Tesco 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 FINANCIAL STATEMENTS

Tesco PLC Annual Report and Financial Statements 2009

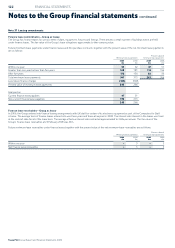

Note 31 Business combinations continued

Homever

On 30 September 2008, the Group acquired 100% of the share capital of Homever, a retailer in South Korea.

The fair value of the identifiable assets and liabilities of Homever as at the date of acquisition were:

Adjustments

Pre-acquisition to align Recognised

carrying accounting Fair value values on

amounts policies adjustments acquisition

£m £m £m £m

Property, plant and equipment 643 2 37 682

Intangible assets 96 (2) (83) 11

Other non-current assets 63 – (3) 60

Deferred tax asset 1 – (1) –

Inventories 45 – (8) 37

Trade and other receivables 32 – (5) 27

Cash and cash equivalents 16 – – 16

Trade and other payables (204) – (16) (220)

Provision for liabilities and charges (5) (2) (52) (59)

Bank and other borrowings (611) – – (611)

Deferred tax liability (5) (35) – (40)

Net assets/(liabilities) acquired 71 (37) (131) (97)

Goodwill arising on acquisition 362

265

Consideration:

Cash consideration 259

Costs associated with the acquisition 6

Total consideration 265

From the date of acquisition, the acquired business has contributed £326m to revenue and £18m of operating loss to the Group.

Dobbies Garden Centres PLC

On 31 July 2008, the Group completed the acquisition of the remaining 34.5% (2007/8 – 65.5%) of the share capital of Dobbies Garden Centres PLC

(Dobbies), a retailer in the United Kingdom, for total consideration of £43m.

This resulted in additional goodwill of £18m, arising on acquisition during the year, based on Dobbies net assets of £77m.

Other acquisitions

The other acquisitions in the year include the trade and assets of Sandyholm Garden Centre and some smaller businesses. The companies acquired

undertake retail activities.

Fair value adjustments of £2m were identified in addition to the £3m pre-acquisition carrying amounts of net assets, resulting in the recognition of £5m

as the fair value of net assets acquired. With cash consideration of £10m, this has resulted in the recognition of £5m of goodwill arising on acquisition.

The post-acquisition contribution of the other acquisitions to the Group was £5m to revenue and £1m to operating profit.

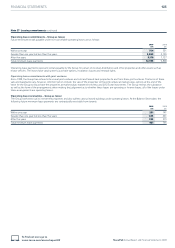

Note 32 Related party transactions

Transactions between the Company and its subsidiaries, which are related parties, have been eliminated on consolidation and are not disclosed in this

note. Transactions between the Group and its joint ventures and associates are disclosed below:

i) Trading transactions

Sales to Purchases from Amounts owed Amounts owed

related parties related parties by related parties to related parties

2009 2008 2009 2008 2009 2008 2009 2008

£m £m £m £m £m £m £m £m

Joint ventures 183 164 290 238 14 39 6 34

Associates – – 1,175 771 – – 156 82

Sales to related parties consists of services/management fees and loan interest.

Purchases from related parties include £174m (2008 – £157m) of rentals payable to the Group’s joint ventures, including those joint ventures formed as

part of the sale and leaseback programme.

Notes to the Group financial statements continued