Toyota 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 98

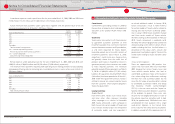

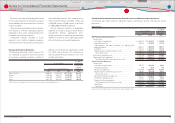

In accordance with U.S. GAAP, Toyota classifi es

fair value into three levels of input as follows

which are used to measure it.

Level 1: Quoted prices in active markets for

identical assets or liabilities

Level 2: Quoted prices for similar assets or

liabilities in active markets; quoted

prices for identical or similar assets

or liabilities in markets that are not

active; inputs other than quoted prices

that are observable for the assets or

liabilities

Level 3: Unobservable inputs for assets or

liabilities

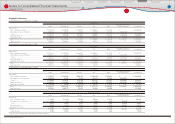

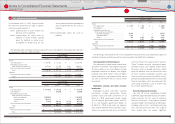

Yen in millions

March 31, 2009

Level 1 Level 2 Level 3 Total

Assets

Cash equivalents ································································· ¥ 1,473,407 ¥ 115,339 ¥ ̶ ¥ 1,588,746

Marketable securities and

other securities investments ··································· 2,273,294 187,236 19,581 2,480,111

Derivative fi nancial instruments ̶ 369,572 17,958 387,530

Total ······················································································ ¥ 3,746,701 ¥ 672,147 ¥ 37,539 ¥ 4,456,387

Liabilities

Derivative fi nancial instruments ································· ¥ ̶ ¥ (427,109) ¥ (23,692) ¥ (450,801)

Total ······················································································ ¥ ̶ ¥ (427,109) ¥ (23,692) ¥ (450,801)

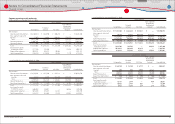

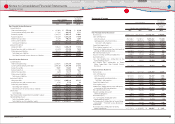

Yen in millions

March 31, 2010

Level 1 Level 2 Level 3 Total

Assets

Cash equivalents ································································· ¥ 677,442 ¥ 69,702 ¥ ̶ ¥ 747,144

Time deposits ········································································ ̶ 173,500 ̶ 173,500

Marketable securities and

other securities investments

Government bonds ················································· 2,654,829 ̶ ̶ 2,654,829

Common stocks ························································ 852,775 ̶ ̶ 852,775

Other ··············································································· 37,296 370,933 13,134 421,363

Derivative fi nancial instruments ································· ̶ 349,556 19,437 368,993

Total ······················································································ ¥ 4,222,342 ¥ 963,691 ¥ 32,571 ¥ 5,218,604

Liabilities

Derivative fi nancial instruments ································· ¥ ̶ ¥ (259,184) ¥ (13,545) ¥ (272,729)

Total ······················································································ ¥ ̶ ¥ (259,184) ¥ (13,545) ¥ (272,729)

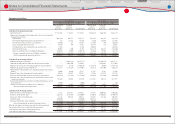

U.S. dollars in millions

March 31, 2010

Level 1 Level 2 Level 3 Total

Assets

Cash equivalents ································································· $ 7,281 $ 749 $ ̶ $ 8,030

Time deposits ········································································ ̶ 1,865 ̶ 1,865

Marketable securities and

other securities investments

Government bonds ················································· 28,534 ̶ ̶ 28,534

Common stocks ························································ 9,166 ̶ ̶ 9,166

Other ··············································································· 401 3,987 141 4,529

Derivative fi nancial instruments ································· ̶ 3,757 209 3,966

Total ······················································································ $ 45,382 $ 10,358 $ 350 $ 56,090

Liabilities

Derivative fi nancial instruments ································· $ ̶ $ (2,786) $ (146) $ (2,932)

Total ······················································································ $ ̶ $ (2,786) $ (146) $ (2,932)

Cash equivalents and time deposits

Cash equivalents include money market funds

and other investments with original maturities

of three months or less. Time deposits include

negotiable certifi cate of deposit with original

maturities over three months. These are highly

liquid investments, and quoted market prices

are used to determine the fair value of these

investments.

Marketable securities and other securities

investments

Marketable securities and other securities

investments include government bonds,

common stocks and other investments. As of

March 31, 2010, government bonds include

76% of Japanese government bonds, and 24%

of U.S. and European government bonds. As

of March 31, 2010, listed stocks on Japanese

stock market represent 88% of common stocks.

Toyota uses quoted market prices for identical

assets to measure fair value of these securities.

Other includes primarily commercial paper.

Generally, Toyota uses quoted market prices

for similar assets or quoted non-active market

prices for identical assets to measure fair value

of these securities. Marketable securities and

other securities investments classifi ed as Level 3

primarily included retained interests in securitized

fi nancial receivables, which are measured at fair

value using assumptions such as interest rate,

loss severity and other factors.

Derivative fi nancial instruments

See note 20 to the consolidated fi nancial

statements about derivative fi nancial instruments.

Toyota estimates the fair value of derivative

fi nancial instruments using industry-standard

valuation models that require observable inputs

including interest rates and foreign exchange

rates, and the contractual terms. The usage of

these models does not require signifi cant

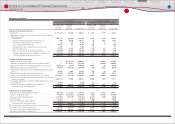

The following is description of the assets and liabilities measured at fair value, information about the

valuation techniques used to measure fair value, key inputs and signifi cant assumptions:

The following table summarizes the fair values of the assets and liabilities measured at fair value on a

recurring basis at March 31, 2009 and 2010:

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Notes to Consolidated Financial Statements

Fair value measurements:

26