Toyota 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 36

TOYOTA ANNUAL REPORT 2010

The business segments of Toyota include

automotive operations, fi nancial services

operations and all other operations. Automotive

operations are Toyotas most signifi cant business

segment, accounting for 89% of Toyotas total

revenues before the elimination of intersegment

revenues for fi scal 2010. Toyotas primary markets

based on vehicle unit sales for fi scal 2010 were

Japan (30%), North America (29%), Europe (12%)

and Asia (14%). During fi scal 2010, as a result

of announcements of recalls and other safety

measures for several models of vehicles in several

countries, the number of recalls and other safety

measures increased. These recalls and other

safety measures have impacted the fi nancial

results of the automotive and fi nancial services

operations and led to a number of claims, lawsuits

and government investigations. As a result of the

foregoing, the fi scal 2010 operating results of the

automotive operations were principally aff ected

by factors including but not limited to the accrued

costs related to the recalls and other safety

measures announced in fi scal 2010, a temporary

decrease in sales mainly in North America and

additional costs resulting from a change in the

estimation model of expenses related to future

recalls and other safety measures. In fi scal 2010,

Toyota has employed an estimation model for

recalls and other safety measures which takes

into account Toyotas historical experience and

individual occurrences of recalls and other safety

measures to accrue recall costs at the time of

vehicle sale. In addition, as a result of the above,

the fi scal 2010 operating results of the fi nancial

services operations were principally aff ected by

the evaluation for credit losses and residual value

losses at March 31, 2010. Not all of the impacts

described above are fi nancially signifi cant or

are able to be precisely measured. Toyota has

included in the following discussion and analysis,

where relevant, signifi cant impacts of these

items.

Automotive Market Environment

The worldwide automotive market is highly

competitive and volatile. The demand for

automobiles is aff ected by a number of factors

including social, political and general economic

conditions; introduction of new vehicles and

technologies; and costs incurred by customers to

purchase and operate vehicles. These factors can

cause consumer demand to vary substantially in

diff erent geographic markets and for diff erent

types of automobiles.

The automotive industry generally experienced

diffi cult market conditions during fi scal 2010 due

to changes in market demand resulting from

a shift in consumer preference towards small

and low-price vehicles, despite the continuous

growth in China, India and other emerging

countries and the eff ects of government stimulus

packages in developed countries.

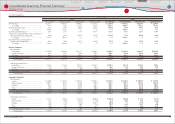

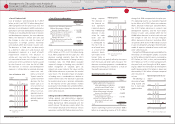

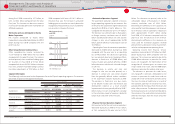

The following table sets forth Toyotas

consolidated vehicle unit sales by geographic

market based on location of customers for the

past three fi scal years.

During fi scal

2009, Toyotas

consolidated ve-

hicle unit sales in

Japan decreased

due to weak mar-

ket conditions as

compared to the

prior fi scal year.

During fi scal 2010,

sales in Japan in-

creased as com-

pared to the prior

fi scal year refl ect-

ing frequent in-

troduction of new

products and sales eff orts of domestic dealers on

the sales of new products. In fi scal 2010, Toyota

and Lexus brands market share excluding mini-

vehicles was 48.2%, and Toyotas market share

(including Daihatsu and Hino brands) including

mini-vehicles was 44.3%, and both market shares

represented record highs. Overseas vehicle unit

sales decreased during fi scal 2009 and 2010,

each compared to the prior fi scal year. During

fi scal 2009, overseas vehicle unit sales decreased,

particularly in North America and Europe, where

the contraction of automotive markets was

especially pronounced. During fi scal 2010, total

overseas vehicle unit sales decreased, particularly

in Europe, despite an increase in Asia.

Toyotas share of total vehicle unit sales in

each market is infl uenced by the quality, safety,

reliability, price, design, performance, economy

and utility of Toyotas vehicles compared with

those off ered by other manufacturers. The timely

introduction of new or redesigned vehicles is also

an important factor in satisfying customer needs.

Toyotas ability to satisfy changing customer

preferences can aff ect its revenues and earnings

signifi cantly.

The profi tability of Toyotas automotive

operations is aff ected by many factors. These

factors include:

vehicle unit sales volumes,

the mix of vehicle models and options sold,

the level of parts and service sales,

the levels of price discounts and other sales

incentives and marketing costs,

the cost of customer warranty claims and

other customer satisfaction actions,

the cost of research and development and

other fi xed costs,

the prices of raw materials,

the ability to control costs,

All fi nancial information discussed in this section is derived from Toyotas consolidated fi nancial

statements that appear elsewhere in this annual report. The fi nancial statements have been prepared

in conformity with accounting principles generally accepted in the United States of America.

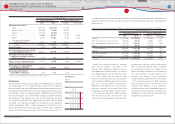

Consolidated Vehicle Sales

0

2,000

4,000

6,000

8,000

10,000

(Thousands of units)

7080 1060FY 09

(Thousands of units)

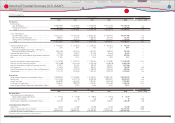

Year ended March 31,

2008 2009 2010

Japan ·············································································································· 2,188 1,945 2,163

North America ·························································································· 2,958 2,212 2,098

Europe ··········································································································· 1,284 1,062 858

Asia ·················································································································· 956 905 979

Other* ············································································································ 1,527 1,443 1,139

Overseas total···························································································· 6,725 5,622 5,074

Total ················································································································ 8,913 7,567 7,237

* Other consists of Central and South America, Oceania, Africa and the Middle East, etc.

Overview

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Management's Discussion and Analysis of

Financial Condition and Results of Operations