Toyota 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 87

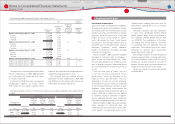

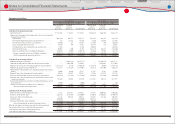

Toyota has certain fi nancial instruments,

including fi nancial assets and liabilities and off -

balance sheet fi nancial instruments which arose

in the normal course of business. These fi nancial

instruments are executed with creditworthy

fi nancial institutions, and virtually all foreign

currency contracts are denominated in U.S.

dollars, euros and other currencies of major

industrialized countries. Financial instruments

involve, to varying degrees, market risk as

instruments are subject to price fl uctuations,

and elements of credit risk in the event a

counterparty should default. In the unlikely

event the counterparties fail to meet the

contractual terms of a foreign currency or an

interest rate instrument, Toyotas risk is limited

to the fair value of the instrument. Although

Toyota may be exposed to losses in the event of

non-performance by counterparties on fi nancial

instruments, it does not anticipate signifi cant

losses due to the nature of its counterparties.

Counterparties to Toyotas fi nancial instruments

represent, in general, international fi nancial

institutions. Additionally, Toyota does not

have a signifi cant exposure to any individual

counterparty. Toyota believes that the overall

credit risk related to its fi nancial instruments is

not signifi cant.

