Toyota 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 83

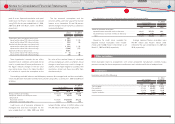

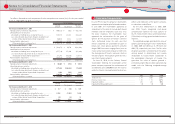

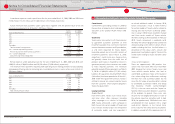

Weighted-average assumptions used to determine benefi t obligations as of March 31, 2009 and 2010

are as follows:

March 31,

2009 2010

Discount rate ········································································································································· 2.8% 2.8%

Rate of compensation increase ··································································································· 0.1 ‒ 10.0% 0.5 ‒ 10.0%

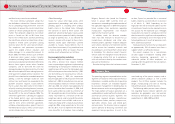

The expected rate of return on plan assets is

determined after considering several applicable

factors including, the composition of plan assets

held, assumed risks of asset management,

historical results of the returns on plan

assets, Toyotas principal policy for plan asset

management, and forecasted market conditions.

Toyotas policy and objective for plan asset

management is to maximize returns on

plan assets to meet future benefi t payment

requirements under risks which Toyota considers

permissible. Asset allocations under the plan

asset management are determined based on

plan asset management policies of each plan

which are established to achieve the optimized

asset compositions in terms of the long-term

overall plan asset management. Excepting equity

securities contributed by Toyota, approximately

50% of the plan assets is invested in equity

securities, approximately 30% is invested in debt

securities, and the rest of them is invested in

insurance contracts and other products. When

actual allocations are not in line with target

allocations, Toyota rebalances its investments

in accordance with the policies. Prior to making

individual investments, Toyota performs in-depth

assessments of corresponding factors including

category of products, industry type, currencies

and liquidity of each potential investment under

consideration to mitigate concentrations of

risks such as market risk and foreign currency

exchange rate risk. To assess performance of

the investments, Toyota establishes bench mark

return rates for each individual investment,

combines these individual bench mark rates

based on the asset composition ratios within

each asset category, and compares the combined

rates with the corresponding actual return rates

on each asset category.

