Toyota 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 84

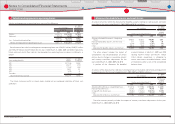

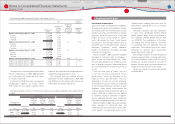

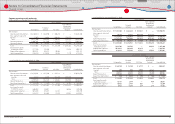

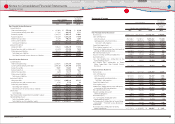

The following table summarizes the changes in Level 3 plan assets measured at fair value for the period

ended March 31, 2010:

Yen in millions

For the year ended March 31, 2010

Debt securities Other Total

Balance at beginning of year ······································································· ¥ 5,242 ¥45,825 ¥51,067

Actual return on plan assets ····································································· 818 (2,206) (1,388)

Purchases, sales and settlements ·························································· (2,233) 3,467 1,234

Other ····················································································································· (236) (568) (804)

Balance at end of year ····················································································· ¥ 3,591 ¥46,518 ¥50,109

U.S. dollars in millions

For the year ended March 31, 2010

Debt securities Other Total

Balance at beginning of year ······································································· $ 56 $ 493 $ 549

Actual return on plan assets ····································································· 9 (24) (15)

Purchases, sales and settlements ·························································· (24) 37 13

Other ····················································································································· (3) (6) (9)

Balance at end of year ····················································································· $ 38 $ 500 $ 538

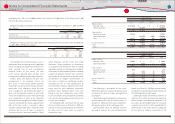

Toyota expects to contribute ¥111,112 million ($1,194 million) to its pension plans in the year ending

March 31, 2011.

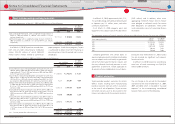

The following pension benefi t payments, which refl ect expected future service, as appropriate, are

expected to be paid:

Years ending March 31, Yen in

millions

U.S. dollars

in millions

2011 ········································································································································································ ¥ 79,457 $ 854

2012 ········································································································································································ 75,952 816

2013 ········································································································································································ 74,915 805

2014 ········································································································································································ 76,933 827

2015 ········································································································································································ 80,622 867

from 2016 to 2020 ·········································································································································· 455,453 4,895

Total ···································································································································································· ¥843,332 $9,064

measurement day.

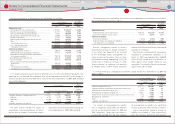

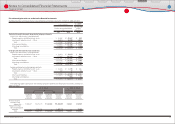

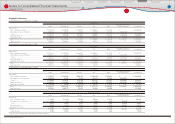

The fair values of insurance contracts are

measured using contracted amount with

accrued interest.

Other consists of cash equivalents, other

private placement investment funds and other

assets. The fair values of other private placement

investment funds are measured using the NAV

provided by the administrator of the fund, and are

categorized by the ability to redeem investments

at the measurement day.

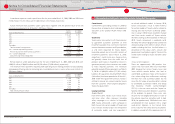

Toyota employs derivative fi nancial instruments,

including foreign exchange forward contracts,

foreign currency options, interest rate swaps,

interest rate currency swap agreements and

interest rate options to manage its exposure to

fl uctuations in interest rates and foreign currency

exchange rates. Toyota does not use derivatives

for speculation or trading.

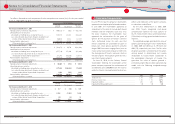

Fair value hedges

Toyota enters into interest rate swaps and

interest rate currency swap agreements mainly

to convert its fi xed-rate debt to variable-rate

debt. Toyota uses interest rate swap agreements

in managing interest rate risk exposure. Interest

rate swap agreements are executed as either

an integral part of specifi c debt transactions or

on a portfolio basis. Toyota uses interest rate

currency swap agreements to hedge exposure

to currency exchange rate fl uctuations on

principal and interest payments for borrowings

denominated in foreign currencies. Notes and

loans payable issued in foreign currencies are

hedged by concurrently executing interest rate

currency swap agreements, which involve the

exchange of foreign currency principal and

interest obligations for each functional currency

obligations at agreed-upon currency exchange

and interest rates.

For the years ended March 31, 2008, 2009 and

2010, the ineff ective portion of Toyotas fair value

hedge relationships was not material. For fair

value hedging relationships, the components of

each derivatives gain or loss are included in the

assessment of hedge eff ectiveness.

Undesignated derivative fi nancial instruments

Toyota uses foreign exchange forward contracts,

foreign currency options, interest rate swaps,

interest rate currency swap agreements, and

interest rate options, to manage its exposure

to foreign currency exchange rate fl uctuations

and interest rate fl uctuations from an economic

perspective, and for which Toyota is unable or

has elected not to apply hedge accounting.

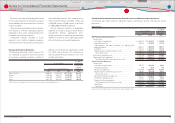

Postretirement benefi ts other than pensions

and postemployment benefi ts

Toyotas U.S. subsidiaries provide certain health

care and life insurance benefi ts to eligible

retired employees. In addition, Toyota provides

benefi ts to certain former or inactive employees

after employment, but before retirement. These

benefi ts are currently unfunded and provided

through various insurance companies and

health care providers. The costs of these benefi ts

are recognized over the period the employee

provides credited service to Toyota. Toyotas

obligations under these arrangements are not

material.

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Notes to Consolidated Financial Statements

Derivative fi nancial instruments:

20