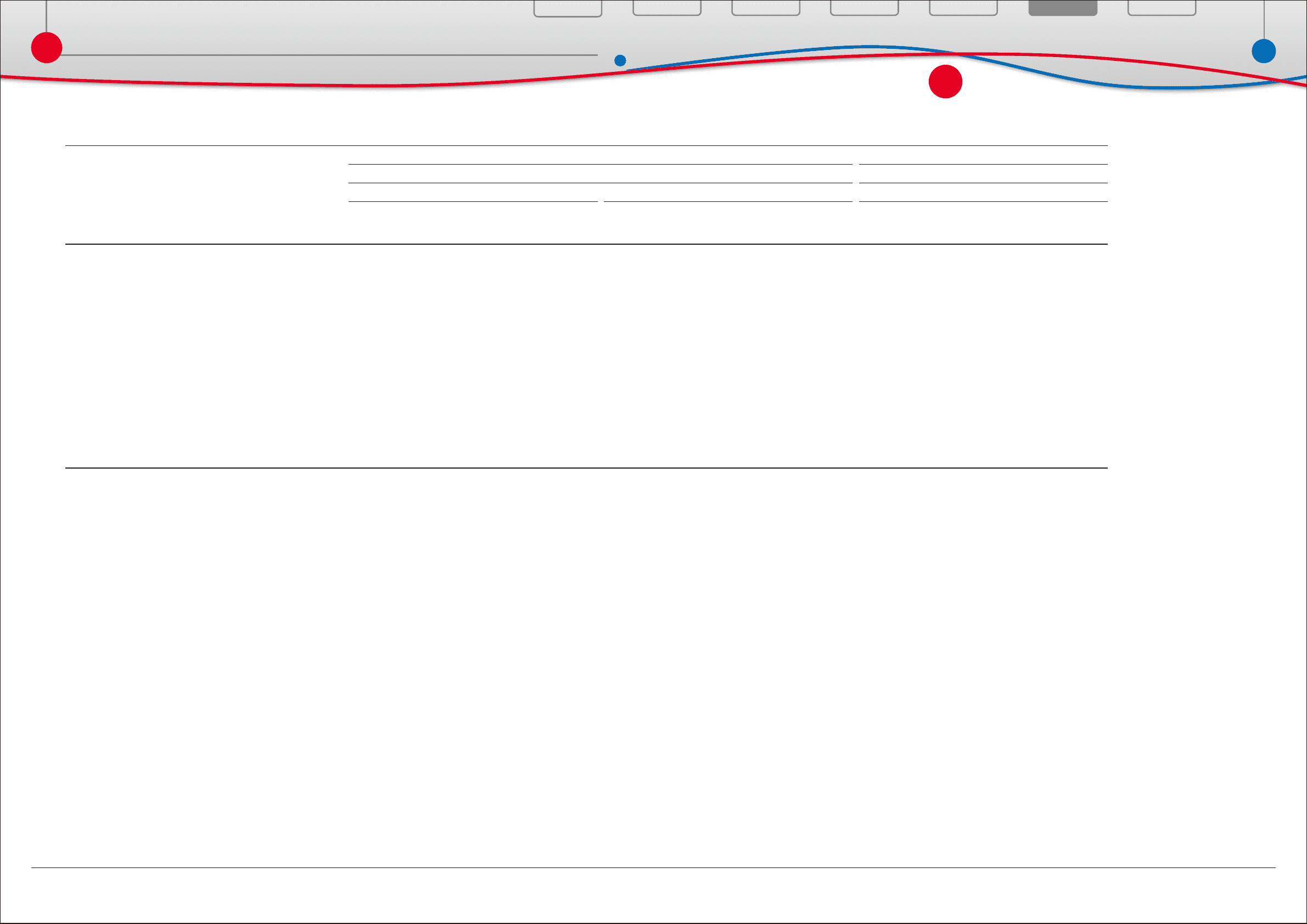

The following table summarizes the gains and losses on derivative fi nancial instruments and hedged items reported in the consolidated statement of income for the years ended March 31, 2009 and 2010:

Yen in millions U.S. dollars in millions

For the years ended March 31, For the year ended March 31,

2009 2010 2010

Gains (losses) on

derivative fi nancial

instruments

Gains (losses) on hedged

items

Gains (losses) on

derivative fi nancial

instruments

Gains (losses) on hedged

items

Gains (losses) on

derivative fi nancial

instruments

Gains (losses) on hedged

items

Derivative fi nancial instruments

designated as hedging instruments - Fair value hedge

Interest rate and currency swap agreements

Cost of fi nancing operations ·············································· ¥ (288,553) ¥ 293,637 ¥ 138,677 ¥ (135,163) $ 1,491 $ (1,453)

Interest expense ······································································· (439) 439 (265) 265 (3) 3

Undesignated derivative fi nancial instruments

Interest rate and currency swap agreements

Cost of fi nancing operations ·············································· ¥ (72,696) ¥ ̶ ¥ 77,939 ¥ ̶ $ 838 $ ̶

Foreign exchange gain (loss), net ··································· (3,016) ̶ (2,819) ̶ (30) ̶

Foreign exchange forward and option contracts

Cost of fi nancing operations ·············································· 24,183 ̶ (21,841) ̶ (235) ̶

Foreign exchange gain (loss), net ·································· 174,158 ̶ 60,599 ̶ 651 ̶

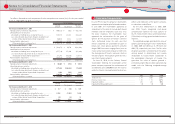

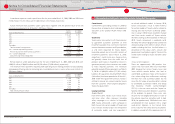

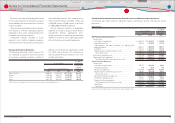

Undesignated derivative fi nancial instruments

are used to manage risks of fl uctuations in

interest rates to certain borrowing transactions

and in foreign currency exchange rates of

certain currency receivables and payables.

Toyota accounts for these derivative fi nancial

instruments as economic hedges with changes

in the fair value recorded directly into current

period earnings.

Unrealized gains or (losses) on undesignated

derivative fi nancial instruments reported in

the cost of fi nancing operations for the years

ended March 31, 2008, 2009 and 2010 were

¥(67,991) million, ¥(80,298) million and ¥71,538

million ($769 million) those reported in foreign

gain (loss), net were ¥45,670 million, ¥(33,578)

million and ¥(26,476) million ($(285) million),

respectively.

Toyota corrected the gains or losses on

derivative fi nancial instruments and hedged

items disclosed for the year ended March 31,

2009 as a result of changes to information

gathered from certain subsidiaries. These

adjustments do not have a material impact on

Toyotas consolidated fi nancial statements.

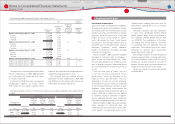

Credit risk related contingent features

Toyota enters into International Swaps and

Derivatives Association Master Agreements

with counterparties. These Master Agreements

contain a provision requiring either Toyota or

the counterparty to settle the contract or to post

assets to the other party in the event of a ratings

downgrade below a specifi ed threshold.

The aggregate fair value amount of derivative

fi nancial instruments that contain credit risk

related contingent features that are in a net

liability position as of March 31, 2010 is ¥63,445

million ($682 million). The aggregate fair value

amount of assets that are already posted as of

March 31, 2010 is ¥9,469 million ($102 million).

If the ratings of Toyota decline below specifi ed

thresholds, the maximum amount of assets to

be posted or for which Toyota could be required

to settle the contracts is ¥63,445 million ($682

million) as of March 31, 2010.

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Notes to Consolidated Financial Statements