Toyota 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 75

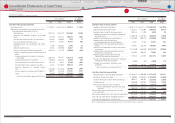

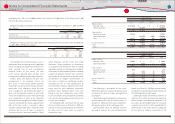

Investments in and transactions with affi liated companies -

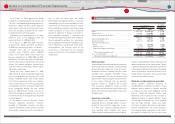

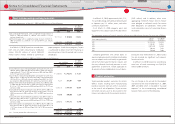

Summarized fi nancial information for affi liated co mpanies accounted for by the equity method is shown below:

Yen in millions

U.S. dollars

in millions

March 31, March 31,

2009 2010 2010

Current assets ··················································································································· ¥ 6,400,685 ¥ 8,034,546 $ 86,356

Noncurrent assets ·········································································································· 9,438,905 9,300,307 99,960

Total assets················································································································· ¥ 15,839,590 ¥ 17,334,853 $ 186,316

Current liabilities ············································································································· ¥ 4,216,956 ¥ 5,056,178 $ 54,344

Long-term liabilities and noncontrolling interest ········································ 5,740,150 5,981,054 64,285

Affi liated companies accounted for by the equity method

shareholders equity ····································································································· 5,882,484 6,297,621 67,687

Total liabilities and shareholders equity ······················································· ¥ 15,839,590 ¥ 17,334,853 $ 186,316

Toyotas share of affi liated companies accounted for by the equity

method shareholders equity ·············································································· ¥ 1,810,106 ¥ 1,867,440 $ 20,071

Number of affi liated companies accounted for by the equity method

at end of period ·················································································································

56 56

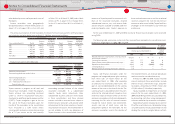

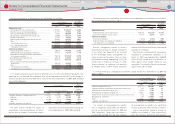

Yen in millions

U.S. dollars

in millions

For the years ended March 31,

For the year

ended

March 31,

2008 2009 2010 2010

Net revenues ·················································································· ¥ 26,511,831 ¥ 23,149,968

¥ 20,599,586

$ 221,406

Gross profi t ······················································································ ¥ 3,081,366 ¥ 2,034,617

¥ 2,269,109

$ 24,389

Net income attributable to affi liated companies

accounted for by the equity method ···························· ¥ 870,528 ¥ 13,838

¥ 317,017

$ 3,407

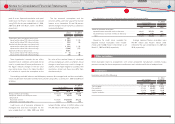

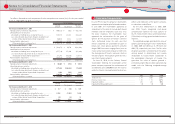

Entities comprising a signifi cant portion of

Toyotas investment in affi liated companies

include Denso Corporation; Toyota Industries

Corporation; Aisin Seiki Co., Ltd.; Aioi Insurance

Co., Ltd.; and Toyota Tsusho Corporation.

Aioi Insurance Co., Ltd. ceased to be an

affi liated company accounted for by the equity

method of Toyota Motor Corporation as of April

1, 2010, due to the business integration through

a share-for-share exchange.

Certain affi liated companies accounted for

by the equity method with carrying amounts

of ¥1,417,896 million and ¥1,439,090 million

($15,467 million) at March 31, 2009 and 2010,

respectively, were quoted on various established

markets at an aggregate value of ¥1,127,976

million and ¥1,711,957 million ($18,400 million),

respectively. For the year ended March 31,

2010, Toyota recognized an impairment loss

on a certain investment in affi liated company

accounted for by the equity method of ¥63,575

million ($683 million), which is included in

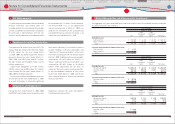

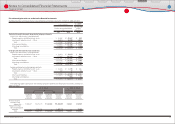

Account balances and transactions with affi liated companies are presented below:

Yen in millions

U.S. dollars

in millions

March 31, March 31,

2009 2010 2010

Trade accounts and notes receivable, and other receivables ················ ¥159,821 ¥274,189 $2,947

Accounts payable and other payables ······························································· 363,954 597,796 6,425

Yen in millions

U.S. dollars

in millions

For the years ended March 31,

For the year

ended

March 31,

2008 2009 2010 2010

Net revenues ·················································································· ¥1,693,969 ¥1,585,814 ¥1,600,365 $17,201

Purchases·························································································· 4,525,049 3,918,717 3,943,648 42,387

Dividends from affi liated companies accounted

for by the equity method for the years ended

March 31, 2008, 2009 and 2010 were ¥76,351

million, ¥114,409 million and ¥82,149 million

($883 million), respectively.

Toyota does not have any signifi cant related

party transactions other than transactions with

affi liated companies in the ordinary course of

business.

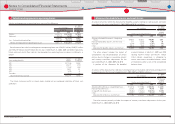

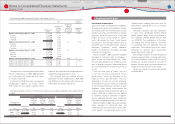

Variable Interest Entities

Toyota enters into securitization transactions

using special-purpose entities, that are

considered variable interest entities (VIEs).

Although the fi nance receivables related to

securitization transactions have been legally

sold to the VIEs, Toyota holds variable interests

in certain VIEs that are expected to absorb a

majority of the VIEs expected losses, receive a

majority of the VIEs expected residual returns,

or both. As a result, Toyota is considered the

primary benefi ciary of certain VIEs and therefore

consolidates certain VIEs except for QSPEs.

The consolidated securitization VIEs have

¥366,886 million ($3,943 million) in retail fi nance

receivables, ¥20,581 million ($221 million) in

restricted cash and ¥363,369 million ($3,906

million) in secured debt. Risks to which Toyota

is exposed including credit, interest rate, and/or

prepayment risks are not incremental compared

with the situation before Toyota enters into

securitization transactions.

Certain joint ventures in which Toyota has

invested are VIEs for which Toyota is not the

primary benefi ciary. However, neither the

aggregate size of these joint ventures nor Toyotas

involvements in these entities are material to

Toyotas consolidated fi nancial statements.

Equity in earnings of affi liated companies in

the accompanying consolidated statements

of income. Toyota evaluated its investments in

affi liated companies, considering the length of

time and the extent to which the quoted market

prices have been less than the carrying amounts,

the fi nancial condition and near-term prospects

of the affi liated companies and Toyotas ability

and intent to retain those investments in the

companies for a period of time.

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Notes to Consolidated Financial Statements

Affi liated companies and variable interest entities:

12