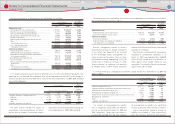

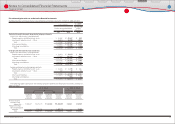

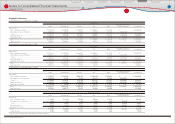

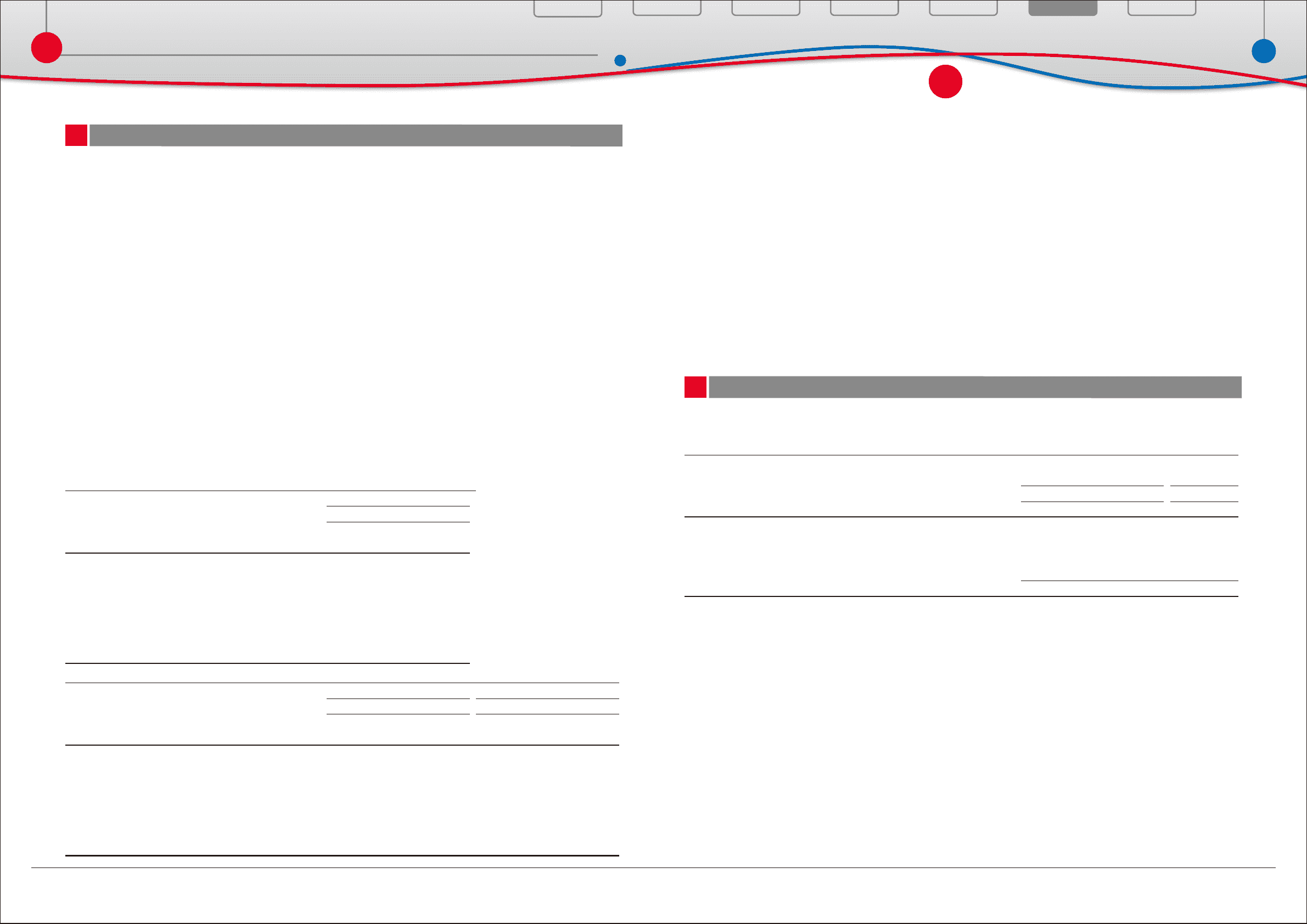

The estimated fair values of Toyotas fi nancial instruments, excluding marketable securities and other

securities investments and affi liated companies and derivative fi nancial instruments, are summarized as

follows:

Yen in millions

March 31, 2009

Carrying

amount

Estimated

fair value

Asset (Liability)

Cash and cash equivalents ·················································· ¥ 2,444,280 ¥ 2,444,280

Time deposits ············································································· 45,178 45,178

Total fi nance receivables, net ············································ 8,450,709 8,677,228

Other receivables ····································································· 332,722 332,722

Short-term borrowings ························································· (3,617,672) (3,617,672)

Long-term debt including the current portion ······· (8,949,615) (9,026,007)

Yen in millions U.S. dollars in millions

March 31, 2010 March 31, 2010

Carrying

amount

Estimated

fair value

Carrying

amount

Estimated

fair value

Asset (Liability)

Cash and cash equivalents ················································· ¥ 1,865,746 ¥ 1,865,746 $ 20,053 $ 20,053

Time deposits ············································································ 392,724 392,724 4,221 4,221

Total fi nance receivables, net ··········································· 8,759,826 9,112,527 94,151 97,942

Other receivables ···································································· 360,379 360,379 3,873 3,873

Short-term borrowings ························································ (3,279,673) (3,279,673) (35,250) (35,250)

Long-term debt including the current portion ······ (9,191,490) (9,297,904) (98,791) (99,934)

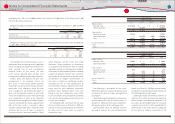

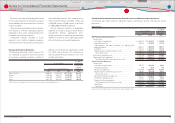

Cash and cash equivalents, time deposits and

other receivables

In the normal course of business, substantially

all cash and cash equivalents, time deposits and

other receivables are highly liquid and are carried

at amounts which approximate fair value.

Finance receivables, net

The carrying value of variable rate fi nance

receivables was assumed to approximate

fair value as they were repriced at prevailing

market rates. The fair value of fi xed rate fi nance

receivables was estimated by discounting

expected cash fl ows to present value using the

rates at which new loans of similar credit quality

and maturity would be made.

Short-term borrowings and long-term debt

The fair values of short-term borrowings and

total long-term debt including the current

portion were estimated based on the discounted

amounts of future cash fl ows using Toyotas

current incremental borrowing rates for similar

liabilities.

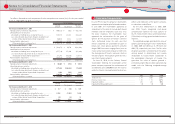

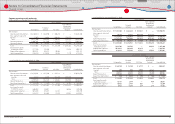

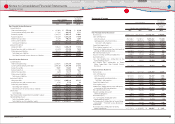

Toyota leases certain assets under capital lease and operating lease arrangements.

An analysis of leased assets under capital leases is as follows:

Yen in millions

U.S. dollars

in millions

March 31, March 31,

2009 2010 2010

Class of property

Building ····························································································································· ¥ 24,369 ¥ 23,518 $ 253

Machinery and equipment ····················································································· 51,971 48,043 516

Less - Accumulated depreciation ······································································· (33,845) (36,926) (397)

¥ 42,495 ¥ 34,635 $ 372

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Notes to Consolidated Financial Statements

Other fi nancial instruments:

21

Lease commitments:

22