Tesco 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

FINANCIAL STATEMENTS

Tesco PLC Annual Report and Financial Statements 2009

To find out more go to

www.tesco.com/annualreport09

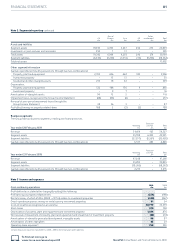

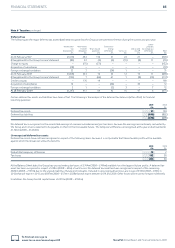

Note 11 Property, plant and equipment continued

The following amounts have been (charged)/credited to operating costs in the Group Income Statement during the current and prior year:

2009 2008

£m £m

Impairment losses

UK (21) (48)

Rest of Europe (31) (25)

Asia (4) (4)

(56) (77)

Reversal of impairment losses

UK 21 48

Rest of Europe 50 36

Asia 17 3

88 87

Net reversal of impairment losses 32 10

The impairment losses relate to stores whose recoverable amounts (either value in use or fair value less costs to sell) do not exceed the asset carrying

values. In all cases, impairment losses arose due to stores performing below forecasted trading levels.

The reversal of previous impairment losses arose principally due to improvements in stores’ performances over the last year which increased the net

present value of future cash flows.

Note 12 Investment property

2009 2008

£m £m

Cost

At beginning of year 1,190 906

Foreign currency translation 24 93

Additions 114 50

Acquisitions through business combinations 86 –

Transfers 260 144

Classified as held for sale (10) –

Disposals (4) (3)

At end of year 1,660 1,190

Accumulated depreciation and impairment losses

At beginning of year 78 50

Foreign currency translation 3 7

Charge for the period 25 16

Transfers 5 5

Impairment losses 10 –

At end of year 121 78

Net carrying value 1,539 1,112

The net carrying value at 24 February 2007 was £856m.

The following amounts have been charged to operating costs in the Group Income Statement during the current and prior year:

2009 2008

£m £m

Impairment losses

Rest of Europe (10) –

Net impairment losses (10) –

The impairment losses relate to malls whose recoverable amounts (either value in use or fair value less costs to sell) do not exceed the asset carrying

values. In all cases, impairment losses arose due to the malls performing below forecasted trading levels.

The estimated fair value of the Group’s investment property is £3,196m (2008 – £2,265m). This fair value has been determined by applying an

appropriate rental yield to the rentals earned by the investment property. A valuation has not been performed by an independent valuer.