Toyota 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2010 80

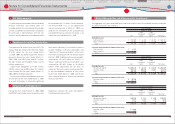

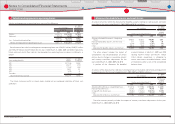

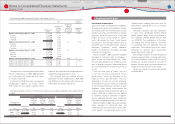

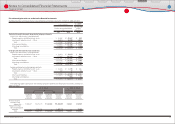

Tax eff ects allocated to each component of other comprehensive income (loss) for the years ended

March 31, 2008, 2009 and 2010 are as follows:

Yen in millions

Pre-tax

amount Tax amount

Net-of-tax

amount

For the year ended March 31, 2008

Foreign currency translation adjustments ················································ ¥ (460,723) ¥ (466) ¥ (461,189)

Unrealized losses on securities:

Unrealized net holding losses arising for the year ···························· (545,555) 219,313 (326,242)

Less: reclassifi cation adjustments for gains included in net

income attributable to Toyota Motor Corporation ······················· (36,099) 14,512 (21,587)

Pension liability adjustments ············································································ (221,142) 87,565 (133,577)

Other comprehensive income (loss)····················································· ¥ (1,263,519) ¥ 320,924 ¥ (942,595)

For the year ended March 31, 2009

Foreign currency translation adjustments ··············································· ¥ (391,873) ¥ 10,570 ¥ (381,303)

Unrealized losses on securities:

Unrealized net holding losses arising for the year ···························· (677,710) 255,890 (421,820)

Less: reclassifi cation adjustments for losses included in net loss

attributable to Toyota Motor Corporation ········································ 215,249 (86,530) 128,719

Pension liability adjustments ············································································ (319,613) 127,441 (192,172)

Other comprehensive income (loss)····················································· ¥ (1,173,947) ¥ 307,371 ¥ (866,576)

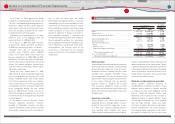

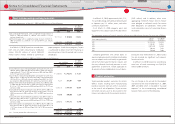

For the year ended March 31, 2010

Foreign currency translation adjustments ················································ ¥ 10,809 ¥ (915) ¥ 9,894

Unrealized gains on securities:

Unrealized net holding gains arising for the year ······························ 277,838 (102,538) 175,300

Less: reclassifi cation adjustments for gains included in net

income attributable to Toyota Motor Corporation ······················· 1,852 (745) 1,107

Pension liability adjustments ············································································ 124,526 (49,881) 74,645

Other comprehensive income ································································· ¥ 415,025 ¥ (154,079) ¥ 260,946

U.S. dollars in millions

Pre-tax

amount Tax amount

Net-of-tax

amount

For the year ended March 31, 2010

Foreign currency translation adjustments ················································· $ 117 $ (10) $ 107

Unrealized gains on securities:

Unrealized net holding gains arising for the year ······························· 2,986 (1,102) 1,884

Less: reclassifi cation adjustments for gains included in net

income attributable to Toyota Motor Corporation ························ 20 (8) 12

Pension liability adjustments ············································································· 1,338 (536) 802

Other comprehensive income ·································································· $ 4,461 $ (1,656) $ 2,805

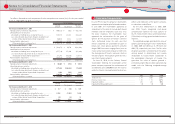

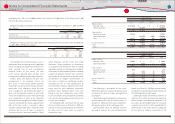

In June 1997, the parent companys shareholders

approved a stock option plan for board members.

In June 2001, the shareholders approved an

amendment of the plan to include both board

members and key employees. Each year, since

the plans inception, the shareholders have

approved the authorization for the grant of

options for the purchase of Toyotas common

stock. Authorized shares for each year that

remain ungranted are unavailable for grant in

future years. Stock options granted in and after

August 2002 have terms ranging from 6 years to

8 years and an exercise price equal to 1.025 times

the closing price of Toyotas common stock on

the date of grant. These options generally vest 2

years from the date of grant.

On June 24, 2010, at the Ordinary General

Shareholders Meeting, the shareholders of the

parent company approved the authorization of

an additional up to 3,600,000 shares for issuance

under the Toyotas stock option plan for directors,

offi cers and employees of the parent company,

its subsidiaries and affi liates.

For the years ended March 31, 2008, 2009

and 2010, Toyota recognized stock-based

compensation expenses for stock options of

¥3,273 million, ¥3,015 million and ¥2,446 million

($26 million) as selling, general and administrative

expenses.

The weighted-average grant-date fair value of

options granted during the years ended March

31, 2008, 2009 and 2010 was ¥1,199, ¥635 and

¥803 ($9), respectively per share. The fair value

of options granted is amortized over the option

vesting period in determining net income

attributable to Toyota Motor Corporation in

the consolidated statements of income. The

grant-date fair value of options granted is

estimated using the Black-Scholes option pricing

model with the following weighted-average

assumptions:

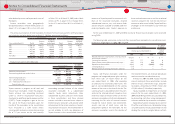

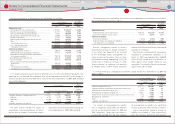

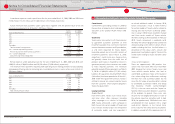

2008 2009 2010

Dividend rate ···················································································································· 1.7% 3.0% 2.4%

Risk-free interest rate···································································································· 1.3% 1.1% 0.7%

Expected volatility ········································································································· 23% 23% 30%

Expected holding period (years) ············································································ 5.0 5.0 5.0

Financial Section

Financial Section

Investor Information

Corporate Information

Special Feature

Consolidated

Performance Highlights

Business Overview

Top Messages

Notes to Consolidated Financial Statements

Stock-based compensation:

18