Tesco 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

FINANCIAL STATEMENTS

Tesco PLC Annual Report and Financial Statements 2009

To find out more go to

www.tesco.com/annualreport09

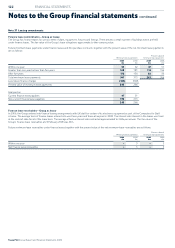

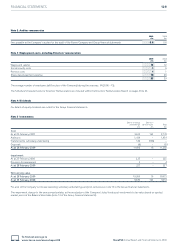

Note 35 Commitments and contingencies

Capital commitments

At 28 February 2009 there were commitments for capital expenditure contracted for, but not provided, of £1,551m (2008 – £1,309m), principally relating

to the store development programme.

Contingent liabilities

The Company has irrevocably guaranteed the liabilities, as defined in Section 5(c) of the Republic of Ireland (Amendment Act) 1986, of various subsidiary

undertakings incorporated in the Republic of Ireland.

For details of assets held under finance leases, which are pledged as security for the finance lease liabilities, see note 11.

There are a number of contingent liabilities that arise in the normal course of business which if realised are not expected to result in a material liability

to the Group. The Group recognises provisions for liabilities when it is more likely than not a settlement will be required and the value of such a payment

can be reliably estimated.

In September 2007, the Office of Fair Trading issued its provisional findings in its Statement of Objections relating to the alleged collusion between

certain large supermarkets and dairy processors. We continue to defend our case vigorously. No provision has been recognised in the Group’s results.

Tesco Personal Finance Group Limited

At 28 February 2009, Tesco Personal Finance Group Limited (TPF) has commitments of formal standby facilities, credit lines and other commitments

to lend, totalling £5.7bn. The amount is intended to provide an indication of the volume of business transacted and not of the underlying credit or

other risks.

The Financial Services Compensation Scheme (‘FSCS’) compensates customers of UK financial institutions when those institutions are unable to pay

out. Firms are being levied only for interest costs and management expenses of the scheme (and not for the capital repayments which will ultimately

need to be made), but the amounts have increased significantly compared to prior years. The levy is calculated based on deposit balances held as at

31 December in each year and as such, this is seen as the ‘trigger event’ under accounting rules. TPF was a market participant at 31 December 2007

and 31 December 2008 and has accrued for its share of the 2008/9 and 2009/10 levy which was not material to the Group. Going forward further

provisions in respect of these costs are likely, the ultimate cost of which remains uncertain.

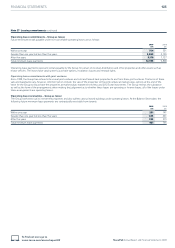

Note 36 Capital resources

The following table shows the composition of regulatory capital resources of Tesco Personal Finance Group Limited at the Balance Sheet date:

2009 2008

£m £m

Tier 1 capital:

Shareholders funds and minority interests 566 –

Tier 2 capital:

Qualifying subordinated debt 205 –

Other interests in tier 2 capital 19 –

Supervisory deductions (259) –

Total regulatory capital 531 –

The movement of tier 1 capital from the date of acquisition to the Balance Sheet date is analysed as follows:

2009 2008

£m £m

At 19 December 2008* 559 –

Profit attributable to shareholders 7 –

At 28 February 2009 566 –

* Tesco Personal Finance Group Limited was acquired on 19 December 2008.

It is Tesco Personal Finance Group Limited’s (TPF) policy to maintain a strong capital base, to expand it as appropriate and to utilise it efficiently

throughout its activities to optimise the return to shareholders while maintaining a prudent relationship between the capital base and the underlying

risks of the business. In carrying out this policy, TPF has regard to the supervisory requirements of the Financial Services Authority (‘FSA’). The FSA

uses Individual Capital Guidance (‘ICG’) as a measure of capital adequacy in the UK banking sector, comparing a bank’s capital resources with its risk-

weighted assets (the assets and off-balance sheet exposures are ‘weighted’ to reflect the inherent credit and other risks). TPF has complied with the

FSA’s capital requirements throughout the period between the date of acquisition and the Balance Sheet date.