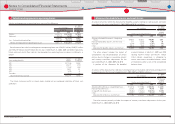

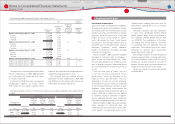

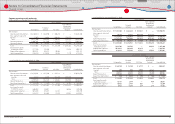

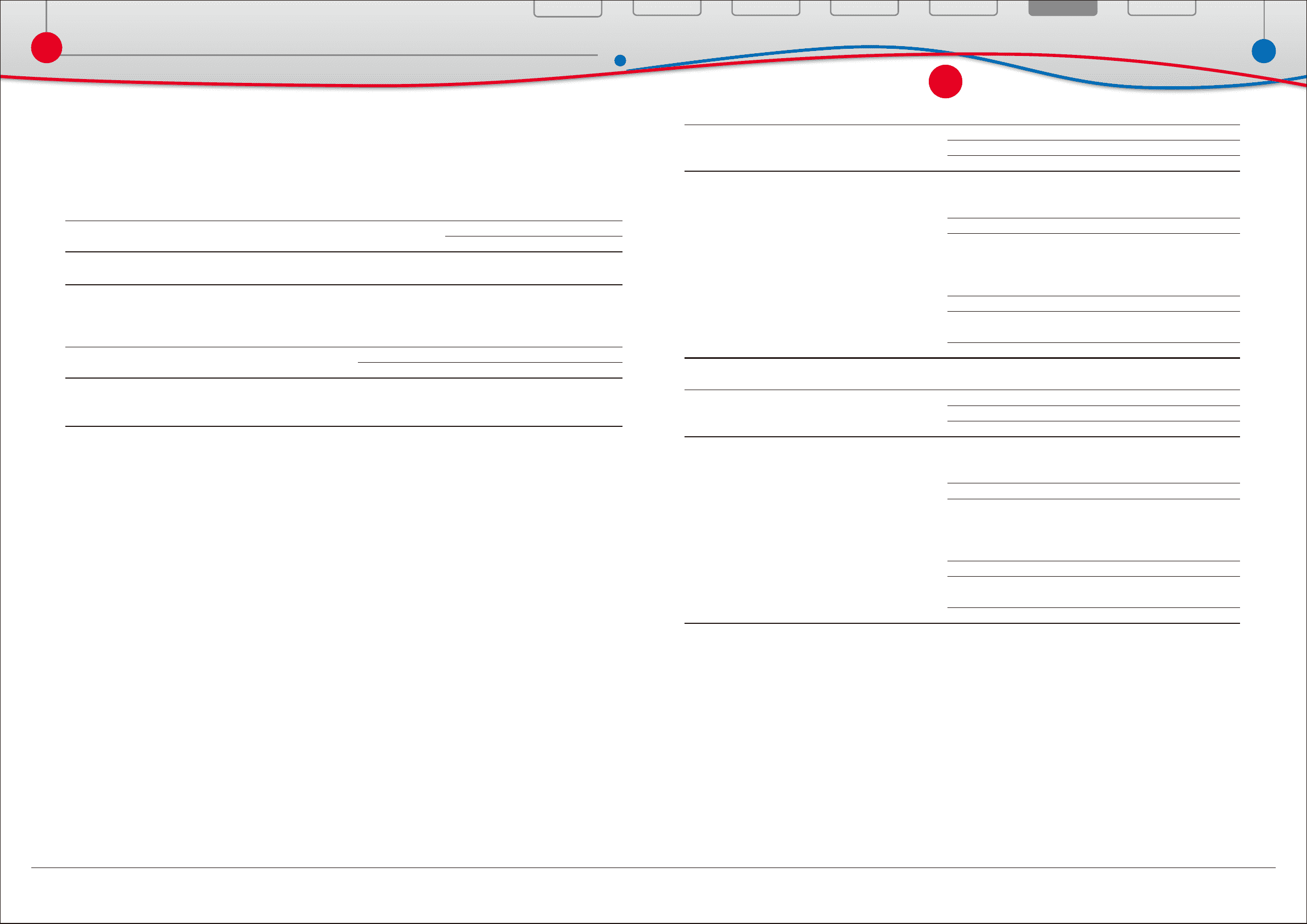

The following table summarizes the fair value

of classes of plan assets as of March 31, 2010. See

note 26 to the consolidated fi nancial statements

for three levels of input which are used to

measure fair value.

Weighted-average assumptions used to determine net periodic pension cost for the years ended March

31, 2008, 2009 and 2010 are as follows:

For the years ended March 31,

2008 2009 2010

Discount rate ································································································ 2.7% 2.8% 2.8%

Expected return on plan assets ·························································· 3.4% 3.6% 3.6%

Rate of compensation increase ·························································· 0.1 ‒ 10.0% 0.1 ‒ 10.0% 0.1 ‒ 10.0%

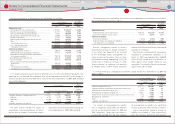

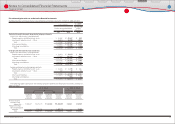

The following is description of the assets,

information about the valuation techniques used

to measure fair value, key inputs and signifi cant

assumptions:

Quoted market prices for identical securities are

used to measure fair value of common stocks. As

of March 31, 2010, common stocks include 64%

of Japanese stocks and 36% of foreign stocks.

Quoted market prices for identical securities

are used to measure fair value of government

bonds. As of March 31, 2010, government bonds

include 25% of Japanese government bonds and

75% of foreign government bonds.

Commingled funds are benefi cial interests of

collective trust, which are mainly invested by the

parent company and Japanese subsidiaries. The

fair values of commingled funds are measured

using the net asset value (NAV) provided by the

administrator of the fund, and are categorized

by the ability to redeem investments at the

Yen in millions

March 31, 2010

Level 1 Level 2 Level 3 Total

Equity securities

Common stocks ········································································ ¥ 471,262 ¥ ̶ ¥ ̶ ¥ 471,262

Commingled funds ································································· ̶ 237,495 ̶ 237,495

471,262 237,495 ̶ 708,757

Debt securities

Government bonds ································································· 79,739 ̶ ̶ 79,739

Commingled funds ································································· ̶ 147,345 2,663 150,008

Other ······························································································· 39,231 19,561 928 59,720

118,970 166,906 3,591 289,467

Insurance contracts ····································································· ̶ 97,086 ̶ 97,086

Other ··································································································· 35,774 1,449 46,518 83,741

Total ································································································· ¥ 626,006 ¥ 502,936 ¥ 50,109 ¥ 1,179,051

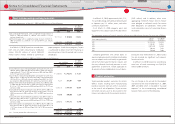

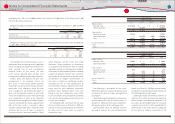

U.S. dollars in millions

March 31, 2010

Level 1 Level 2 Level 3 Total

Equity securities ···········································································

Common stocks ······································································· $ 5,065 $ ̶ $ ̶ $ 5,065

Commingled funds ································································ ̶ 2,553 ̶ 2,553

5,065 2,553 ̶ 7,618

Debt securities

Government bonds ································································ 857 ̶ ̶ 857

Commingled funds ································································ ̶ 1,584 28 1,612

Other ······························································································ 422 210 10 642

1,279 1,794 38 3,111

Insurance contracts ···································································· ̶ 1,043 ̶ 1,043

Other ·································································································· 384 16 500 900

Total ································································································ $ 6,728 $ 5,406 $ 538 $ 12,672

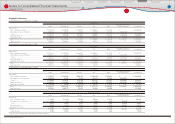

ending March 31, 2011 are ¥(15,000) million ($(161) million), ¥15,700 million ($169 million) and ¥1,900

million ($20 million), respectively.

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Notes to Consolidated Financial Statements